FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:-d

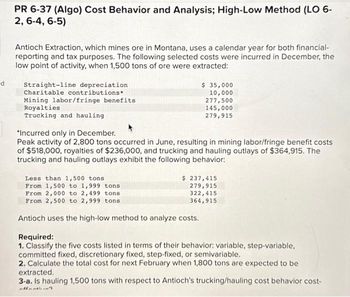

PR 6-37 (Algo) Cost Behavior and Analysis; High-Low Method (LO 6-

2, 6-4, 6-5)

Antioch Extraction, which mines ore in Montana, uses a calendar year for both financial-

reporting and tax purposes. The following selected costs were incurred in December, the

low point of activity, when 1,500 tons of ore were extracted:

Straight-line depreciation

Charitable contributions*

Mining labor/fringe benefits

Royalties

Trucking and hauling

$ 35,000

10,000

277,500

145,000

279,915

*Incurred only in December.

Peak activity of 2,800 tons occurred in June, resulting in mining labor/fringe benefit costs

of $518,000, royalties of $236,000, and trucking and hauling outlays of $364,915. The

trucking and hauling outlays exhibit the following behavior:

Less than 1,500 tons.

From 1,500 to 1,999 tons

From 2,000 to 2,499 tons

From 2,500 to 2,999 tons

$ 237,415

279,915

322,415

364,915

Antioch uses the high-low method to analyze costs.

Required:

1. Classify the five costs listed in terms of their behavior: variable, step-variable,

committed fixed, discretionary fixed, step-fixed, or semivariable.

2. Calculate the total cost for next February when 1,800 tons are expected to be

extracted.

3-a. Is hauling 1,500 tons with respect to Antioch's trucking/hauling cost behavior cost-

offentliin?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- i need the answer quicklyarrow_forward12. On July 23 of the current year, Dakota Mining Company pays $7,398,720 for land estimated to contain 8,808,000 tons of recoverable ore. It installs and pays for machinery costing $968,880 on July 25. The company removes and sells 451,000 tons of ore during its first five months of operations ending on December 31. Depreciation of the machinery is in proportion to the mine's depletion as the machinery will be abandoned after the ore is mined. Required:Prepare entries to record the following.(a) The purchase of the land.(b) The cost and installation of machinery.(c) The first five months' depletion assuming the land has a net salvage value of zero after the ore is mined.(d) The first five months' depreciation on the machinery.arrow_forwardLast Chance Mine (LCM) purchased a coal deposit for $1,654,350. It estimated it would extract 13,450 tons of coal from the deposit. LCM mined the coal and sold it, reporting gross receipts of $1.35 million, $6.25 million, and $5.2 million for years 1 through 3, respectively. During years 1–3, LCM reported net income (loss) from the coal deposit activity in the amount of ($16,400), $705,000, and $577,500, respectively. In years 1–3, LCM extracted 14,450 tons of coal as follows: (1) Tons of Coal (2) Basis Depletion (2)/(1) Rate Tons Extracted per Year Year 1 Year 2 Year 3 13,450 $1,654,350 $123.00 2,550 7,450 4,450 b. What is LCM's percentage depletion for each year (the applicable percentage for coal is 10 percent)?arrow_forward

- The Flintstone Construction Company delivers dirt and stone from local quarries to its construction sites. A new truck that was purchased for a cost of $122,000 at the beginning of the year was expected to deliver 122,000 tons over its useful life. The following is a breakdown of the tons delivered during the year to each construction site: Construction Sites: Tons Delivered: Multiple Choice $12,767 $1,400 A 1,400 How much truck depreciation should be allocated to Site A? (Do not round intermediate calculations. Round your answer to the nearest dollar.) $1,220 B 2,900 None of the answers are correct. с 3,400 D 900arrow_forwardQuantum Electronic Services paid P = $40,000 for its networked computer system. Both tax and book depreciation accounts are maintained. The annual tax depreciation rate is based on the previous year’s book value (BV), while the book depreciation rate is based on the original first cost (P). Use the rates listed to plot annual depreciation and book values for each method. Develop the graphs using hand calculations or a spreadsheet, as directed by your instructor.arrow_forwardPR 6-37 (Algo) Cost Behavior and Analysis; High-Low Method (LO 6-2, 6-4, 6-5) Antioch Extraction, which mines ore in Montana, uses a calendar year for both financial-reporting and tax purposes. The following selected costs were incurred in December, the low point of activity, when 1,800 tons of ore were extracted: Straight-line depreciation Charitable contributions* Mining labor/fringe benefits Royalties Trucking and hauling *Incurred only in December. Peak activity of 3,100 tons occurred in June, resulting in mining labor/fringe benefit costs of $666,500, royalties of $173,000, and trucking and hauling outlays of $495,385. The trucking and hauling outlays exhibit the following behavior: Less than 1,800 tons From 1,800 to 2,299 tons From 2,300 to 2,799 tons From 2,800 to 3,299 tons Antioch uses the high-low method to analyze costs. Required: 1. Classify the five costs listed in terms of their behavior: variable, step-variable, committed fixed, discretionary fixed, step-fixed, or…arrow_forward

- Colorado Mining paid $564.000 to acquire a mine with 47,000 tons of coal reserves. The financial statements model shown on the last tab reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 24,675 tons of coal in year Land 21150 tons in year 2. Required a Compute the depletion charge per unit b-1. Compute the depletion expense for years 1 and 2 in a financial statements. b-2. Record the acquisition of the coalreserves and the depletion expense for years Fand 2 in a financial statements model. Complete this question by entering your answers in the tabs below. Req A Req B1 Req B2 Compute the depletion charge per unit. Deple charge per unit per ton Reg BTXarrow_forwardThis is business algebra please show your work so I can understand the question. Thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education