FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please answer it in detailed and comprehensively with explanation. Please use proper accounting format.

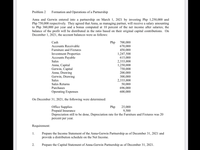

Transcribed Image Text:Problem 2

Formation and Operations of a Partnership

Anna and Gerwin entered into a partnership on March 1, 2021 by investing Php 1,250,000 and

Php 750,000 respectively. They agreed that Anna, as managing partner, will receive a salary amounting

to Php 360,000 per year and a bonus computed at 10 percent of the net income after salaries; the

balance of the profit will be distributed in the ratio based on their original capital contributions. On

December 1, 2021, the account balances were as follows:

Cash

Php

700,000

670,000

450,000

1,247,500

615,000

2,333,000

1,250,000

750,000

200,000

300,000

2,333,000

50,000

696,000

600,000

Accounts Receivable

Furniture and Fixtures

Investment Properties

Accounts Payable

Sales

Anna, Capital

Gerwin, Capital

Anna, Drawing

Gerwin, Drawing

Sales

Sales Returns

Purchases

Operating Expenses

On December 31, 2021, the following were determined:

Office Supplies

Prepaid Insurance

Depreciation still to be done, Depreciation rate for the Furniture and Fixtures was 20

percent per year.

Php

25,000

9,500

Requirement:

Prepare the Income Statement of the Anna-Gerwin Partnership as of December 31, 2021 and

provide a distribution schedule on the Net Income.

1.

2.

Prepare the Capital Statement of Anna-Gerwin Partnership as of December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In your own words, what does relevance mean to you? After tackling this topic, then research characteristics of relevance from an Accounting standards perspective and explain.arrow_forwardPlease answer the question with the steps... Thank youarrow_forwardmy accounting - auditing class, the question in the justification of planning materiality: Basis (normalized net income, revenue, total assets, other). What is the basis? what are the different ones and how are they calculated?arrow_forward

- Briefly describe the two fundamental qualities of useful accounting information.arrow_forwardMay you tell me where I can get reliable IFRS relevant to accounting changes?arrow_forwardClassify the following activities as part of the identifying (I), recording (R), or communicating (C) aspectsof accounting. Analyzing and interpreting reportsarrow_forward

- Illustrate the importance of the flow of information in accounting?arrow_forwardcompliance requirements in terms of documenting transactions and reporting .you should list the elements required in a tax invoice which a computerized accounting system will quickly and accurately procedurearrow_forwardIn 2018, Bax had revenues of 008.38M, cost of revenue of $173 50M, R&D expenses of $163 75M, and other expenses of $405 65M What is the net profe margin for the company? Ⓒa. (22.13%) Ob (12 13%) OC 44.35% Od 0122%3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education