Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working

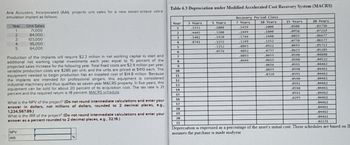

Transcribed Image Text:Aria Acoustics, Incorporated (AAI), projects unit sales for a new seven-octave voice

emulation implant as follows

Table 6.3 Depreciation under Modified Accelerated Cost Recovery System (MACRS)

Year

Unit Sales

71,000

2

84,000

3

103,000

5

95,000

64,000

Recovery Period Class

Year

1

3 Years

.3333

5 Years

7 Years

10 Years

15 Years

20 Years

.2000

1429

.1000

.0500

.03750

2

4445

.3200

.2449

.1800

.0950

.07219

3

.1481

1920

.1749

.1440

.0855

.06677

4

0741

.1152

1249

.1152

.0770

06177

5

.1152

.0893

0922

.0693

.05713

6

.0576

0892

.0737

0623

.05285

0893

.0655

.0590

.04888

0446

.0655

.0590

.04522

9

10

11

.0656

.0591

04462

.0655

.0590

04461

.0328

.0591

.04462

0590

.04461

.0591

04462

.0590

.04461

15

0591

.04462

.0295

04461

17

18

19

20

21

.04462

.04461

.04462

.04461

.02231

Production of the implants will require $2.3 million in net working capital to start and

additional net working capital investments each year equal to 15 percent of the

projected sales increase for the following year. Total fixed costs are $2.9 million per year,

variable production costs are $285 per unit, and the units are priced at $410 each. The

equipment needed to begin production has an installed cost of $14.8 million. Because

the implants are intended for professional singers, this equipment is considered

industrial machinery and thus qualifies as seven-year MACRS property. In five years, this

equipment can be sold for about 20 percent of its acquisition cost. The tax rate is 21

percent and the required return is 18 percent. MACRS schedule

What is the NPV of the project? (Do not round intermediate calculations and enter your

answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g.,

1,234,567.89.)

What is the IRR of the project? (Do not round intermediate calculations and enter your

answer as a percent rounded to 2 decimal places, e.g., 32.16.)

NPV

IRR

7

8

12

13

14

16

Depreciation is expressed as a percentage of the asset's initial cost. These schedules are based on IE

assumes the purchase is made midyear

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A system contains many processes. Three common processes that are “grouped” together are transaction corrections, adjustments, and cancellations. These three elements work to properly serve customers. Imagine a system that allows you to register for a class online. The online system must give you a way to correct any errors you made, such as registering for the wrong class. This would be a transaction correction. The system should also allow you to make adjustments, such as adding or dropping classes. Finally, the system should allow you to make cancellations, such as cancelling the registration process entirely. Notice that all three of these processes, correction, adjustment, and cancellation, work together to provide you with one service, which is registering for classes. What type of requirements are transaction corrections, adjustments, and cancellations? Select one. Question 4 options: A Functional Requirements B Nonfunctional Requirementsarrow_forwardWhen should you use Power BI Services?arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- Please provide only typed answer solution no handwritten solution needed allowed... Please do it neat and clean correctly.arrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!!arrow_forwardQ1: Write an e-mail to technical support team of your college to retrieve your login credentials. In order to make your e- mail effective mention all the important details and reasons to prioritize your responsearrow_forwardHow can you display or print a batch or group of reports quickly? A. Create a memorized group of reports. B. Click Batch Reports from the Home Page C. Click Reports > Process multiple reports D. You cannot do this in Quickbooksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education