ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

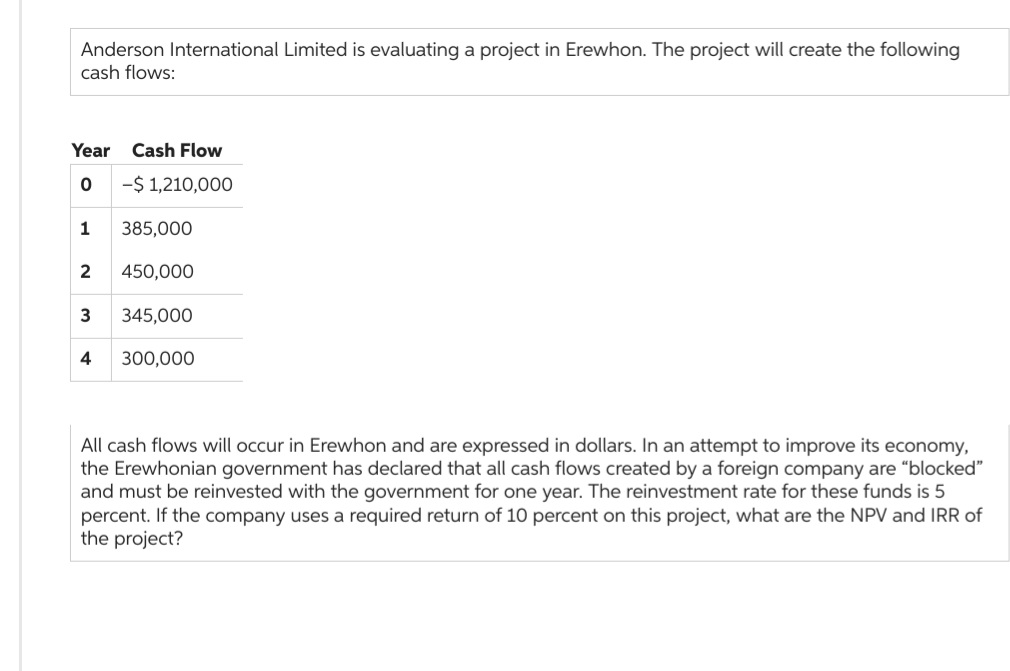

Transcribed Image Text:Anderson International Limited is evaluating a project in Erewhon. The project will create the following

cash flows:

Year Cash Flow

0

-$ 1,210,000

1

385,000

2 450,000

3

4

345,000

300,000

All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy,

the Erewhonian government has declared that all cash flows created by a foreign company are "blocked"

and must be reinvested with the government for one year. The reinvestment rate for these funds is 5

percent. If the company uses a required return of 10 percent on this project, what are the NPV and IRR of

the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (d) Using Growth Accounting equations derive the selow Residual.arrow_forwardAnswer all partsarrow_forwardAn initial $2000 investment is made that returns profits of $1000 and 1500 in the first and second years, respectively. The inflation rate is 5% and the market interest rate is 8%. Find the PW of the CFs assuming that they are expressed in terms of constant dollars.arrow_forward

- Can someone double check my work-out? Is my workout and solution correct?arrow_forwardUsing this Intertemporal Budget Constraint how can you solve for C2 (consumption in period 2)arrow_forwardGive typing answer with explanation and conclusion A small company purchased now for $120,000 will lose $300 each year for the first four years. An additional $600 in the company in the fourth year will result in a profit of $9500 each year from the fifth through the twelfth year. At the end of 12 years, the company can be sold for $135,000. a) Draw the cash flow diagram b) Determine the IRR for this project. c) Calculate the FW if MARR is 5%. d) Calculate the ERR when ε = 7%.arrow_forward

- Need some assistance with thisarrow_forwardAfter spending $10 million on research and development, the company Patronus, Inc. rolled out a new heat-sensing home alarm system called "Thermo-Shield." Patronus has made $8 million in direct sales of "Thermo-Shield" materials to customers via their website, and $12 million in sales to the home building firm D.R. Horton that will provide the alarm system as a standard part of the new houses they are building. Also, while the alarm installation company Guardian Services does not carry "Thermo-Shield" to sel, they will install "Thermo-Shield" systems that homeowners already purchased. So far, Home Depot has recorded $2,500,000 in installation service sales putting in "Thermo-Shield" systems. Based on this information, the "Thermo-Shield" product has increased GDP by which amount? $20.5 million $24.5 million O $32.5 million $30 millionarrow_forward(7.2) The NPV of an asset equals the difference between the PV of the future produced by an asset and the present value turned out to be exactly zero, we would be investment and not taking it. of the asset. In the unlikely event that the net between taking the (7.3) The IRR is the rate of return which equates the NPV of an investment to An investment is bies if the IRR exceeds the required return that could be earned in the financial markets on investment of equal risk; the IRR on an investment is the required return that results in a zero when it is used as the (7.4) A is the impact that a given capital budgeting project might have on cash flows in another area of the firm. One of the examples of this is cash flows of a new project that come at the expense of a firm's existing projects. which is the (7.5) In the bottom-up approach, OCF = crucial to remember that this definition of OCF as only if there is no It is is correct plus subtracted in the calculation of net income. (7.6) The…arrow_forward

- A semiconductor chip maker purchased a small manufacturing process plant for $2,131,020. The money coming in from that purchase was determined to be $500,000 annually in before-tax cash flow during its 10-year use. The net cash flow after tax is $300,000. If the chip maker wants to realize a 10% return on its investment after tax, for how many more years should the plant operate? (hint, tables)arrow_forwardThe following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods: Current assets as of March 31: Cash Accounts receivable Inventory Buildings and equipment, net Accounts payable Common shares Retained earnings a. The gross margin is 25% of sales. b. Actual and budgeted sales data are as follows: March (actual) April May June $50,000 $60,000 $72,000 $ 8,000 20,000 36,000 120,000 21,750 150,000 12,250 July $90,000 $48,000 c. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are the result of March credit sales. d. Each month's ending inventory should equal 80% of the following month's budgeted cost of goods sold. e. One-half of a month's inventory purchases is paid for in the month of purchase; the other one-half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory. f. Monthly expenses are as follows:…arrow_forwardIf the profit function for selling smart phone screen magnifier is -4500p2 + 561500p – 11898000, what is the maximum profit that can be expected from selling smart phone screen magnifiers? Question 1 options: $ 0, no profit $ 5,617,681 $ 1,717,764 -$ 8,004,171arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education