FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

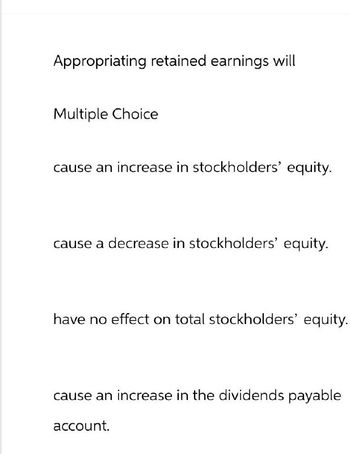

Transcribed Image Text:Appropriating retained earnings will

Multiple Choice

cause an increase in stockholders' equity.

cause a decrease in stockholders' equity.

have no effect on total stockholders' equity.

cause an increase in the dividends payable

account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What impact do flotation costs have on the cost of common equity? Question 8 options: None. The cost of retained earnings and new stock must be the same since they both represent the same claim by shareholders. It makes new stock less expensive compared to retained earnings. It makes new stock more expensive compared to retained earnings.arrow_forwardManagers often complain that the stock market is short-sighted and focused on accounting earnings. In your post, make a case to convince your manager that this view is either true or not true.arrow_forwardWhich statement is false? - stock dividend increases the amount of paid in capital -Stock splits cause no change in the amount of the stockholder's equity - stock splits increase the number of shares -stock dividend increases total stockholders equityarrow_forward

- Conflicts of interest between stockholders and bondholders are known as: O agency costs. O financial distress costs. O underwriting costs. Odealer costs. Otrustee costs. Click Save and Submit to save and submit. Click Save All Answers to save all answers. TCL Savearrow_forwardInvestments in smaller company stock compared to investments in larger company stock are generally: A) more volatile because they are less liquid, have less stock issued and have less diversified sources of income. B) more volatile because they are less liquid, have less stock issued and have more diversified sources of income. C) less volatile because they are less liquid, have less stock issued and have less diversified sources of income. D) less volatile because they are less liquid, have less stock issued and have more diversified sources of income.arrow_forwardRetained earnings not paid out to shareholders in the form of dividends are: Select one: a. Re-invested in the company b. Confiscated by the government c. Sold on the secondary market d. Paid as executive bonusesarrow_forward

- 4. What forms of market efficiency are violated if investors overreact to good news, resulting in stock price increases followed by stock price decreases: a. Semi-strong form efficiency b. Strong-form efficiency c. Both 1 and 2 d. Neither 1 nor 2arrow_forwardstock splits are similar to stock dividends in that both reduce retained earnings and have no effect on par true falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education