Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

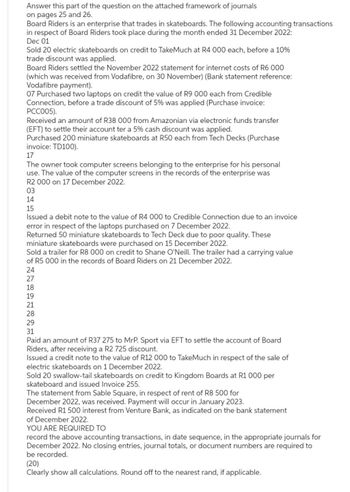

Transcribed Image Text:Answer this part of the question on the attached framework of journals

on pages 25 and 26.

Board Riders is an enterprise that trades in skateboards. The following accounting transactions

in respect of Board Riders took place during the month ended 31 December 2022:

Dec 01

Sold 20 electric skateboards on credit to TakeMuch at R4 000 each, before a 10%

trade discount was applied.

Board Riders settled the November 2022 statement for internet costs of R6 000

(which was received from Vodafibre, on 30 November) (Bank statement reference:

Vodafibre payment).

07 Purchased two laptops on credit the value of R9 000 each from Credible

Connection, before a trade discount of 5% was applied (Purchase invoice:

PCC005).

Received an amount of R38 000 from Amazonian via electronic funds transfer

(EFT) to settle their account ter a 5% cash discount was applied.

Purchased 200 miniature skateboards at R50 each from Tech Decks (Purchase

invoice: TD100).

17

The owner took computer screens belonging to the enterprise for his personal

use. The value of the computer screens in the records of the enterprise was

R2 000 on 17 December 2022.

03

14

15

Issued a debit note to the value of R4 000 to Credible Connection due to an invoice

error in respect of the laptops purchased on 7 December 2022.

Returned 50 miniature skateboards to Tech Deck due to poor quality. These

miniature skateboards were purchased on 15 December 2022.

Sold a trailer for R8 000 on credit to Shane O'Neill. The trailer had a carrying value

of R5 000 in the records of Board Riders on 21 December 2022.

24

27

18

19

21

28

29

31

Paid an amount of R37 275 to MrP. Sport via EFT to settle the account of Board

Riders, after receiving a R2 725 discount.

Issued a credit note to the value of R12 000 to TakeMuch in respect of the sale of

electric skateboards on 1 December 2022.

Sold 20 swallow-tail skateboards on credit to Kingdom Boards at R1 000 per

skateboard and issued Invoice 255.

The statement from Sable Square, in respect of rent of R8 500 for

December 2022, was received. Payment will occur in January 2023.

Received R1 500 interest from Venture Bank, as indicated on the bank statement

of December 2022.

YOU ARE REQUIRED TO

record the above accounting transactions, in date sequence, in the appropriate journals for

December 2022. No closing entries, journal totals, or document numbers are required to

be recorded.

(20)

Clearly show all calculations. Round off to the nearest rand, if applicable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- as show in the picarrow_forwardGive solution to this accounting problemarrow_forwardSmith had the following transactions during March, 2022. 2 4. 5. Smith sold and delivered $13.000 of merchandise to LJ Enterprises. terms 2/10,n30. LJEnterprises also ordered an additional $4,000 worth of goods on the last day of the month. Smith lent $900 to its company president who promised to repay the loan on the 15th day of the next month. Smith sold old storage sheds to Alt Traders on 3/31. Alt Traders gave a $2.000 promissory note to Smith agreeing to pay for the sheds in 3 months. Other current assets totaled $45,000. Smith received no cash arising from the above transactions during March. Based only on the above transactions, and ignoring beginning balances, compute the accounts receivable as a percentage of the total current assets as of month end. (Round answer to 0 decimal places, e.g. 25%.) Accounts Receivablearrow_forward

- Ryan Manufacturing sells flat-pack bookcases to retailers. The following transactions occurred during the month of July 2019. All sales on account come with terms of 5/10, net 30. Jul 1 Received a loan from the bank for $20,000. Jul 5 Sold products for cash to Brock Retailer for $9,000. The products had a cost of $4,950. Jul 9 Sold products on account to Furniture Outlet for $10,200. The products had a cost of $6,120. Jul 11 Furniture Outlet paid the amount owing from Jul 9. Jul 19 Sold products on account to Brock Retailer for $6,700. The products had a cost of $3,685. Requireda) Record the above transactions in the sales journal and the cash receipts journal.b) Post the appropriate transactions from the journals to the subledger accounts.c) At the end of the month, total the journals and update the accounts receivable control account.Do not enter dollar signs or commas in the input boxes. Sales Journal Page 1 Date Account Invoice # Accounts Receivable / Sales…arrow_forward1. on 1st Jan 2019 a club had received prepaid subscription of GHS 560. during the year ended 31 december 2019, the club received subscription GHS8480. on 31 december 2019 subscription to the club amounted to GHS400. which amount should be shown for subscription in the income and expenditure account for 2019. 2. A company has sales of GHS1000. the company sells three types of goods. 60% of sales are of type A which is sold at a markup of 20%. Type B goods are sold at a margin of 30%. The cost of type B sold in the year was GHS154 and total gross profit for the year was GHS184. What was the cost of sales of type A?arrow_forwardPagan Restaurants accepts credit and debit cards as forms of payment. Assume Pagan had $10,000 of credit and debit card sales on April 30, 2023. 9. 10. Suppose Pagan's processor charges a 1% fee and deposits sales net of the fee. Joumalize the sales transaction for the restaurant. Suppose Pagan's processor charges a 1% fee and deposits sales using the gross method. Journalize the sales transaction for the restaurant. 9. Suppose Pagan's processor charges a 1% fee and deposits sales net of the fee. Journalize the sales transaction for the restaurant. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Apr. 30 10. Suppose Pagan's processor charges a 1% fee and deposits sales using the gross method. Joumalize the sales transaction for the restaurant. Date Apr. 30 Accounts and Explanation Debit Creditarrow_forward

- Kristopher Company sold $40,500 of goods to Evan Company on credit on March 1, 2022. Terms were 3/10, n/30. Required: Prepare the journal entry on Kristopher’s books to record the sale. Prepare the journal entries to record collection, if the customer paid on April 8, 2021. Prepare the journal entry to record collection, if the customer paid on March 8, 2021.arrow_forwardMarx Corp. purchases 135 fax machines on credit from a manufacturer on April 7 at a price of $290 per machine. Terms of the purchase are 4/10, n/20 with an invoice date of April 7. Marx Corp pays in full for the fax machines on April 17. Create the journal entries for Marx Corp. to record: A. the initial purchase B. the subsequent payment on April 17 If an amount box does not require an entry, leave it blank. Assume the perpetual inventory system is used. Apr. 7 Apr. 17 Accounts Payable Accounts Receivable Merchandise Inventory Sales Discounts Sales II III II IIarrow_forwardA. Camy Enterprise is a wholesaler company that sells various types of kitchenware. The following is the list of transactions in December 2021. Dec 2 Makes a payment of RM220,500 to Yuhan Sdn Bhd for the pressure cooker purchased on 18 October 2021. 6 Purchases 25 units of frying pans from The King Ware Sdn Bhd with a total cost of RM7,000 by account. The credit term is 5/15, n/45. The frying pans were delivered with an agreement of F.O.B shipping point that cost RM100. 11 Sells 32 units of steamers to Pan Asia Nusantara Resort at a total sales price of RM9,600. The cost of the steamer is RM220 per unit. The transaction was made by cash. Accepts a return of two units of steamers from Pan Asia Nusantara Resort due to a slight dent on the steamers. Camy Enterprise made full cash return to Pan Asia Nusantara Resort. 16 A unit of frying pan is returned to The King Ware Sdn Bhd due to the wrong size and the outstanding balance owed is reduced by RM280. 18 Golden Chef Cullinary College…arrow_forward

- Sage sells its specialty combination gas/wood-fired grills to local restaurants. Each grill is sold for $1,010 (cost $601) on credit with terms 2/30, net/90. Prepare the journal entries for the sale of 20 grills on September 1, 2020, and upon payment, assuming the customer paid on (1) September 25, 2020, and (2) October 15, 2020. Assume the company records sales net. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Date Account Titles and Explanation Debit Cre (1) (To record sales) (To record cost of goods sold)arrow_forwardPrepare the appropriate journal entry(s) for the following transaction made by Steel Al tematives Corp. during March. Note: Steel Alternatives Corp. records sales using the NET method. On March 6 Steel Alternatives Corp. sold 1.5 million pounds of aluminum to Southern Framing Inc. The tems of the sale were 2/ 10 , n / 30 Selling price per pound S 0.89 COGS per pound is 0.36 On March 20 Steel Alternatives Corp. received payment from Southern Framing Inc.arrow_forwardOn July 10, 2023, Cullumber Ltd. sold GPS systems to retailers on account for a selling price of $1,080,000 (cost $864,000). Cullumber grants the right to return systems that do not sell in three months following delivery. Past experience indicates that the normal return rate is 15%. By October 11, 2023, following the collection on account, retailers returned systems to Cullumber and were granted credits of $89,000. The company follows IFRS. Prepare Cullumber's journal entries to record the $89,000 of actual returns on October 10, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit ber 10, 2023 Refund Liability Accounts Payable (To record returns from customers) ber 10, 2023 Estimated Inventory Returns (To record return of inventory) ber 10,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College