Concept explainers

On January 1, 2016, Halstead, Inc., purchased 75,000 shares of Sedgwick Company common stock for $1,480,000, giving Halstead 25 percent ownership and the ability to apply significant influence over Sedgwick. Any excess of cost over book value acquired was attributed solely to goodwill.

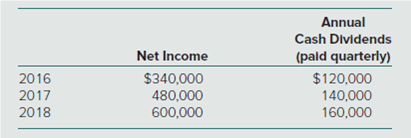

Sedgwick reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout these years. Dividends are declared and paid in the same period.

On July 1, 2018, Halstead sells 12,000 shares of this investment for $25 per share, thus reducing its interest from 25 to 21 percent, but maintaining its significant influence.

Determine the amounts that would appear on Halstead’s 2018 income statement relating to its ownership and partial sale of its investment in Sedgwick’s common stock.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Porter Corporation purchased 80% of the common stock of Salem Company for $850,000 on January 1, 2013. During the next three years, Salem had the following income and Dividends paid: Year Income Dividends 2013 $100,000 $25,000 2014 $110,000 $35,000 2015 $170,000 $60,000 Prepare the journal entries made under both methods and then compute the ending balance in the "investment" account under both methods.arrow_forwardThe following information relates to Crip Crippy Investment of HIJ Corporation. (1). Purchase investment for $1,000,000 on January 1, 2009 (2) HIJ Corporation had earnings of $600,00 at December 31, 2009 and declared dividends of $400,000. (3) The dividends were paid on January 2, 2010. (4) On July 1, 2010 Crip Crippy sold fifty percent of its interest for $ 400,000 (5) At June 30, 2010, HIJ had earnings of $600,000 for the year and paid dividends of $200,000 for shares outstanding as at November 30, 2010. Requiement: Using the cost and equity method, record all entries from January 1, 2009 to December 31, 2010 using the following scenarios (a) Crip Crippy purchased 40% of HIJ Corporation (b) Crip Crippy purchased 18% of HIJ Corporationarrow_forwardHerbert, Inc., acquired all of Rambis Company’s outstanding stock on January 1, 2020, for $649,000 in cash. Annual excess amortization of $19,800 results from this transaction. On the date of the takeover, Herbert reported retained earnings of $410,000, and Rambis reported a $226,000 balance. Herbert reported internal net income of $42,500 in 2020 and $55,400 in 2021 and declared $10,000 in dividends each year. Rambis reported net income of $28,500 in 2020 and $41,400 in 2021 and declared $5,000 in dividends each year. a. Assume that Herbert’s internal net income figures above do not include any income from the subsidiary. If the parent uses the equity method, what is the amount reported as consolidated retained earnings on December 31, 2021? What would be the amount of consolidated retained earnings on December 31, 2021, if the parent had applied either the initial value or partial equity method for internal accounting purposes? b. Under each of the following situations, what is…arrow_forward

- Godoarrow_forwardHerbert, Inc., acquired all of Rambis Company’s outstanding stock on January 1, 2020, for $652,000 in cash. Annual excess amortization of $13,700 results from this transaction. On the date of the takeover, Herbert reported retained earnings of $498,000, and Rambis reported a $232,000 balance. Herbert reported internal net income of $44,750 in 2020 and $58,350 in 2021 and declared $10,000 in dividends each year. Rambis reported net income of $23,300 in 2020 and $36,900 in 2021 and declared $5,000 in dividends each year. a. Assume that Herbert’s internal net income figures above do not include any income from the subsidiary. If the parent uses the equity method, what is the amount reported as consolidated retained earnings on December 31, 2021? What would be the amount of consolidated retained earnings on December 31, 2021, if the parent had applied either the initial value or partial equity method for internal accounting purposes? Equity method, initial value method and partial…arrow_forwardAt the beginning of 2022, CPA Company purchased 20% of ACCA Corp’s ordinary shares outstanding for P3,000,000. Transaction cost incurred is 10% of the purchase price of the shares. at the data of acquisition, the carrying amount of the identifiable net assets were equal to their fair values. During 2022, the investee reported net income of 3,500,000 and paid cash dividend of P2,000,000. In 2023, Oriental reported loss of P500,000 and issued 10% stock dividends a. Investment Income for 2022 b. Carrying Amount of the investment in Associate on December 31, 2022 c. Investment Loss in 2023?arrow_forward

- Munabhaiarrow_forwardOn January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $198,000. On that date, Burks’s balance sheet disclosed net assets with both a fair and book value of $353,000. During 2021, Burks reported net income of $84,000 and declared and paid cash dividends of $24,000. Alamar sold inventory costing $27,000 to Burks during 2021 for $35,000. Burks used all of this merchandise in its operations during 2021. Prepare all of Alamar’s 2021 journal entries to apply the equity method to this investment 1. Record the acquisition of a 36 percent interest in Burksarrow_forwardSunland Corporation purchased 370 shares of Sherman Inc. common stock for $ 13,100 ( Sunland does not have significant influence). During the year, Sherman paid a cash dividend of $ 3.00 per share. At year-end, Sherman stock was selling for $ 37.50 per share.Prepare Sunland's journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit (a) enter an account title to record the purchase of the investment enter a debit amount enter a credit amount enter an account title to record the purchase of the investment enter a debit amount enter a credit amount (b) enter an account title to record…arrow_forward

- On January 1, 2013, Ruark Corporation acquired a 40 percent interest in Batson, Inc., for $210,000. On that date, Batson's balance sheet disclosed net assets with both a fair and book value of $360,000. During 2013, Batson reported net income of $80,000 and paid cash dividends of $25,000. Ruark sold inventory costing $30,000 to Batson during 2013 for $40,000. Batson used all of this merchandise in its operations during 2013. Prepare all of Ruark's 2013 journal entries to apply the equity method to this investment. General Journal Debit To record acquisition. Investment in Batson, Inc. Cash To recognize income earned. Investment in Batson, Inc. Equity in Investee Income To record collection of dividend. Cash Investment in Batson, Inc. Creditarrow_forwardThe following information was taken from the records of Blue Inc. for the year 2025: Income tax applicable to income from continuing operations $228,140, income tax applicable to loss on discontinued operations $31,110, and unrealized holding gain on available-for- sale debt securities (net of tax) $18,300. Gain on sale of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write-down of inventory Revenues Sales Revenue Rent Revenue Shares outstanding during 2025 were 100,000. Total Revenues Expenses Cost of Goods Sold Selling Expenses Administrative Expenses Prepare a single-step income statement (with respect to items in Income from operations). (Round earnings per share to 2 decimal places, e.g. 1.48. Enter other revenue and gains before other expenses and losses) Total Expenses Income from Operations Other Revenues and Gains Gain on Sale of Equipment Other Expenses and Losses Inventory Loss Income before Income Tax Income Tax Income from…arrow_forwardSwifty Company reported net income of $481000 for the year ended 12/31/25. Included in the computation of net income were the following: depreciation expense, $59400; amortization of a patent, $32000; income from an investment in the common stock of Blue Inc., accounted for under the equity method, $ 48400; and amortization of bond discount, $12000. Swifty also paid an $81000 dividend during the year. The net cash provided by operating activities would be reported at (a) $455000 (b) 423000 (c)342000 (d ) 536000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education