Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

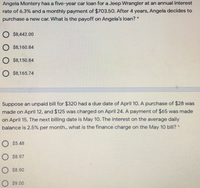

Transcribed Image Text:Angela Montery has a five-year car loan for a Jeep Wrangler at an annual interest

rate of 6.3% and a monthly payment of $703.50. After 4 years, Angela decides to

purchase a new car. What is the payoff on Angela's loan? *

O $8,442.00

O $8,160.84

O $8,150.84

O $8,165.74

Suppose an unpaid bill for $320 had a due date of April 10. A purchase of $28 was

made on April 12, and $125 was charged on April 24. A payment of $65 was made

on April 15. The next billing date is May 10. The interest on the average daily

balance is 2.5% per month., what is the finance charge on the May 10 bill? *

O $5.48

O $8.97

O $8.90

O $9.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Jorge is buying a new car for $24,750. Compare the two loan offers by finding the monthly payments for each and calculating the total amount paid for each. Loan Options Down Payment Monthly Payment Total 5% down payment, 4.25% APR for 5 years 10% down payment, 3.25% APR for 4 yearsarrow_forwardHelp plsarrow_forwardCurrent Attempt in Progress After living in a university residence for one year, Alysha decides to rent an apartment for the remaining three years of her degree. She has found a nice location that will cost $740 per month. Rent for the first and last month must be paid up front. How much money would Alysha need to have in her bank account right now to be sure she will always have enough for rent? The bank account pays 6.0 percent interest, compounded monthly. (Round answer to 2 decimal places, e.g. 125.12. Do not round your intermediate calculations.) Amount Alysha would need to have right now $arrow_forward

- Mr. and Mrs. Fuller are buying a new house for $350,000. Compare the two loan offers by finding the monthly payments for each and calculating the total amount paid for each. Loan Options Down Payment Monthly Payment Total 10% down payment, 5.5% APR for 30 years 15% down payment, 4.5% APR for 25 yearsarrow_forward6. Jake and Archie are looking for places to live. Jake decides to rent a house for $1400 . Archie buys a house for $189 900, with a down payment of 10%. The bank has offered Archie a 20-year mortgage for the remainder of the cost, at 4% compounded semi-annually, with payments every two weeks. Jake and Archie both move after 5 years. Archie's house has depreciated by 2% per year. Compare Jake's and Archie's housing costs. per month.arrow_forwardit For pre nments Unit Activity: Credit Cards and Large Purchases Buying a House Bethany and Samuel are buying a new house. They have $25,000 saved for a down payment and know that they can afford a monthly payment of $1,500 or less. They also know that the best interest rate they can get is 5.1% annually and they want to sign a 30-year mortgage. Part A If 5.1% is the annual interest rate, what is the monthly interest rate? BI U X² X₂ V 田 15px- Space used (includes formatting): 0/ 15000 V V Part B If they sign a 30-year mortgage, how many monthly payments will they make? BIUX² X₂ 15px M くく EEEEE 6 of 7 E Dec 1 1:56 Save & Exitarrow_forward

- Mario is buying a new car for $18,500. Compare the two loan offers by finding the monthly payments for each and calculating the total amount paid for each. Loan Options Down Payment Monthly Payment Total 5% down payment, 4.5% APR for 5 years 10% down payment, 3.5% APR for 4 yearsarrow_forwardApril borrows $20000 at an interest rate of 7% to purchase a new automobile. At what rate (in dollars per year) must she pay back the loan, if the loan must be paid off in 5 years? (Use decimal notation. Give your answer to two decimal places.) withdrawal rate: $ per yeararrow_forwardQuestion 5: JJ takes out a conventional loan to purchase a car. The interest rate is 6.8% compounded monthly and JJ has six years to repay the $10,000 they borrowed. What are JJ's monthly payments?arrow_forward

- An acquaintance asks Kara to borrow money today to help her repair her car. The person will be able to repay Kara $500 in one year, and Kara is fully expects she will be repaid on time (risk free). If Kara requires a 5.0% return, what (largest) amount should she lend to her acquaintance?$525.00$495.00$475.00$476.19$471.43arrow_forwardLinda wants to buy a new car in a few years. She sets a goal to have $43,950 in her savings account to buy a car. Linda plans to save money for 5 years by making monthly deposits to a saving account at APR 2.5% compounded monthly. Round answer to two decimal places a. In order for Linda to reach her saving goal. How much will Linda need to save each money b. Overall Linda contributed how much of her own money into saving account?arrow_forwardQUESTION 1 Liam can afford $175 per month as a car payment. If Liam can get an auto loan at 4% interest for 5 years, how expensive of a car can Liam afford? Give your answer to the nearest dollar.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education