FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

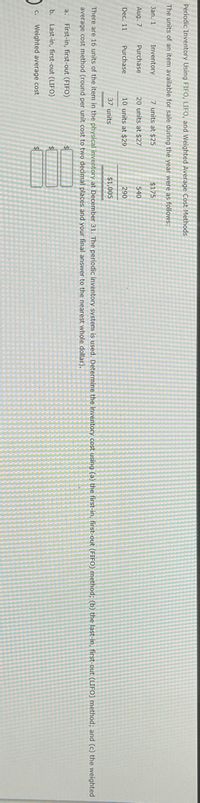

Transcribed Image Text:### Periodic Inventory Using FIFO, LIFO, and Weighted-Average Cost Methods

**Units of item available for sale and units sold at $55 are shown below:**

| Date | Purchases/Sales | Units | Unit Cost | Total Cost |

|-----------|-------------------|-------|-----------|-------------|

| Jan. 1 | Inventory | 35 | $ 12.75 | $ 446.25 |

| Apr. 7 | Purchase | 20 | $ 13.25 | $ 265.00 |

| Aug. 7 | Purchase | 20 | $ 13.75 | $ 275.00 |

| Dec. 11 | Purchase | 10 | $ 14.00 | $ 140.00 |

| Dec. 31 | Total Sales | 37 | | |

| Totals | | 85 | | $ 1,126.25 |

There are 10 units of the item in physical inventory on December 31. The Periodic Inventory System is used to determine the inventory cost using (a) the First-In, First-Out (FIFO) method, (b) the Last-In, First-Out (LIFO) method, and (c) the Weighted-Average Cost method:

- **a. First-In, First-Out (FIFO)**

- **b. Last-In, First-Out (LIFO)**

- **c. Weighted-Average Cost**

The graph or diagram section appears to have three blank boxes labeled: $, $, $

Utilize the above information to perform calculations and provide your final answer to the nearest whole dollar.

---

This transcribed text provides a clear and concise layout for understanding inventory costing methods for educational purposes. These methodologies are critical in accounting practices and business financial management.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Plz don't copy answer without plagiarism please little words different answersarrow_forwardDate July 1 July 7 July 12 5 July 14 July 26 3 July 29 units 6 c. 254 d. 250 unit cost $47 $51 c. 254 d. 250 I $54 unit sold 4 3 NI 26. Ending inventory under LIFO is: a. 264 b. 258 2 27. Cost of goods sold under FIFO is a. 435 b. 441 c. 445 d. 250 28. Ending inventory under FIFO is: a. 264 b. 258arrow_forwardDate Transaction Number of Units Unit Cost & 1 Beginning inventory 400 $10 8/3 Purchase No. 1 600 $10 85 Sale No. 1 500 817 Sale No. 2 200 8/11 Purchase No. 2 800 $12 8/17 Sale No. 3 1900 8/19 Purchase No. 3 1500 $11 8/21 Sale No. 4 I 800 8/28 Sale No. 5 500 8/29 Purchase No. 4 900 $10 8/30 Ending inventory Required: Determine the amount of the ending inventory and cost of goods sold under of the following methods assuming the periodic inventory system. Method Weighted-average b FIFO S each Inventory Cost of Goods Sold $ $arrow_forward

- Which assets depreciate?arrow_forwardces aw 11 Given the following: F1 January 1 inventory April 1 June 1 November 1 Cost of ending inventory 5_1442....jpg Cost of goods sold a. Calculate the cost of ending inventory using the LIFO (ending inventory shows 68 units). (@ F2 Number purchased 47 67 57 62 233 #3 b. Calculate the cost of goods sold using the LIFO (ending inventory shows 68 units). 80 F3 Cost per unit $5 8 $ 4 10 900 000 F4 15 Total $ % 235 536 513 620 $1,904 FS 4 8arrow_forwardQuestion 1 Inventory 1. A. Raytheon inventory information is as follows: o Beginning inventory (1/1/19): 200 units @ $1.00 o Purchase of inventory (1/14/19): 400 units @ $4.00 o Sale of inventory: 1/15/19: 300 units 1/16/19: 250 units o Total Sales Revenue = $2,250 Q1. Using the information above, compute COGS, Ending Inventory and Gross Profit under FIFO, LIFO, and Weighted average:arrow_forward

- QUESTION 9 If merchandise sells for $3,500, with terms of 3/15, n/45 and the cost of the inventory sold is $2,100, the amount charged to sales is a. $3,500 b. $3,395 c. $2,100 d. $2,037arrow_forward✔Total cost of goods sold, $791,600 SHOW ME HOW EX 6-8 Weighted average cost flow method under perpetual inventory system Obj. 3 The following units of a particular item were available for sale during the calendar year: Jan. 1 Mar. 18 May 2 Aug. 9 Oct. 20 Inventory Sale Purchase Sale Purchase 9,000 units at $50.00 7,000 units 8,000 units at $56.50 8,000 units 4,000 units at $60.00 The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in Exhibit 5.arrow_forwardProblem 1 - Inventory Methods Magic Jelly Beans Company Operating information Sales Price per case $ 150.00 Unit Unit Extended Quantity $ Price Cost $$$ Beginning Inventory 2,000 $ 90.00 $ 180,000.00 Purchased Units 7,000 $ 110.00 $ 770,000.00 Sold 2,000 Sold 4,000 Purchased Units 10,000 $ 130.00 $ 1,300,000.00 Purchased Units 4,000 $ 135.00 $ 540,000.00 Sold 6,000 Sold Units 5,000 Fixed Selling General and Administrative costs $ 75,000.00 Income Tax rate 35% Requirement: Calculate the Cost Flow assumptions for Revenue, Cost of Goods Sold, SGA Income Tax, Net Income and Ending Inventory…arrow_forward

- 5arrow_forwardBI 420 $200 Sold 150 $401 Pur. 250 $205 Sold 275 $421 Pur. 200 $215 Sold 260 $441 EI 185 PB10. LO 10.3Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for Weighted Average.arrow_forwardQuestion 8arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education