ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

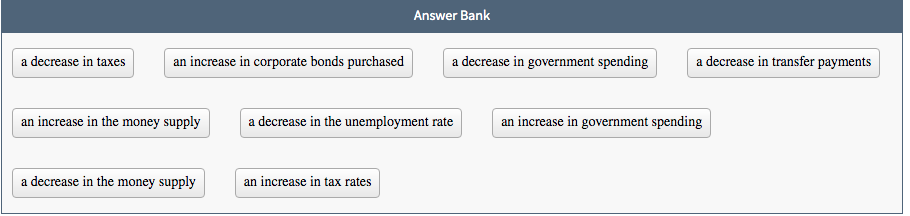

Classify each statement as an example of expansionary fiscal policy, contractionary fiscal policy, or not an example of fiscal policy. Answer bank In image

| Expansionary fiscal policy | Contractionary fiscal policy | Not an example of fiscal policy | |

Transcribed Image Text:Answer Bank

a decrease in taxes

an increase in corporate bonds purchased

a decrease in government spending

a decrease in transfer payments

an increase in the money supply

a decrease in the unemployment rate

an increase in government spending

a decrease in the money supply

an increase in tax rates

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Fiscal policy of increasing government expenditures can be more potent than monetary policy in getting us out of a recession because Question 44 options: Monetary policy takes a lot of time to implement there is no lagged effect of fiscal policy on GDP Monetary policy produces too much uncertainty Fiscal policy has a larger multiplier effectarrow_forwardWhich of the following could NOT be contractionary fiscal policy tool? OA) decreasing government expenditure OB)decreasing taxes Oc) decreasing transfer paymentsarrow_forwardExplain fiscal policy and its role in stabilizing economies during recessions.arrow_forward

- How do the instances when expansionary fiscal policy should be used compare with those for contractionary fiscal policy? Expansionary fiscal policy should be used during recessions to help build the economy and contractionary fiscal policy should be used when there is high inflation. Expansionary fiscal policy should be used to increase government revenue and contractionary fiscal policy should be used to increase consumer spending. Expansionary fiscal policy should be used to combat high inflation and contractionary fiscal policy should be used to increase government revenue. Expansionary fiscal policy should be used to decrease the unemployment rate and contractionary fiscal policy should be used when economic growth is too fast.arrow_forwardCite the five major demand-side components of GDP. Then, identify the major elements affected by fiscal policy.arrow_forwardAssign the correct label to the corresponding events/ policy actions that occurred during the 2007–2011 time period. Events/policy actions: TARP, the 2009 stimulus package, the 2010 extension of the Bush tax cuts, the reduction in taxes most Americans paid because they had less income than they would have had. Label: discretionary fiscal policy, non-discretionary fiscal policy?arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWhich is considered expansionary fiscal policy? a)a tax increase for wealthy individuals b)an increase in national defense spending c)regulations raising emission standards on trucks d)an increase in the money supplyarrow_forwardNo chatgpt i will give 5 upvotes plzarrow_forward

- List what specific, deliberate actions the federal government could take to enact expansionary fiscal policy.arrow_forwardTo enact Contractionary Fiscal Policy, the federal government must be running a budget ___________.arrow_forwardHow relevant is the multiplier concept to the implementation of expansionary andcontractionary fiscal policies?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education