Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

An oil and gas producing company owns 48,000 acres of land in a southeastern state. It operates 700 wells which produce 21,000 barrels of oil per year and 1.5 million cubic feet of natural gas per year. The revenue from the oil is $2,100,000 per year and for natural gas the annual revenue is $588,000 per year. What bid should be made to purchase this property if the potential buyer is hoping to make 14% per year on his investment over a period of 12 years.

Transcribed Image Text:Present

Worth Factor

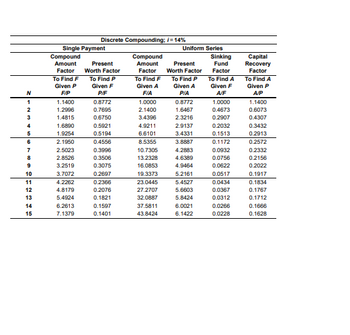

Discrete Compounding; /=14%

Single Payment

Compound

Amount

Factor

Compound

Amount

Uniform Series

Sinking

Factor

Present

Worth Factor

Fund

Factor

To Find F

To Find P

To Find F

To Find P

To Find A

Capital

Recovery

Factor

To Find A

Given P

Given F

Given A

Given A

Given F

Given P

N

F/P

P/F

F/A

P/A

A/F

A/P

1

1.1400

0.8772

1.0000

0.8772

1.0000

1.1400

2

1.2996

0.7695

2.1400

1.6467

0.4673

0.6073

3

1.4815

0.6750

3.4396

2.3216

0.2907

0.4307

4

1.6890

0.5921

4.9211

2.9137

0.2032

0.3432

5

1.9254

0.5194

6.6101

3.4331

0.1513

0.2913

6

2.1950

0.4556

8.5355

3.8887

0.1172

0.2572

7

2.5023

0.3996

10.7305

4.2883

0.0932

0.2332

8

2.8526

0.3506

13.2328

4.6389

0.0756

0.2156

9

3.2519

0.3075

16.0853

4.9464

0.0622

0.2022

10

3.7072

0.2697

19.3373

5.2161

0.0517

0.1917

11

4.2262

0.2366

23.0445

5.4527

0.0434

0.1834

12

4.8179

0.2076

27.2707

5.6603

0.0367

0.1767

13

5.4924

0.1821

32.0887

5.8424

0.0312

0.1712

14

6.2613

0.1597

37.5811

6.0021

0.0266

0.1666

15

7.1379

0.1401

43.8424

6.1422

0.0228

0.1628

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An oil and gas producing company owns 45,000 acres of land in a south eastern state. It operates 650 wells which produce 21,000 barrels of oil per year and 1.5 million cubic feet of natural gas per year. The revenue from the oil is $2,100,000 per year and for natural gas the annual revenue is $584,000 per year. If a potential buyer of this property is hoping to make 15% per year on his investment, what is the bid that should be made to purchase this property if the study period is 10 years?arrow_forwardYou are evaluating a proposed acquisition of a new machine costing $50,000. While the machine is expected to last for 5 years, it falls into the MACRS 3-year class. Purchase of the machine would require an increase of net operating working capital of $2,000. The machine would increase the firm's revenue by $15,000 per year and its operating costs by $7,000 per year. The firm's marginal tax rate is 30 percent, and the project's cost of capital is 14 percent. What is the operating cash flow in Year 1? MACRS 3-year schedule is as follows: 33%, 45%, 15%, and 7% for years 1 to 4, respectively. Question 11 options: $10,550 $10,720 $10,940 $11,180 $11,370 $11,670arrow_forwardYou are evaluating a proposed acquisition of a new machine costing $50,000. While the machine is expected to last for 5 years, it falls into the MACRS 3-year class. Purchase of the machine would require an increase of net operating working capital of $2,000. The machine would increase the firm's revenue by $19,000 per year and its operating costs by $10,000 per year. The firm's marginal tax rate is 25 percent, and the project's cost of capital is 14 percent. What is the operating cash flow in Year 4? MACRS 3-year schedule is as follows: 33%, 45%, 15%, and 7% for years 1 to 4, respectively.arrow_forward

- Dog Up! Franks is looking at a new sausage system with an installed cost of $695,000. The asset qualifies for 100 percent bonus depreciation and can be scrapped for $93,000 at the end of the project's 5-year life. The sausage system will save the firm $199,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $51,000. If the tax rate is 23 percent and the discount rate is 8 percent, what is the NPV of this project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPV Answer is complete but not entirely correct. $ 76,896.20 ☑arrow_forwardA firm that purchases electricity from the local utility for $300,000 per year is considering installing a steam generator at a cost of $340,000. The cost of operating this generator would be $160,000 per year, and the generator will last for five years. If the firm buys the generator, it does not need to purchase any electricity from the local utility. The cost of capital is 11%. For the local utility option, consider five years of electricity purchases. For the generator option, assume immediate installation, with purchase and operating costs in the current year and operating costs continuing for the next four years. Assume payments under both options at the start of each year (i.e., immediate, one year from now,..., four years from now). What is the net present value of the more attractive choice?arrow_forwardFoster Incorporated is trying to decide whether to lease or purchase a piece of equipment needed for the next 10 years. The equipment would cost $53,000 to purchase, and maintenance costs would be $5,200 per year. After 10 years, Foster estimates it could sell the equipment for $25,000. If Foster leases the equipment, it would pay $15,000 each year, which would include all maintenance costs. If Foster's cost of capital is 12%, Foster should: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1) Note: Use the appropriate factors from the PV tables. Multiple Choice buy the equipment, as the net present value of the cost is about $53,000 less. lease the equipment, as the net present value of the cost is about $10,400 less. buy the equipment, as the net present value of the cost is about $10,400 less. О lease the equipment, as the net present value of the cost is about $6,700 less.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education