FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Answer the following questions.

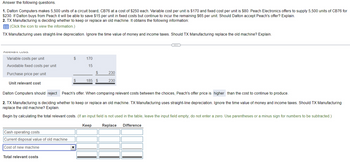

1. Dalton Computers makes 5,500 units of a circuit board, CB76 at a cost of $250 each. Variable cost per unit is $170 and fixed cost per unit is $80. Peach Electronics offers to supply 5,500 units of CB76 for

$230. If Dalton buys from Peach it will be able to save $15 per unit in fixed costs but continue to incur the remaining $65 per unit. Should Dalton accept Peach's offer? Explain.

2. TX Manufacturing is deciding whether to keep or replace an old machine. It obtains the following information:

(Click the icon to view the information.)

TX Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should TX Manufacturing replace the old machine? Explain.

Relevant COSIS.

Variable costs per unit

Avoidable fixed costs per unit

Purchase price per unit

Unit relevant cost

Cash operating costs

Current disposal value of old machine

Cost of new machine

$

Total relevant costs

170

15

$

185 $

230

230

Dalton Computers should reject Peach's offer. When comparing relevant costs between the choices, Peach's offer price is higher than the cost to continue to produce.

2. TX Manufacturing is deciding whether to keep or replace an old machine. TX Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should TX Manufacturing

replace the old machine? Explain.

Begin by calculating the total relevant costs. (If an input field is not used in the table, leave the input field empty; do not enter a zero. Use parentheses or a minus sign for numbers to be subtracted.)

Difference

Keep

Replace

C---

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Holiday Corporation has two divisions, Quail and Marlin. Quail produces a widget that Marlin could use in its production. Quail's variable costs are $4.30 per widget while the full cost is $7.30. Widgets sell on the open market for $12.60 each. If Quail has excess capacity, what would be the minimum transfer price if Marlin currently is purchasing 115,000 units on the open market? Multiple Choice $5.30 $4.30 $12.60 $7.30arrow_forwardRadar Company sells bikes for $520 each. The company currently sells 4,300 bikes per year and could make as many as 4,620 bikes per year. The bikes cost $265 each to make: $170 in variable costs per bike and $95 of fixed costs per bike. Radar receives an offer from a potential customer who wants to buy 320 bikes for $500 each. Incremental fixed costs to make this order are $70 per bike. No other costs will change if this order is accepted. (a) Compute the income for the special offer. (b) Should Radar accept this offer? (a) Special offer analysis Per Unit Total Contribution margin Income (b) The company shouldarrow_forwardAt Cullumber Electronics, it costs $30 per unit ($16 variable and $14 fixed) to make an MP3 player that normally sells for $51. A foreign wholesaler offers to buy 3,580 units at $28 each. Cullumber Electronics will incur special shipping costs of $3 per unit. Assuming that Cullumber Electronics has excess operating capacity, indicate the net income (loss) Cullumber Electronics would realize by accepting the special order. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Costs-Variable manufacturing Shipping Net income The special order should be $ 69 accepted Reject Order $ Accept Order 4 Net Income Increase (Decrease)arrow_forward

- The Arthur Company manufactures kitchen utensils. The company is currently producing well below its full capacity. The Benton Company has approached Arthur with an offer to buy 17,000 utensils at $0.85 each. Arthur sells its utensils wholesale for $0.96 each; the average cost per unit is $0.91, of which $0.10 is fixed costs. If Arthur were to accept Benton's offer, what would be the increase in Arthur's operating profits? Multiple Choice O O $850. $1,020. $680. $1,870.arrow_forwardVista Company manufactures electronic equipment. It currently purchases the special switches used in each of its products from an outside supplier. The supplier charges Vista $1.80 per switch. Vista’s CEO is considering purchasing either machine A or machine B so the company can manufacture its own switches. The projected data are as follows: Machine A Machine B Annual fixed costs $ 141,450 $ 188,325 Variable cost per switch 0.57 0.25 Required: For each machine, what is the minimum number of switches that Vista must make annually for total costs to equal outside purchase cost? What volume level would produce the same total costs regardless of the machine purchased? What is the most profitable alternative for producing 155,000 switches per year and what is the total cost of that alternativearrow_forwardRowan Quinn Company manufactures kitchen appliances. Currently, it is manufacturing one of its components at a variable cost of $40 and fixed costs of $15 per unit. An outside provider of this component has offered to sell Rowan Quinn the component for $45. Determine the best plan and compute the savings assuming fixed costs are unaffected by the decision.arrow_forward

- Paradise Manufacturing currently makes one of its parts for a total cost of $3.80 per unit. This cost is based on a normal capacity of 60,000 units. Variable cost are $2.50 per unit. Fixed cost related to making this part is $30,000. Allocated fixed cost are unavoidable and amount to $30,000. Paradise Manufacturing is considering buying the part for $2.80 per unit. Should the company continue making the part or should they buy the part from the outside supplier? Give a numerical justification for your answer.arrow_forwardVoltaic Electronics uses a standard part in the manufacture of different types of radios. The total cost of producing 30,000 parts is $100,000, which includes fixed costs of $40,000 and variable costs of $60,000. The company can buy the part from an outside supplier for $2 per unit and avoid 20% of the fixed costs. Assume that the company can use the freed manufacturing space to make another product that can earn a profit of $16,000. If Voltaic outsources, what will be the effect on operating income? A. decrease of $8,000 B. decrease of $24,000 C. increase of $16,000 D. increase of $24,000arrow_forwardJ.W. Electronics sells one of its Toshiba 43" 1080p LED TV for $370 The fixed cost for producing this type of TV is $166500. The variable cost per unit is $185 Based on the above information, what is the break-even point in units? Show your calculations. The competition has reduced its price on a similar TV to $310. J.W. Electronics is considering reducing its selling price to $310 to compete. Find the new break-even b point if the sales price is reduced to $310. Show your calculations Calculate the profit realized by J.W. Electronics on the sale of 2500 TVs if it keeps its selling price at $370. Show your calculations.arrow_forward

- Answer the following questions. 1. Douglas Computers makes 5,900 units of a circuit board, CB76 at a cost of $220 each. Variable cost per unit is $170 and fixed cost per unit is $50. Peach Electronics offers to supply 5,900 units of CB76 for $200. If Douglas buys from Peach it will be able to save $20 per unit in fixed costs but continue to incur the remaining $30 per unit. Should Douglas accept Peach's offer? Explain. 1. Douglas Computers makes 5,900 units of a circuit board, CB76 at a cost of $220 each. Variable cost per unit is $170 and fixed cost per unit is $50. Peach Electronics offers to supply 5,900 units of CB76 for $200. If Douglas buys from Peach it will be able to save $20 per unit in fixed costs but continue to incur the remaining $30 per unit. Should Douglas accept Peach's offer? Explain. Begin by calculating the relevant cost per unit. (If a box is not used in the table, leave the box empty; do not enter a zero.) Make Buy Relevant costs: Unit relevant cost Douglas…arrow_forwardBig Seats has the capacity to produce 100,000 sofas per year but only produces 80,000 sofas per year. The sale price is $1,000 each. Direct materials equals $100 per sofa, direct labor equals $200 per sofa, and allocated overhead equals $100,000 per year. Buy & Large offers to buy an additional 2,000 sofas but is only willing to pay $800 per sofa. What is the additional operating income (loss) of accepting the offer? ENTER NEGATIVE NUMBERS WITH A "_" SIGN. DO NOT USE PARENTHESES. EXAMPLE: -1000arrow_forwardSheffield Corp. is unsure of whether to sell its product assembled or unassembled. The unit cost of the unassembled product is $27 and Sheffield would sell it for $62. The cost to assemble the product is estimated at $19 per unit and the company believes the market would support a price of $66 on the assembled unit. What decision should Sheffield make and why? O Process further because the company will be better off by $16 per unit. O Sell before assembly because the company will be better off by $15 per unit. O Sell before assembly because the company will be better off by $4 per unit. O Process further because the company will be better off by $12 per unit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education