Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

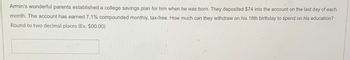

Transcribed Image Text:Armin's wonderful parents established a college savings plan for him when he was born. They deposited $74 into the account on the last day of each

month. The account has earned 7.1% compounded monthly, tax-free. How much can they withdraw on his 18th birthday to spend on his education?

Round to two decimal places (Ex. $00.00)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Since the birth of her daughter, 20 years ago, William has deposited $50 at the beginning of every month into a Registered Education Savings Plan (RESP). The interest rate on the plan was 5.10% compounded monthly for the first 8 years and 4.00% compounded monthly for the next 12 years. a. What would be the accumulated value of the RESP at the end of 8 years? Round to the nearest cent b. What would be the accumulated value of the RESP at the end of 20 years? Round to the nearest cent c. What is the amount of interest earned during the 20 year period? Round to the nearest centarrow_forwardStarting on the day Kelly was born, her mother has invested $50 at the beginning of every month in a savings account that earns 2.20% compounded monthly. a. How much did Kelly have in this account on her 22nd birthday? Assume that there was no deposit on that day. b. What was her mother's total investment? c. How much interest did the investment earn? How much should Diana's dad invest into a savings account today, to be able to pay for Diana's rent for the next five years if rent is $950 payable at the beginning of each month? The savings account earns 3.75% compounded monthly.arrow_forwardJames and Mary Garfield invested $5,000 in a savings account paying 4% annual interest when their daughter, Patricia, was born. They also deposited $1,000 on each of her birthdays until she was 14 (including her 14th birthday). Click here to view the factor table. How much was in the savings account on her 14th birthday (after the last deposit)? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Amount on 14th birthday $arrow_forward

- Upon graduating from college 40 years ago, Dr. Nick Riviera was already planning for his retirement. Since then, he has made deposits into a retirement fund on a weekly basis in the amount of $25.Nick has just completed his final payment and is at last ready to retire. His retirement fund has earned 9 percent compounded weekly. Use five decimal places for the periodic interest rate in your calculations. a. How much has Nick accumulated in his retirement account? b. In addition to this, 10 years ago Nick received an inheritance check for $20,000 from his beloved uncle. He decided to deposit the entire amount into his retirement fund. What is his current balance in the fund?arrow_forwardWhen you were born, your dear old Aunt Minnie promised to deposit $1,000 into a savings account bearing a 5% compounded annual rate on each birthday, beginning with your first. You have just turned 22 and want the dough. However, it turns out that dear old (forgetful) aunt Minnie made no deposits on your third, fifth, and eleventh birthdays. How much is in the account right now?arrow_forwardSince he was 24 years old, Ben has been depositing $225 at the end of each month into a tax-free retirement account earning interest at the rate of 3.5%/year compounded monthly. Larry, who is the same age as Ben, decided to open a tax-free retirement account 5 years after Ben opened his. If Larry's account earns interest at the same rate as Ben's, determine how much Larry should deposit each month into his account so that both men will have the same amount of money in their accounts at age 65. (Round your answer to the nearest cent.)arrow_forward

- When Gerardo was born, his grandparents started a savings account for him with a beginning balance of 1,250 Peruvian Sols. Every month they deposited 160 Sols into the account. The savings account paid an annual interest rate of 2.1%, compounded monthly. Gerardo just turned 24 and the balance of his account is now $61,917.43. How much of the money in Gerardo's account was earned in interest? (Round your answer to two decimal places, and don't include a currency sign.)arrow_forwardGilberto opened a savings account for his daughter and deposited $1000 on the day she was born. Each year on her birthday, he deposited another $1000. If the account pays 11% interest, compounded annually, how much is in the account at the end of the day on her 12th birthday? At the end of the day on her 12th birthday, the amount in the account is $ (Simplify your answer. Type an integer or a decimal. Round to the nearest cent if needed.)arrow_forwardYour grandma gave you $150 to start a college fund when you were born. This account earns 6% interest compounded yearly. Then, she gave you $10 in this account on each of your birthdays. Finally, you found a $20 bill on the ground on your 8th birthday that you also put into this account. How much much money is in this account on your 18th birthday (after your grandma made her deposit)? Do by formulas only pls, you may use excel to verify if you want.arrow_forward

- Since the birth of his granddaughter, 20 years ago, Jacob has deposited $100 at the beginning of every month into a Registered Education Savings Plan (RESP). The interest rate on the plan was 4.50% compounded monthly for the first 11 years and 5.00% compounded monthly for the next 9 years. a. What was the accumulated value of the RESP at the end of 11 years?arrow_forwarda mother earned $15000.00 from royalties on her cookbook. She set aside 20% of this for a down payment for a new home. The balance will be used for her son's future education. She invested a portion of the money in a bank certificate of a deposit (cd account) that earns 4% and the remainder in a savings bond that earns 7%. IF the total interest earned after one year is $720.00, how much money was invested at each rate?arrow_forwardWhen she was 6 years old, Jane’s parents set up an annuity for her college education, with the first payment deferred for 12 years until she reached the age of 18. The annuity, rated at 6%, compounded semi-annually, will pay $8,000 at the end of every 6 months for the 4 year period of her college education. a) Find the number of payment periods (N) Find the number of deferment periods (k) c) Find the Present Value of this annuity, i.e., what lump sum payment must Jane’s parents invest (at t = 0 ) to start the account [Find A(N,k)]arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education