Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Homework i

Saved

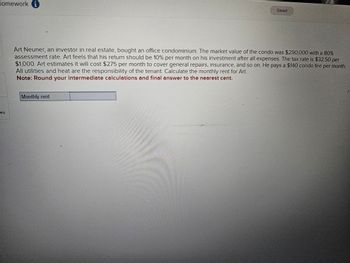

Art Neuner, an investor in real estate, bought an office condominium. The market value of the condo was $290,000 with a 80%

assessment rate. Art feels that his return should be 10% per month on his investment after all expenses. The tax rate is $32.50 per

$1,000. Art estimates it will cost $275 per month to cover general repairs, insurance, and so on. He pays a $140 condo fee per month.

All utilities and heat are the responsibility of the tenant. Calculate the monthly rent for Art.

Note: Round your intermediate calculations and final answer to the nearest cent.

Monthly rent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 20 images

Knowledge Booster

Similar questions

- A couch with a list price of $3400 will be discounted 35% at the time of purchase. What is the sale price before taxes?arrow_forwardA loan for a new tractor is to be simple interest. The rate is 7.2% for 6 years on $43,400. How much should each payment be?arrow_forwardDuring 2022, Betty Simmons purchased 275 shares of common stock Issued by Doctor's Medical Supply for $9700 Including commission. Later in the same year,Betty sold the shares for $10,300 after commission. Calculate the following. (Round all answers to two decimal places.)1. Profit on this stock transaction:2. Percentage return on investment:arrow_forward

- Deandre has a salary of $82,100. What are his gross semi-monthly earnings?arrow_forwardIf Mary received a 10% raise and is now making $17,600 a year, what was her salary before the raise?arrow_forwardSuppose that under your health insurance policy, hospital expenses are subject to a $750 deductible and $150 per day copay. You get sick and hospitalized for 4 days, and the bill (after your insurance discounts are applied) comes to $6250. How much of that hospital bill will you have to pay yourself.arrow_forward

- If John earns $4,500 per month and spends 20% of his earnings on his monthly rent, how much does he have left over to spend each month?arrow_forwardA young professional wishes to have $730000 in her retirement account. She invests $900 monthly in the account which earns 10.2% annually. Find the number of payments needed to reach her goal.arrow_forwardAdelaide is self-employed and must submit estimated quarterly tax payments. Her predicted total tax liability for the current year will be $28,000, and her current withholdings are $17,385. She is advised to determine her quarterly payments by subtracting her current withholdings from her predicted total tax liability and dividing by four. What is a good estimate for Adelaide to use for her quarterly payments?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,