Annabelle Invests in the Market

Annabelle Sizemore has cashed in some treasury bonds and a life insurance policy that her parents had accumulated over the years for her. She has also saved some money in certificates of deposit and savings bonds during the 10 years since she graduated from college. As a result, she has $120,000 available to invest. Given the recent rise in the stock market, she feels that she should invest all of this amount there. She has researched the market and has decided that she wants to invest in an index fund tied to S&P stocks and in an Internet stock fund. However, she is very concerned about the volatility of Internet stocks. Therefore, she wants to balance her risk to some degree.

She has decided to select an index fund from Shield Securities and an Internet stock fund from Madison Funds, Inc. She has also decided that the proportion of the dollar amount she invests in the index fund relative to the Internet fund should be at least one-third but that she should not invest more than twice the amount in the Internet fund that she invests in the index fund. The price per share of the index fund is $175, whereas the price per share of the Internet fund is $208. The average annual return during the last 3 years for the index fund has been 17%, and for the Internet stock fund it has been 28%. She anticipates that both mutual funds will realize the same average returns for the coming year that they have in the recent past; however, at the end of the year she is likely to reevaluate her investment strategy anyway. Thus, she wants to develop an investment strategy that will maximize her return for the coming year.

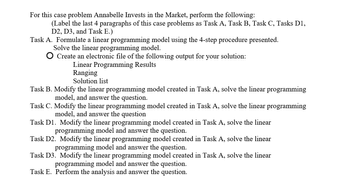

Formulate a linear programming model for Annabelle that will indicate how much money she should invest in each fund, and solve this model by using the graphical method.

Suppose Annabelle decides to change her risk balancing formula by eliminating the restriction that the proportion of the amount she invests in the index fund to the amount that she invests in the Internet fund must be at least one-third. What will the effect be on her solution? Suppose instead that she eliminates the restriction that the proportion of money she invests in the Internet fund relative to the stock fund not exceed a ratio of 2 to 1. How will this affect her solution?

If Annabelle can get $1 more to invest, how will that affect her solution? $2 more? $3 more? What can you say about her return on her investment strategy, given these successive changes?

Step by stepSolved in 2 steps

- The board of directors of a corporation feels that senior management deserves compensation for their contributions to achieving the company's objectives. The board of directors decides whether or not to provide bonuses based on share price rises at the end of each year. Managers will get bonuses in the form of shares, which they may either retain or sell. What effects would putting in place such a bonus scheme have?arrow_forwardPlease help me with. I dont understand what to do Make a university 2nd year type Essay: is an academic paper specifically examining a relevant topic. You are free to write on any relevant issue of the course subject. The suggested topics are: government policy on uniting efforts of the state, business, and society in a country of your choice in dealing with any of the following issues: eradicating poverty and hunger; providing for quality education, good health and well-being; gender equality; decent work and economic growth; sustainable cities and communities; peace, justice, and strong institutions; clean energy; industry, innovation and infrastructure; reducing inequality; climate action; clean water and sanitation; responsible consumption and production. The minimum number of references is six including two books and four academic journal articles (other than the articles required or recommended as the readings in the syllabus). Feel free to additionally refer to other sources of…arrow_forwardTell me about the benefits of taking baby steps.arrow_forward

- A Helping Hand is an Australian charity that helps people in Australia and overseas. Their work in Australia involves serving hot meals to the homeless, providing food packs to families in need and companionship to sick children and the elderly. Overseas, the charity employs a nurse to support the Naga Community in the Philippines and runs an Operational Therapy Centre to help children. The charity also runs a yearly mission where volunteers travel to various countries to deliver medical aid and support the vulnerable. The charity has identified the inefficient way in which it currently operates. This inefficiency means the charity is unable to easily maintain compliance with regulatory requirements (e.g. WWC monitoring) nor easily fill available shifts and engage with current and prospective stakeholders. To solve the issue, the charity wants to develop a website that facilitates administration (i.e. Login Creations, Registration Requests and Password Resets), Donations and…arrow_forwardHak Young has accumulated some credit card debt while he was in college. His total debt is now $23,864.00 and his credit card charges 18% interest compounded monthly. He is getting worried about his debt and is determined to pay it off completely. What would Hak Young’s minimum monthly payment have to be in order to pay off his debt in 5 years? What will be the total interest paid?arrow_forwardExplain in your own words the benefits that come along with having a social security system.arrow_forward

- Create a spreadsheet to calculate your projected total costs, total revenues, and total profits for giving a seminar on cost estimating. Make the following assumptions: • You will charge $600 per person for a two-day class (i.e., the class fee). • Your fixed costs include $500 total to rent a room for both days, setup fees of $400 for registration, and $300 for designing a postcard for advertising. • You will not include your labor costs for this estimate, but you estimate that you will spend at least 150 hours developing materials, managing the project, and giving the actual class. You would like to know what your time is worth given different scenarios. • You will order 5,000 postcards, mail 4,000, and distribute the rest to friends and colleagues. • Your variable costs include the following: a. $5 per person for registration plus 4 percent of the class fee per person to handle credit card processing; assume that everyone pays by credit card b. $.40 per postcard for printing if you…arrow_forwardTell me about a moment when you struggled to get your ideas across in an online class or assignment. Do you have any thoughts about how we might solve these issues?arrow_forwardWrite down the things that are most important to you in your job and explain why they are important.arrow_forward

- If you could provide us with a rough idea of the entire quantity of information that goes into making the big picture, that would be much appreciated. Is it possible for a young person to travel the world without running the risk of becoming bankrupt as a consequence of their experiences?arrow_forwardThe impact of IT on every aspect of our life and on the world at large Give an account of the pluses and minuses.arrow_forwardWhat are some of the effects of Moore's Law in terms of technology? How will it affect your life in the long run?arrow_forward

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON

Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON

Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON

C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning

Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education