Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

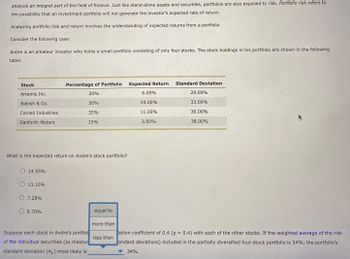

Transcribed Image Text:analysis an integral part of the field of finance. Just like stand-alone assets and securities, portfolios are also exposed to risk. Portfolio risk refers to

the possibility that an investment portfolio will not generate the investor's expected rate of return.

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio.

Consider the following case:

Andre is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following

table:

Stock

Artemis Inc.

Babish & Co.

Cornell Industries

Danforth Motors

What is the expected return on Andre's stock portfolio?

O 14.55%

13.10%

7.28%

Percentage of Portfolio

20%

30%

35%

15%

O 9.70%

Suppose each stock in Andre's portfoli

of the individual securities (as measur

standard deviation (op) most likely is

equal to

more than

less than

Expected Return

6.00%

14.00%

11.00%

3.00%

34%.

Standard Deviation

29.00%

33.00%

36.00%

38.00%

lation coefficient of 0.4 (p = 0.4) with each of the other stocks. If the weighted average of the risk

andard deviations) included in the partially diversified four-stock portfolio is 34%, the portfolio's

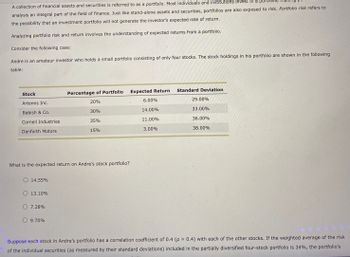

Transcribed Image Text:A collection of financial assets and securities is referred to as a portfolio. Most individuals and institutions invest in a portroll

analysis an integral part of the field of finance. Just like stand-alone assets and securities, portfolios are also exposed to risk. Portfolio risk refers to

the possibility that an investment portfolio will not generate the investor's expected rate of return.

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio.

Consider the following case:

Andre is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following

table:

Stock

Artemis Inc.

Babish & Co.

Cornell Industries

Danforth Motors

What is the expected return on Andre's stock portfolio?

O 14.55%

O 13.10%

O 7.28%

Percentage of Portfolio Expected Return

20%

30%

35%

15%

O 9.70%

6.00%

14.00%

11.00%

3.00%

Standard Deviation

29.00%

33.00%

36.00%

38.00%

Suppose each stock in Andre's portfolio has a correlation coefficient of 0.4 (p = 0.4) with each of the other stocks. If the weighted average of the risk

of the individual securities (as measured by their standard deviations) included in the partially diversified four-stock portfolio is 34%, the portfolio's

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A portfolio's manager's views on the term structure of interest rates: "Yields reflect expected spot rates and risk premiums. Investors demand risk premiums for holding long-term bonds, and these risk premiums increase with maturity. This manager's views are most consistent with the: A. Segmented markets theory B. Local expectations theory C. Preferred habitat theory OD. Liquidity preference theoryarrow_forwarda) Distinguish between systematic risk and unsystematic risk, and explain the significance of the distinction in portfolio analysis. b) Explain what is meant by a share’s beta value. c) Outline the main practical problems in using the CAPM in capital investment decisions. d) Discuss the assumption in CAPM analysis that corporate debt has a zero beta valuearrow_forwardQUESTION ONE Why do most investors hold diversified portfolios? and What is covariance, and why is it important in portfolio theory? Why do most assets of the same type show positive covariances of returns with each other? Would you expect positive covariances of returns between differenttypes of assets such as returns on Treasury bills, General Electric common stock, and commercial real estate? Why or why not? What is the relationship between covariance and the correlation coefficient? and Explain the shape of the efficient frontier. Draw a properly labeled graph of the Markowitz efficient frontier. Describe the efficient frontier in exact terms. Discuss the concept of dominant portfolios, and show an example of one on your graph. Assume you want to run a computer program to derive the efficient frontier for your feasible set of stocks. What information must you input to the program?arrow_forward

- Do not use chatgpt. Thank you!arrow_forwardYou are a portfolio manager for a wealthy individual who is interested in investing in the stock market. The individual is risk-averse and wants to maximize returns while minimizing risk. Which of the following asset classes would be most appropriate for a well-diversified portfolio? Stocks only Bonds only A mix of stocks, bonds, and other asset classes Real estate onlyarrow_forwardAssume that markets are efficient. Give 2 reasons why you cannot retire all portfolio managers / financial analysts and simply rely on a random choice via computer to select securities for your portfolio.arrow_forward

- Question Five: Which of the following is not an assumption that underpins the capital asset pricing model (CAPM)? Investors behave in accordance with Markowitz mean-variance portfolio theory. Investors are rational and risk averse. Investors all invest for the same period of time. Investors have heterogeneous expectations about expected returns and return variances for all assets. There is a risk free rate at which all investors can borrow or lend any amount. Capital markets are perfectly competitive, frictionless and efficient. Question Six: Which of the following expressions best describes the slope of the security market line? The slope of the security market line is equal to the Sharpe ratio. The slope of the security market line is equal to the Treynor ratio. The slope of the security market line is equal to alpha. The slope of the security market line is equal to the market risk premium. The slope of the security market line is equal to the standard deviation of the risky…arrow_forwardWhich one of the following expressions about risk and returns is wrong? A. In general, one reason why a stock is riskier than a bond is that because cash flows from a bond are known and promised, whereas cash flows from a stock are neither known nor promised. B. According to CAPM model, a well-diversified portfolio will have a beta which equals to 0. C. Risk premium is the extra return provided on risky assets to compensate for risk. The difference between risky return and the risk-free return. D. Unexpected return happened because new information came to light which caused our expectations about prices and returns to change.arrow_forwardAn informed and prudent investor uses a variety of measures such as financial ratios, book value, earnings per share, return on equity etc. to evaluate the worthiness and prospects of stocks he/she would invest in. It is important for you as an investor to understand how these values are calculated and what do they mean. Use the following tables to assess the worthiness of Verticon stock as an investment. Verticon Stock Data (Current and Historical) 2:12PM EDT Aug 16, 2011 Price 18.85 USD Change +0.64 (+3.51%) Mkt cap 147.1B Div/yield 0.20/4.24 Shares 8,012 Beta 0.70 Book/share 11.335 PE ratio 17 12/2010 12/2009 12/2008 (Millions of Dollars) Total Assets 195,014 195,949 111,148 Total Liabilities 107,201 122,935 53,592 Preferred Shareholders’ Equity 52 61 73 Common Shareholders’ Equity 87,761 72,953 57,483 Shares Outstanding 8,012 8,070 6746 Book/Share ? 9.040 8.521 Q1 (Mar ’11) 2010 Net profit…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education