Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:homework 2

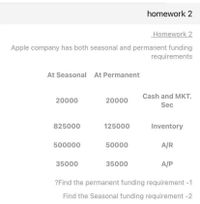

Homework 2

Apple company has both seasonal and permanent funding

requirements

At Seasonal At Permanent

Cash and MKT.

20000

20000

Sec

825000

125000

Inventory

500000

50000

A/R

35000

35000

A/P

?Find the permanent funding requirement -1

Find the Seasonal funding requirement -2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- which has a better IRR Project 1 Year Cashflows Discount Rate 10% 0 $ (750,000.00) 1 $ 250,000.00 2 $ 300,000.00 3 $ 350,000.00 4 $ 200,000.00 5 $ 100,000.00 Project 2 Year Cashflows Discount Rate 10% 0 $ (1,000,000.00) 1 $ 200,000.00 2 $ 300,000.00 3 $ 400,000.00 4 $ 500,000.00 5 $ 700,000.00arrow_forward20. Complete the following table: Purchase price of product Landcruiser Down payment Amount financed Number of monthly payments amount of monthly payments total of monthly payments total finance charge $83,900 $50,000 72 $618arrow_forwardPlease correct answer and don't use hend raitingarrow_forward

- Hi please provide stepwise solution of all and not handwritten please good way ill like.arrow_forwardYou are given the following cash flow information for Project A TV Inflows Year 0 PV Outflows -$150,000.00 1 Project A -$150,000.00 $80,000.00 -$25,000.00 $50,000.00 2 $80,000.00 -$30,000.00 $75,000.00 Totals 3 4 5 6 O 19.33% $75,000.00 Now assume that the project's cost of capital is 16.0 percent, but that its true reinvestment rate is 24.0 percent. Given this information, determine the project's modified internal rate of return (MIRR). Ⓒ 18.56% 5 ptsarrow_forwardShould the company accept or reject it using a discount rate of 18%arrow_forward

- ofice eBook Problem Walk-Through A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 1 2 3 4 Project S -$1,000 $878.81 $250 $15 $5 Project L -$1,000 $0 $240 $400 $782.91 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places. %arrow_forwardBased on the following table. Bid Ask EURUSD 1M FWD 7.05 7.34 EURUSD 2M FWD 14.99 15.15 EURUSD 3M FWD 22.57 23.05 EURUSD 4M FWD 30.25 30.55 EURUSD 5M FWD 38.03 38.43 EURUSD 6M FWD 45.91 47.2 EUR/USD Spot 1.1320 1.1328 What is the average annualized forward premium/discount for the EUR if you use the 4M forward contract (Format for answer: X.XX% or –X.XX%)arrow_forwardGuerilla Radio Broadcasting has a project available with the following cash flows: Year Cash Flow 0 -$ 15,000 1 6, 200 2 7,500 3 4,900 4 4, 500 What is the payback period? Multiple Choice 2.52 years 1.73 years 3.00 years 2.27 years 2.64 yearsarrow_forward

- omplete the following table: x Answer is complete but not entirely correct. Number of Amount of monthly Total of monthly Total finance Amount Purchase price of product Landcruiser Down financed monthly payments payments payments charge payment 538 52 x $ 36,584 X 75,900 48,000 27,900 24 68 %24 %24 Σ %24 %24arrow_forwardSolve all subparts Explain it early but not in excel works. Typed or handwriting use onlysarrow_forwardBased on the following table. Bid Ask EURUSD 1M FWD 7.05 7.34 EURUSD 2M FWD 14.99 15.15 EURUSD 3M FWD 22.57 23.05 EURUSD 4M FWD 30.25 30.55 EURUSD 5M FWD 38.03 38.43 EURUSD 6M FWD 45.91 47.2 EUR/USD Spot 1.1618 1.1624 What is the average annualized forward premium/discount for the EUR if you use the 6M forward contract (Format for answer: X.XX% or –X.XX%)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education