Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Answer the following simple interest problem using the provided formula ONLY. Show your complete solution.

2. Clara has invested 10,000.00 pesos, part at 5% and the remainder at 10% simple interest. How much is invested at higher rate if the total annual interest from this investment is 950.00 pesos?

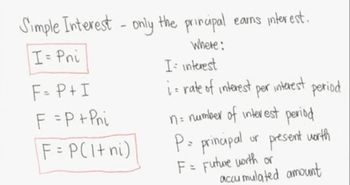

Transcribed Image Text:Simple Interest - only the principal earns interest.

where:

I = Pni

F= P + I

F = P + Pni

F = P(ltni)

I= interest

i= rate of interest

period

per

interest

n = number of interest period

P= principal or present worth

F = Future worth or

accumulated amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- c. A person who invests $1, 600 each year finds one choice that is expected to pay 3 percent per year and another choice that may pay 4 percent. What is the difference in return if the investment is made for four years? Round your answer to the nearest dollar. (Hint: Use Appendox A-3 or the Garman/Forgue companion website.) Round Future Value of Series of Equal Amounts in intermediate calculations to four decimal places.arrow_forwardPlease try to do with formula. Justin invested $5,200 for 345 days at 5.5% p.a. How much more interest would he have earned on the investment if the interest rate was 5.9% p.a. instead of 5.5% p.a.?arrow_forwardSuppose that immediately after making the fifth payment to Joseph as described above, Wagon Financial also implements a new investment strategy which they believe will yield even higher investment returns than the original 12% per annum. Assuming this to be true, would Wagon Financial need to set aside more or less money than your answer in part f) to be sure that they can afford to make all future payments to Joseph? Justify your answer.arrow_forward

- PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULASMr. Romuaro Godinez comes to the financial advisor Alquimidez Serrano, and asks him to calculate the interest to be earned on a deposit for the amount of 850,000.00; when the current interest rate is 8.75%, capitalizable quarterly, and it was invested for 15 years, 4 months and 17 days. The Finance Company reinvests at simple interest when there are not complete capitalization periods.arrow_forwardPerformance task No.2: SIMPLE INTERESTS Directions: Complete the table below. Show your solution on a separate sheet. 1. Find the simple interest on a loan of P65,000 if the loan is given at a rate of20% and is due in 3 years. 2. Amparo invested a certain amount at 10% simple interest per year. After 2years, the interest she received amounted to P3,000. How much did she invest? 3. Miko borrowed P25,000 at 10% annual simple interest rate. How much should he pay after 3 years and 6 months?arrow_forwardTOPIC: ENGINEERING ECONOMICS Specific Instructions: Solve each problem NEATLY and SYSTEMATICALLY. Show your COMPLETE solutions and BOx your final answers. Express all your answers in 2 decimal places. Problem: 1. What is the future amount of my Php 100, 000 after 5 years if I invest today at a rate of 12 % compounded annually? The inflation rate is 8 % per year. What is the actual effective rate given to the account?arrow_forward

- Your answer is incorrect. Sheridan Company is considering investing in an annuity contract that will return $33,500 annually at the end of each year for 15 years. Click here to view the factor table. What amount should Sheridan Company pay for this investment if it earns an 10% return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Sheridan Company should pay $ eTextbook and Media Save for Later SUPP Attempts: 2 of 3 used Submit Answerarrow_forwardOriental Corporation has gathered the following data on a proposed investment project: Investment in depreciable equipment Annual net cash flows Life of the equipment $600,000 $ 64,000 15 years Salvage value Discount rate 6% The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period for the investment would be: (Round your answer to 1 decimal place.)arrow_forwardA woman invests $1,900 at a rate of 4%. Find the time in vears that it takes her investment to double with annual compounding (a) using the future value formula and (b) using the Rule of 72.arrow_forward

- if magui will invest her money today worth 500000 in JMC Mining company, how much is the expected annual net income if the money has an interest rate of 7% and yield of investment of 6% for 10 years? Annual Income = ___ (2decimal places only) All answer must be rounded off. Do not store values on your calculator. Use the previous answer if needed.arrow_forwardT5.arrow_forwardBill Padley expects to invest $6,000 for 3 years, after which he wants to receive $6,945.60. What rate of interest must Padley earn? (PV of $1. EV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Future Value Present Value Table Factor Interest Rate %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education