FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hardev

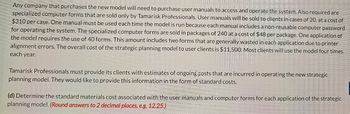

Transcribed Image Text:Any company that purchases the new model will need to purchase user manuals to access and operate the system. Also required are

specialized computer forms that are sold only by Tamarisk Professionals. User manuals will be sold to clients in cases of 20, at a cost of

$310 per case. One manual must be used each time the model is run because each manual includes a non-reusable computer password

for operating the system. The specialized computer forms are sold in packages of 240 at a cost of $48 per package. One application of

the model requires the use of 40 forms. This amount includes two forms that are generally wasted in each application due to printer

alignment errors. The overall cost of the strategic planning model to user clients is $11,500. Most clients will use the model four times

each year.

Tamarisk Professionals must provide its clients with estimates of ongoing costs that are incurred in operating the new strategic

planning model. They would like to provide this information in the form of standard costs.

(d) Determine the standard materials cost associated with the user manuals and computer forms for each application of the strategic

planning model. (Round answers to 2 decimal places, e.g, 12.25.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marquette has an opportunity to sell its product through an online retailer. To begin selling through this online platform, they are required to ship 2,000 units to the retailers’ order fulfillment warehouse. The other condition of this offer is that they pay a one-time vendor marketing fee of $5,000. To get the units to the fulfillment warehouse by the deadline Marquette will need to pay for expedited shipping at a cost of $10 per unit. What is the minimum price Marquette should charge the retailer for this initial order of 2,000 units? (Show all supporting calculations). (NOTE: ignore taxes or other costs not specifically mentioned in the questions.)arrow_forwardVaibharrow_forwardThe PUPPY SAFETY Corp. is dedicated to the wholesale of microfiche systems to detect the location of lost pets. The company has a production capacity of 10,000 system units and currently only produces 8,000. The company is operating above its tie point. The sale price per system is $500.00 and the related costs are presented later. Required: Indicate whether this business should accept or reject a special order of 500 microchips at a price of $300. The client is the Humane Society and it is an order that will not be repeated in the future as this comes from non-recurring funds. When we learned that the Humane Society was seeking bids, we took it upon ourselves to send our sales specialists who brought a proposal prepared following the usual sales and marketing practices. Despite being a special order, if accepted, it will follow the typical pattern of routine orders in terms of transaction costs. This order has no effect on the routine business of PUPPY SAFETY. Manufacturing costs…arrow_forward

- A company manufactures various-sized plastic bottles for its medicinal product. The manufacturing cost for small bottles is $52 per unit (100 bottles), including fixed costs of $10 per unit. A proposal is offered to purchase small bottles from an outside source for $31 per unit, plus $3 per unit for freight. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Prepare a differential analysis dated January 25 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the bottles, assuming fixed costs are unaffected by the decision. If an amount is zero, enter "0". Enter unit costs as positive values. Use a minus sign to indicate negative Differential Effects. Differential Analysis Make Bottles (Alt. 1) or Buy Bottles (Alt. 2) January 25 Make Bottles (Alternative 1) Buy Bottles (Alternative 2)…arrow_forwardAutomatic versus Manual ProcessingPhoto Station Company operates a printing service for customers with digital cameras. The current service, which requires employees to download photos from customer cameras, has monthly operating costs of $9,000 plus $0.20 per photo printed. Management is evaluating the desirability of acquiring a machine that will allow customers to download and make prints without employee assistance. If the machine is acquired, the monthly fixed costs will increase to $14,000 and the variable costs of printing a photo will decline to $0.04 per photo.(a) Determine the total costs of printing 20,000 and 50,000 photos per month. Units Current Process Proposed Process 20,000 Answer Answer 50,000 Answer Answer (b) Determine the monthly volume at which the proposed process becomes preferable to the current process.Answer unitsarrow_forwardPlease see the attachment, thank you! Cheers!arrow_forward

- I need all subparts....arrow_forwardPlease help mearrow_forwardA company has a central document copying service. With the present copy machines, the average time for making copies is 3 minutes. A new machine reduces the copy time to 2 minutes on average. The new machine would cost 10$ per hour to rent more than the present machine. The average wage of the company employees that make copies is 7.5$ an hour. Is the new machine worth the 10$ more rent? To answer this question, answer the following questions: 1) How many employees want to make copies in an hour and what is the total labor cost saving?arrow_forward

- Video Planet (VP) sells a big screen TV package consisting of a 60-inch plasma TV, a universal remote, and on-site installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer’s home entertainment system. VP concludes that the TV, remote, and installation service are separate performance obligations. VP sells the 60-inch TV separately for $2,150 and sells the remote separately for $300, and offers the entire package for $2,700. VP does not sell the installation service separately. VP is aware that other similar vendors charge $350 for the installation service. VP also estimates that it incurs approximately $300 of compensation and other costs for VP staff to provide the installation service. VP typically charges 50% above cost on similar sales. Required:1. to 3. Calculate the stand-alone selling price of the installation service using each of the following approaches.arrow_forwardEastman Publishing Company is considering publishing an electronic textbook about spreadsheet applications for business. The fixed cost of manuscript preparation, textbook design, and web-site construction is estimated to be $175,000. Variable processing costs are estimated to be $8 per book. The publisher plans to sell single-user access to the book for $54. (a) Build a spreadsheet model in Excel to calculate the profit/loss for a given demand. What profit can be anticipated with a demand of 3,300 copies? For subtractive or negative numbers use a minus sign. -23,200 (b) Use a data table to vary demand from 1,000 to 6,000 in increments of 200 to test the sensitivity of profit to demand. Breakeven occurs where profit goes from a negative to a positive value, that is, breakeven is where total revenue = total cost yielding a profit of zero. In which interval of demand does breakeven occur? (i) Breakeven appears in the interval of 3,400 to 3,600 copies. (ii) Breakeven appears in the…arrow_forwardVideo Planet (VP) sells a big screen TV package consisting of a 60-inch plasma TV, a universal remote, and on-site installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer’s home entertainment system. VP concludes that the TV, remote, and installation service are separate performance obligations. VP sells the 60-inch TV separately for $1,500, sells the remote separately for $200, and offers the installation service separately for $300. The entire package sells for $1,900. Required: How much revenue would be allocated to the TV, the remote, and the installation service? Note: Do not round intermediate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education