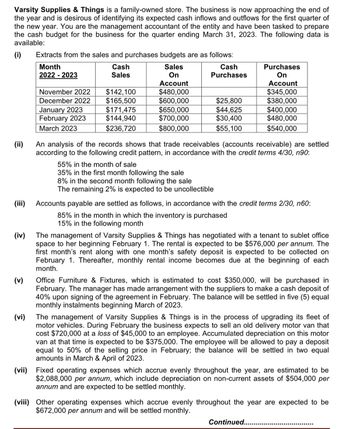

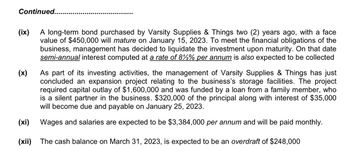

REQUIRED:

The business needs to have a sense of its future

- A schedule of budgeted cash collections for trade receivables for each of the months January to March.

- A schedule of expected cash disbursements for accounts payable for each of the months January to March.

- A

cash budget , with a total column, for the quarter ending March 31, 2023, showing the expected cash receipts and payments for each month and the ending cash balance for each of the three months, given that no financing activities took place.

SHOW THE WORKINGS

Step by stepSolved in 4 steps with 8 images

Another team member who is preparing the Budgeted

the same quarter ending March 31, 2023 and has asked you to furnish him with the figures

for the expected trade receivables and payables to be included in the statement. Is that a

reasonable request? If yes, what should these amounts be?

Another team member who is preparing the Budgeted

the same quarter ending March 31, 2023 and has asked you to furnish him with the figures

for the expected trade receivables and payables to be included in the statement. Is that a

reasonable request? If yes, what should these amounts be?

- how about these 3 requirments Prepare a direct materials budget for the first quarter of the financial year ending 30 September 2022. Prepare a cash budget for the first quarter of the financial year ending 30 September 2022 including any necessary schedules. Prepare a budgeted income statement for the first quarter of the financial year ending 30 September 2022.arrow_forwardCash budgeting is critical to a company’s financial information needs. The following information was extracted from the records of A & B Manufacturing Company Limited. The opening cash balances on January 01, 2021 was expected to be $30,000. The budgeted sales were as follows: Budgeted Sales Month Year $ November 2020 80,000 December 2020 90,000 January 2021 80,000 February 2021 75,000 March 2021 60,000 April 2021 70,000 Analysis of records shows that debtors settle according to the following pattern: 70% within the month of sale 30% the following month Extracts of the purchases budget were as follows: Purchases budget Month Year $ December 2020 65,000 January 2021 50,000 February 2021 75,000 March…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education