FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

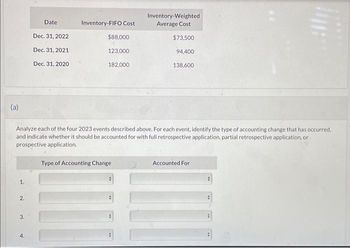

Transcribed Image Text:Bramble Corp., which began operations in January 2020, follows IFRS and is subject to a 30% income tax rate. In 2023, the following

events took place:

1.

2.

3.

4.

The company switched from the zero-profit method to the percentage-of-completion method of accounting for its long-term

construction projects. This change was a result of experience with the project and improved ability to estimate the costs to

completion and therefore the percentage complete.

Due to a change in maintenance policy, the estimated useful life of Bramble's fleet of trucks was lengthened.

It was discovered that a machine with an original cost of $240,000, residual value of $30,800, and useful life of 4 years was

expensed in error on January 23, 2022, when it was acquired. This situation was discovered after preparing the 2023

adjusting entries but before calculating income tax expense and closing the accounts. Bramble uses straight-line depreciation

and takes a full year of depreciation in the year of acquisition. The asset's cost had been appropriately added to the CCA class

in 2022 before the CCA was calculated and claimed.

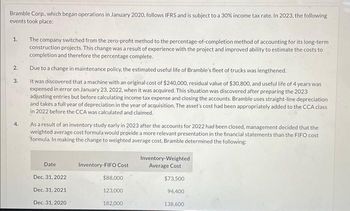

As a result of an inventory study early in 2023 after the accounts for 2022 had been closed, management decided that the

weighted average cost formula would provide a more relevant presentation in the financial statements than the FIFO cost

formula. In making the change to weighted average cost, Bramble determined the following:

Inventory-Weighted

Average Cost

$73,500

Date

Inventory-FIFO Cost

Dec. 31, 2022

$88,000

Dec. 31, 2021

123,000

94,400

Dec. 31, 2020

182,000

138,600

Transcribed Image Text:Bramble Corp., which began operations in January 2020, follows IFRS and is subject to a 30% income tax rate. In 2023, the following

events took place:

1.

2.

3.

4.

The company switched from the zero-profit method to the percentage-of-completion method of accounting for its long-term

construction projects. This change was a result of experience with the project and improved ability to estimate the costs to

completion and therefore the percentage complete.

Due to a change in maintenance policy, the estimated useful life of Bramble's fleet of trucks was lengthened.

It was discovered that a machine with an original cost of $240,000, residual value of $30,800, and useful life of 4 years was

expensed in error on January 23, 2022, when it was acquired. This situation was discovered after preparing the 2023

adjusting entries but before calculating income tax expense and closing the accounts. Bramble uses straight-line depreciation

and takes a full year of depreciation in the year of acquisition. The asset's cost had been appropriately added to the CCA class

in 2022 before the CCA was calculated and claimed.

As a result of an inventory study early in 2023 after the accounts for 2022 had been closed, management decided that the

weighted average cost formula would provide a more relevant presentation in the financial statements than the FIFO cost

formula. In making the change to weighted average cost, Bramble determined the following:

Inventory-Weighted

Average Cost

$73,500

Date

Inventory-FIFO Cost

Dec. 31, 2022

$88,000

Dec. 31, 2021

123,000

94,400

Dec. 31, 2020

182,000

138,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explain when it is appropriate to recognize revenue over a period of time.arrow_forwardWhich of the following accounting principles requires that expenses be recognized in the same period as the revenue they helped to generate? A) Matching principle B) Conservatism principle C) Revenue recognition principle D) Cost-benefit principlearrow_forwardDiscuss the importance of the matching principle in determining the timing and recognition of revenues and expenses.arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education