FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Part

(a) Debit allowance for doubtful accounts $16,508 credit

Transcribed Image Text:* 00

C CengageNOWv2 | Online teaching and learning resource from Cengage Learning

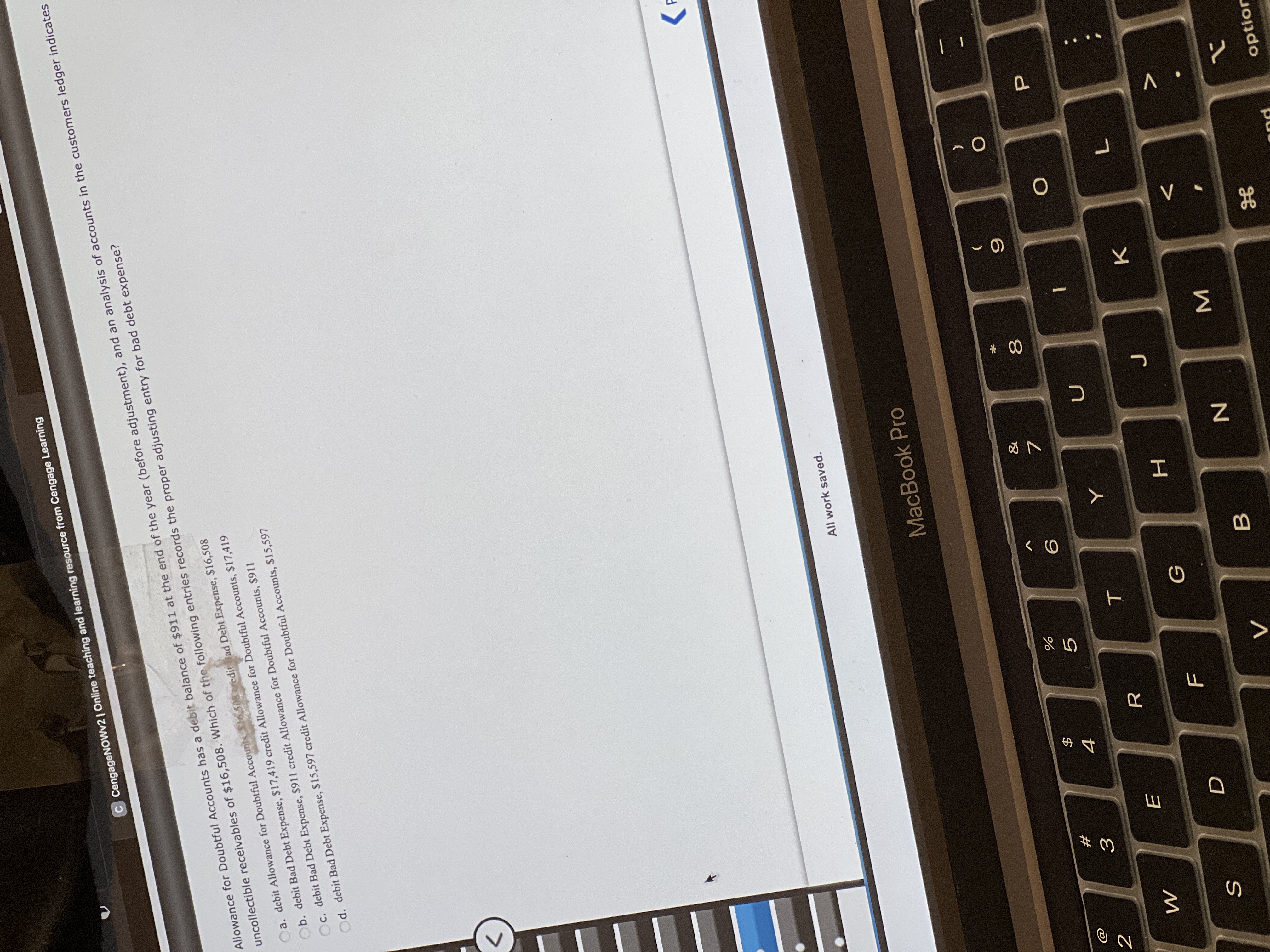

Allowance for Doubtful Accounts has a debit balance of $911 at the end of the year (before adjustment), and an analysis of accounts in the customers ledger indicates

uncollectible receivables of $16,508. Which of the following entries records the proper adjusting entry for bad debt expense?

a. debit Allowance for Doubtful Accounts S16,508

edit ad Debt Expense, $16,508

b. debit Bad Debt Expense, $17,419 credit Allowance for Doubtful Accounts, $17,419

Oc. debit Bad Debt Expense, $911 credit Allowance for Doubtful Accounts, $911

Od. debit Bad Debt Expense, $15,597 credit Allowance for Doubtful Accounts, $15,597

All work saved.

MacBook Pro

$

4

2

#

%

*

ヨ

B.

N

optior

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 7-12 (Algo) Accounts and notes receivable; discounting a note receivable; receivables turnover ratio financial statement effects [LO7-5, 7-6, 7-7, 7-8, 7-9] Chamberlain Enterprises incorporated reported the following receivables in its December 31, 2024, year-end balance sheet: Current assets: accounts Accounts receivable, net of $37,000 in allowance for uncollectible $ 283,000 11,050 390,000 Interest receivable Notes receivable Additional Information: 1. The notes receivable account consists of two notes, a $65,000 note and a $325,000 note. The $65,000 note is dated October 31, 2024, with principal and interest payable on October 31, 2025. The $325,000 note is dated June 30, 2024, with principal and 6% Interest payable on June 30, 2025. 2. During 2025, sales revenue totaled $1,470,000, $1,345,000 cash was collected from customers, and $35,000 in accounts receivable were written off. All sales are made on a credit basis. Bad debt expense is recorded at year-end by adjusting the…arrow_forwardQUESTION 28 An aging of a company's accounts receivable indicates that $5,000 is estimated to be uncollectible. If Allowance for Doubtful Accounts has a $900 credit balance, the adjustment to record bad debts for the period will require a debit to Allowance for Doubtful Accounts for $4, 100. credit to Allowance for Doubtful Accounts for $5,000. debit to Bad Debt Expense for $4,100. debit to Bad Debt Expense for $5,000. QUESTION 29arrow_forwardMirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. 0-30 days 31-90 days Over 90 days past due past due past due Accounts receivable amount $55,000 $33,000 $17,000 Percent uncollectible 8% 15% 30% Total per category ? Total uncollectible ? To manage earnings more efficiently, Mirror Mart decided to change past-due categories as follows. 0-60 days 61-120 days Over 120 days past due past due past due Accounts receivable Amount $84,000 $11,000 $7,000 Percent uncollectible 8% 15% 30% Total per category ? ? ? Total uncollectible ? Complete the following. A. Complete each table by filling in the blanks. 0-30 days 31-90 days Over 90 days past due past due past due Accounts receivable amount $55,000 $33,000 $17,000 Percent uncollectible 8% 15% 30% Total per category Total uncollectiblearrow_forward

- Exercise 7-13 (Algo) Percent of accounts receivable method LO P3 Mazie Supply Company uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $112,500, and it estimates that 5% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has: (a) a $1,913 credit balance before the adjustment. (b) a $563 debit balance before the adjustment. View transaction list View journal entry worksheet No Transaction General Journal Debit Credit 1 Bad debts expense 7,538 Allowance for doubtful accountsarrow_forwardSubject:arrow_forwardPA 4. LO 9.2 Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- Nonearrow_forward! Required information Problem 7-2A (Static) Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $ 1,905,000 $ 5,682,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts Problem 7-2A (Static) Part 1 $ 1,270,100 debit $ 16,580 debit Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 1.5% of credit sales. b. Bad debts are estimated to be 1% of total sales. c. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education