Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?

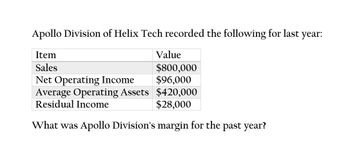

Transcribed Image Text:Apollo Division of Helix Tech recorded the following for last year:

Item

Sales

Net Operating Income

Average Operating Assets

Residual Income

Value

$800,000

$96,000

$420,000

$28,000

What was Apollo Division's margin for the past year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following selected data pertain to the Argent Division for last year: Required: 1. How much is the residual income? 2. How much is the return on investment? (Rounded to four significant digits.)arrow_forwardThe Holmes Division recorded operating data as follows for the past year: Sales Operating Income Average Operating Assets Shareholders' Equity Residual Income $200,000 $ 25,000 $100,000 $ 80,000 $ 13,000 For the past year, what was the minimum required rate of return? A) B) C) D) 12%. 11%. 14%. 13%.arrow_forwardGeneral accounting MCQarrow_forward

- Financial accounting problemarrow_forwardParker compound has provided the following datavfor the most recent yeararrow_forwardAssume the Residential Division of Kipper Faucets had the following results last year: What is the division’s RI? a. $(140,000) b. $104,000 c. $140,000 d. $(104,000)arrow_forward

- General accounting questionarrow_forwardWhat was the Paper Division's net operating income last year? A. P24,300B. P29,160C. P145,800D. P162,000arrow_forwardThe Millard Division's operating data for the past two years are provided below: Return on investment Net operating income Turnover Margin Sales Multiple Choice O $264,800 $232,000 $99,300 Year 1 $132,400 15% ? 77 ? $ 3,310,000 Millard Division's margin in Year 2 was 130% of the margin in Year 1. The net operating income for Year 1 was: (Round intermediate percentage computations to the nearest whole ? Year 2 20% $ 580,000 5 ? ?arrow_forward

- Margin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: Sales $1,040,000,000 Less: Variable expenses 700,250,000 Contribution margin $ 339,750,000 Less: Fixed expenses 183,750,000 Operating income $ 156,000,000 At the beginning of last year, Elway had $28,300,000 in operating assets. At the end of the year, Elway had $23,700,000 in operating assets. Required: 1. Compute average operating assets.$fill in the blank 1 2. Compute the margin (as a percent) and turnover ratios for last year. Margin fill in the blank 2 % Turnover fill in the blank 3 3. Compute ROI as a percent.fill in the blank 4 % 4. ROI measures a company’s ability to generate relative to its investment in assets. The greater the ROI, the efficiently the company is generating from its assets. 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a…arrow_forwardKindly help me with accounting questionsarrow_forwardCarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub