EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Net income will decrease or increase??

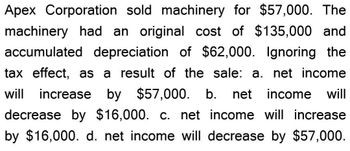

Transcribed Image Text:Apex Corporation sold machinery for $57,000. The

machinery had an original cost of $135,000 and

accumulated depreciation of $62,000. Ignoring the

tax effect, as a result of the sale: a. net income

will increase by $57,000. b. net income will

decrease by $16,000. c. net income will increase

by $16,000. d. net income will decrease by $57,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- MCQarrow_forwardA truck costs $82,000 when new and has accumulated depreciation of $70,000. Suppose Frank Towing exchanges the truck for a new truck. The new truck has a market value of $79,000, and Frank pays cash of $52,000. Assume the exchange has commercial substance. What is the result of this exchange? OA. No gain or loss OB. Gain of $15,000 OC. Gain of $67,000 OD. Loss of $15,000arrow_forwardGive me Answer of this Question.. need correct optionarrow_forward

- Question for Maroon Company: • HOW MUCH IS THE GAIN OR LOSS IF THE BLDG IS SOLD FOR P8MILLION ONE YEAR AFTER REVALUATION? • HOW MUCH IS THE BLANCE OF REVALUATION SURPLUS AFTER THE SALE? For Noypi Store, follow the requirement. (Choose from the choices and kindly provide a solution.)arrow_forwardIn each of the following cases, find the unknown variable. Ignore taxes. (Do not round intermediate calculations and enter your depreciation answer rounded to the nearest whole number and other answers rounded to 2 decimal places.) Accounting Break-Even Unit Price Unit Variable Cost Fixed Costs Depreciation 95,800 $42 $30 $820,000 143,806 64 2,750,000 1,150,000 7,835 97 245,000 105,000arrow_forwardGlobal Positioning Net purchased equipment on January 1, 2018, for $15,233. Suppose Global Positioning Net sold the equipment for $11,000 on December 31, 2020. Accumulated Depreciation as of December 31, 2020, was $10,155. Journalize the sale of the equipment, assuming straight-line depreciation was used. First, calculate any gain or loss on the disposal of the equipment. Market value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss)arrow_forward

- At the end of its financial year, Tanner Co had the following non-current assets: Land and buildings at cost $10.4 million Land and buildings: accumulated depreciation $0.12 million Tanner Co decided to revalue its land and buildings at the year-end to $15 million. What will be the value of the revaluation surplus if the revaluation is accounted for? %24arrow_forwardAssume that Peak Co. Is considering disposing of equipment that cost... Please need answer the general accounting questionarrow_forwardA publishing company wants to replace an old machine, which to date is totally depreciated. The new equipment will increase earnings before depreciation and taxes by $ 33,000 per year over its useful life, calculated at 9 years. Its price is $ 166,500 including installation costs. If the company pays taxes of 47% and its MARR is 11%, establish the convenience of replacement if depreciation is declared through: a.straight line method b.Method of the sum of the digits of the years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning