ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ded

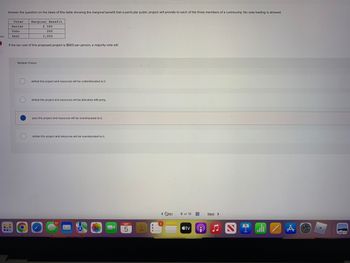

Answer the question on the basis of this table showing the marginal benefit that a particular public project will provide to each of the three members of a community. No vote trading is allowed.

Voter Marginal Benefit

Xavier

Yoho

Zest

1

If the tax cost of this proposed project is $600 per person, a majority vote will

Multiple Choice

$ 500

200

2,000

O

defeat this project and resources will be underallocated to it.

defeat this project and resources will be allocated efficiently.

pass this project and resources will be overallocated to it.

defeat this project and resources will be overallocated to it.

SEP

5

<rev

6 of 10

tv

⠀

Next >

▶

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer this for me mate. Much appreciated.arrow_forwardTable 10-4 Quantity 3 4 5 16 N Private Value a tax of $4 per unit of output a subsidy of $4 per unit of output a tax of $6 per unit of output a subsidy of $6 per unit of output $46 $44 $42 $40 $38 $36 $34 Private Cost $21 $24 $27 $30 $33 $36 $39 External Cost $6 $6 $6 $6 $6 $6 $6 Refer to Table 10-4. Which of the following policies would move the market from the market equilibrium to the socially optimal equilibrium?arrow_forwardEconomists James Buchanan and Gordon Tullock are well-known for developing Group of answer choices the impossibility theorem. the voting paradox. the public choice model. the concept of government failure.arrow_forward

- Question 1- If the seller has the constitutional burden, then A.the supply curve is shifted to show the imposition of the tax. B.the after-tax price to the buyer(PB)equals the original price plus the tax. C.the demand curve is shifted to show the imposition of the tax. D.the after-tax price to the seller(PS)equals the original price minus the tax. 2- When an effective production quota is applied, the quantity produced ______ and the price ______. On the last unit, the marginal benefit ______ marginal cost. A.decreases; rises; exceeds B.increases; rises; exceeds C.decreases; falls; is less than D.increases; falls; is less thanarrow_forwardGovernments continue to provide public support to some farmers, even in the absence of market failures. Choose the best explanation for this practice according to public choice theory. а. The benefits of the support are concentrated among a small and vocal group of farmers and the costs are widely dispersed among millions of consumers. b. Vote-maximising governments are irrational in their response to powerful lobbying. С. All consumers are willing to pay higher prices to provide financial support to some farmers. d. Government support goes to consumers in the form of price controls, which balances the support given to farmers. e. The marginal social cost of providing support is equal to the marginal social benefit.arrow_forward11.04 Unanswered • 2 attempts left When a corrective tax is created so that it equals the external costs linked to the production of a product, it will and the market result becomes the price buyers pay efficient. A decrease; more B decrease; less C increase; more D increase; lessarrow_forward

- A Section 1115 demonstration waiver led directly to ____. a. the expansion of home- and community-based services to elders and persons with disabilities b. the creation of the Centers for Medicare and Medicaid Services c. near universal health insurance coverage in Massachusetts d. the creation of the licensing model to replace the intergovernmental bargaining modelarrow_forward2. In this problem, you will compare the level of a public good chosen under majority voting to the socially-optimal level under three different sets of circumstances. Suppose first that individual i's demand curve for z is given by αi/z, where αi is a positive parameter. Instead of being linear, this demand curve is a hyperbola. Suppose further that z costs $1 per unit to produce (c = 1) and that this cost is shared equally among consumers. Therefore, cost per person is 1/n per unit of z. Then consider the three sets of circumstances listed below. Each situation has a different number of consumers in the economy and different collections of α values for the consumers. The number of consumers is denoted n and the vector of α values is denoted A = (α1,α2,...,αn-1,αn). Case 1: n = 7, A = (4, 2, 12, 4, 5, 13, 8). Case 2: n = 5, A = (10, 6, 11, 14, 8). Case 3: n = 9, A = (6, 9, 10, 4.5, 12, 7, 13.5, 8, 11). Using this information, do the following: a)For each case, compute the preferred z…arrow_forward. Explain why it might be socially and economically optimal for a government to have a public policy that subsidizes students who attend and graduate collegearrow_forward

- 23arrow_forward2. Consider the figure below showing the situation of Mr. P, a property-tax "free-rider," in Wilmette, Illinois (a suburb of Chicago) where everyone else is an R. Assume c=600, a=0.5. z are pure public goods. *=100, z'=300 and z*R=500. There are 100 taxpayers in Wilmette. 100 ac 88 100 R T S DR DP zp Z' ZR Z a. How much public good z is provided in Wilmette? What is the tax-price for Mr. R? How much is Mr. R's tax bill? b. What is Mr. P's tax-price if he lives in Wilmette? What is his tax bill if he lives in Wilmette? c. If Mr. P lives in North Chicago, another suburb of Chicago made up 100 P's, how much public good z would he be provided? How much would his tax bill be? d. By living in Wilmette, Mr. P enjoys how much more or less consumer surplus than he would in North Chicago? Try to be quantitative.arrow_forward5. Describe how taxes can lead to efficiency losses. Your answer should include a graph and an explanation of what the graph illustrates.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education