FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Give me correct answer with explanation.

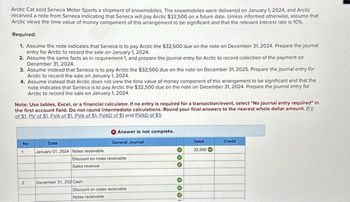

Transcribed Image Text:Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2024, and Arctic

received a note from Seneca indicating that Seneca will pay Arctic $32,500 on a future date. Unless informed otherwise, assume that

Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10%.

Required:

1. Assume the note indicates that Seneca is to pay Arctic the $32,500 due on the note on December 31, 2024. Prepare the journal

entry for Arctic to record the sale on January 1, 2024.

2. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on

December 31, 2024.

3. Assume instead that Seneca is to pay Arctic the $32,500 due on the note on December 31, 2025. Prepare the journal entry for

Arctic to record the sale on January 1, 2024.

4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant and that the

note indicates that Seneca is to pay Arctic the $32,500 due on the note on December 31, 2024. Prepare the journal entry for

Arctic to record the sale on January 1, 2024.

Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in

the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. (EV

of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1)

No

1

Date

January 01, 2024 Notes receivable

Answer is not complete.

General Journal

Debit

Credit

32,500

Discount on notes receivable

Sales revenue

2

December 31, 202 Cash

Discount on notes receivable

Notes receivable

000

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education