Question

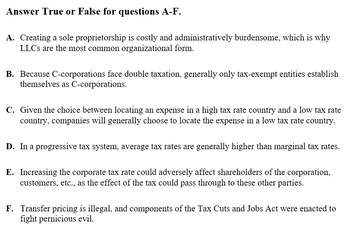

Transcribed Image Text:Answer True or False for questions A-F.

A. Creating a sole proprietorship is costly and administratively burdensome, which is why

LLCs are the most common organizational form.

B. Because C-corporations face double taxation, generally only tax-exempt entities establish

themselves as C-corporations.

C. Given the choice between locating an expense in a high tax rate country and a low tax rate

country, companies will generally choose to locate the expense in a low tax rate country.

D. In a progressive tax system, average tax rates are generally higher than marginal tax rates.

E. Increasing the corporate tax rate could adversely affect shareholders of the corporation,

customers, etc., as the effect of the tax could pass through to these other parties.

F. Transfer pricing is illegal, and components of the Tax Cuts and Jobs Act were enacted to

fight pernicious evil.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What is the most common type of corporate foundation? A. Company sponsored foundation B. A limited liability corporation (L3C) C. Community foundation D. Nonprofits that operate on behalf of the corporationarrow_forwardWhich of the following is correct for stakeholder approach a. All stakeholders affected by company have legitimate interest in corporation b. Employees only have legitimate interest in corporation c. Suppliers have legitimate interest in corporation d. Cant sayarrow_forward39. Ethical issues about the economic, political, or legal aspects that a business operates under are referred to as _____ issues.a. corporateb. individualc. governmentald. systemicarrow_forward

- Limited liability companies are primarily designed to: A. allow a portion of their owners to enjoy limited liability while granting the other portion of their owners control over the entity. B. provide the benefits of the corporate structure only to foreign-based entities. C. spin off a wholly owned subsidiary. D. allow companies to reorganize themselves through the bankruptcy process. E. provide limited liability while avoiding double taxation.arrow_forwardHelp A gesner Which of the following is required of branch agencies a. must be listed under the parent agency recent with the department of financial service b. Establish an office in the county where the company is based C. Be based in the home county of the agent in charge d. Be open to the public during regular business hours. Comarrow_forwardWhich of the following statements below is correct about shareholders? A. They are the legal owners of business corporations B. They own equal shares of company assets. C. They are nonmarket stakeholders in the company. D. They have no stake in how well the company performs.arrow_forward

- You should use secondary sources for legal research when you’re trying to get background information, context, or interpretation of the primary legal resources. A legal encyclopedia is one secondary resource for legal research that is commonly used. They’re commonly used since the legal issues are in alphabetical order and they’re usually easy to use. A legal encyclopedia is known to be used to “get your feet wet” so you can gain background knowledge. Another secondary source that’s good to use for legal research is legal periodicals. Legal periodicals are published on a regular or periodic basis and are known for discussing a variety of legal topics. “There are four broad categories of legal periodicals: publications of law schools; publications of bar associations and paralegal associations; specialized publications for those in the legal profession sharing similar interests; and legal newspapers and newsletters” (Bouchoux,2019). Legal periodicals are used to learn about the analysis…arrow_forwardIf the current account balance is $100 billion, net interest = $0, net transfers = $0, then - A. the country is loaning abroad. B. imports are greater than exports. C. the capital account balance must be +$100 billion. D. exports are greater than imports. E. there was an increase in net foreign assets.arrow_forward

arrow_back_ios

arrow_forward_ios