Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

9

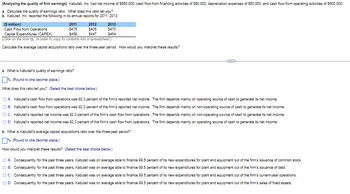

Transcribed Image Text:(Analyzing the quality of firm earnings) Kabutell, Inc. had net income of $850,000, cash flow from financing activities of $90,000, depreciation expenses of $50,000, and cash flow from operating activities of $600,000.

a. Calculate the quality of earnings ratio. What does this ratio tell you?

b. Kabutell, Inc. reported the following in its annual reports for 2011-2013:

($ million)

2011

2012

2013

Cash Flow from Operations

$478

$405

Capital Expenditures (CAPEX)

$459

$447

$470

$454

(Click on the icon in order to copy its contents into a spreadsheet.)

Calculate the average capital acquisitions ratio over the three-year period. How would you interpret these results?

a. What is Kabutell's quality of earnings ratio?

% (Round to one decimal place.)

What does this ratio tell you? (Select the best choice below.)

A. Kabutell's cash flow from operations was 92.3 percent of the firm's reported net income. The firm depends mainly on operating source of cash to generate its net income.

OB. Kabutell's cash flow from operations was 92.3 percent of the firm's reported net income. The firm depends mainly on non-operating source of cash to generate its net income.

OC. Kabutell's reported net income was 92.3 percent of the firm's cash flow from operations. The firm depends mainly on non-operating source of cash to generate its net income.

OD. Kabutells reported net income was 92.3 percent of the firm's cash flow from operations. The firm depends mainly on operating source of cash to generate its net income.

b. What is Kabutell's average capital acquisitions ratio over the three-year period?

% (Round to one decimal place.)

How would you interpret these results? (Select the best choice below.)

A. Consequently, for the past three years, Kabutell was on average able to finance 99.5 percent of its new expenditures for plant and equipment out of the firm's issuance of common stock.

OB. Consequently, for the past three years, Kabutell was on average able to finance 99.5 percent of its new expenditures for plant and equipment out of the firm's issuance of debt.

OC. Consequently, for the past three years, Kabutell was on average able to finance 99.5 percent of its new expenditures for plant and equipment out of the firm's current-year operations.

OD. Consequently, for the past three years, Kabutell was on average able to finance 99.5 percent of its new expenditures for plant and equipment out of the firm's sales of fixed assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kingcade Corporation keeps careful track of the time required to fill orders. Data concerning a particular order appear below: Hours 18.3 Wait time Process time Move time Queue time 1. 1 Inspection time 0.1 2.0 9.1 The manufacturing cycle efficiency (MCE) was closest to: (Round your intermediate calculations to 1 decimal place.)arrow_forwardRound 1.1235 to the nearest tenth. O 1.12 O 1.2 1.0 1.1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education