Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please help me in this problem

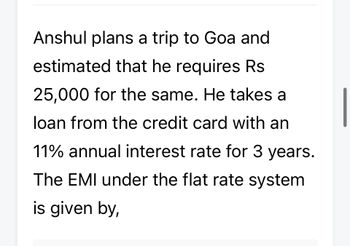

Transcribed Image Text:Anshul plans a trip to Goa and

estimated that he requires Rs

25,000 for the same. He takes a

loan from the credit card with an

11% annual interest rate for 3 years.

The EMI under the flat rate system

is given by,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- John borrows money from a bank. Interest rate is 9.5%pa compounded half yearly. He has 2 options to repay the loan: A: repay $5000 in 5 years and $ 5000 in 8 years B: make a single repayment of x in 7 years. Two options are equivalent. Calculate X using Excel TVM function.arrow_forwardA man plans to take a vacation in 5 years. He wants to buy a certificate of deposit for $1300 that he will cash in for the trip. What is the minimum annual interest rate he must obtain on the certificate if he needs at least $1500 for the trip? Assume that the interest on the loan is computed using simple interest. The rate he must obtain isarrow_forwardArchitech Anino will deposit money in the bank equally to "x" on the 2nd year, 2x on the 3rd year and 3x on the 4th year. If the present worth of all money he deposited now is P21,891, find the value of x if the interest rate is 10%.arrow_forward

- Dr. Dennis Natali plans to take advantage of 0% interest balance transfer credit card offer to pay off a $7250 loan he has.if his loan is at 7.5% interest for 12 months ,what is his payment? How much will he save in interest?arrow_forwardMaheera can get a certificate of deposit (CD) at his bank that will pay 3.5% annually for 10 years. If he places $2442 in this CD, how much will it be worth when it matures? (a) Use the formula. (b) Use the interest tables and interpolation. (c) Use a calculator or spreadsheet for a 5-button solution.arrow_forwardSolve it correctly please.arrow_forward

- Dr. Dennis Natali plans to take advantage of a 0% interest balance transfer credit card offer to pay off a $7,250 loan he has. If his loan is at 7.5% interest for 12 months, what is his payment? How much will he save in interest? (Use Table 14.2) Note: Do not round intermediate calculations. Round your final answers to the nearest cent.arrow_forwardHo is now saving his money HK$2000 per month in a regular savings account of HSBC which offers him interest rate of 4%p.a. compound monthly. A bank teller suggest him to setup a monthly saving plan. The details are as follow Maturity of 5 years Fixed interest rate 8% p.a. compound quarterly A handling fee equivalent to 2% of the total investment amount for early withdrawal If he needs to use the money 4 years from now, should he take the offer?arrow_forwardReggie availed of a deferred payment scheme from a bank that gave her an option to pay ₱5,500 monthly for 2 years. The first payment is due after 3 months. How much is the present value of the loan if the interest rate is 12% converted monthly?arrow_forward

- If you are planning to apply for a personal loan and borrow PhP 30,000 and repay the principal and interest for an agreed length of time of 3 years, How much monthly payment is needed for each bank offer? b. How much interest would you pay for 3 years for each bank offer? Which is the best option for you among the given choices below if you are to pay monthly for 3 years? а. с. Bank (Personal Loan) Monthly Interest Rate A 1.3% B 1.89% 1.22% D 1.5% 1.25%arrow_forwardDr. Dennis Natali plans to take advantage of a 0% interest balance transfer credit card offer to pay off a $7,250 loan he has. If his loan is at 7.5% interest for 12 months, what is his payment? How much will he save in interest? (Use Table 14.2) Note: Do not round intermediate calculations. Round your final answers to the nearest cent. Payment Savings in interestarrow_forwardYou decide to treatyour friends to a €20,000 luxury trip to the tent village at WorldCup in Qatar. You must borrow the full amount (€20,000) on your credit card. The interest rate is 2.0 percent per month, compounded on a monthly basis. (20 Points) Required: i. Assuming there no additional fees or late payment fees, what is the future balance of your credit card if you make no payments for 5 years based on the interest rate above? ii. How long will it take you to payoff this debt assuming that you do not charge anything else and only make regular monthly payments of €500? iii. After 12 months of making €500 monthly payments on your credit card, Easy Bank offers you an amortising loan with the same payment of €500 but with an effective annual rate of 6.17%. How long will it take to payoff the loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education