EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

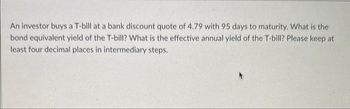

Transcribed Image Text:An investor buys a T-bill at a bank discount quote of 4.79 with 95 days to maturity. What is the

bond equivalent yield of the T-bill? What is the effective annual yield of the T-bill? Please keep at

least four decimal places in intermediary steps.

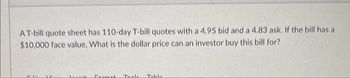

Transcribed Image Text:A T-bill quote sheet has 110-day T-bill quotes with a 4.95 bid and a 4.83 ask. If the bill has a

$10,000 face value, What is the dollar price can an investor buy this bill for?

11

Commah Toale Table

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A T - bill quote sheet has 90 day T - bill quotes with a 4.92 bid and a 4.86 ask . If the bill has a $ 10,000 face value an investor could buy this bill forarrow_forwardSuppose you purchase a bank accepted bill with a face value of $100,000. It has 120 days to maturity and is trading at an interest rate of 8% pa. 1.1 What was the purchase price today (Day 0)? 1.2 Suppose you sell the BAB 30 days later. What was the sale price, if the interest rate was 8.0%? 1.3 (Still assuming 30 days later) What was the sale price if the interest rate was 7.5%?arrow_forwardTreasury Bill :$10,000 face value: Days to maturity: 153 Bid yield: 0.038 Ask yield: 0.034 What is the price that you will have to pay if you were to buy one T-bill from a dealer?arrow_forward

- An investor buys a $10,000 face value T-bill at a bank discount quote of 5.76% with 175 days to maturity. The investor's actual annual rate of return on this investment is _____. Group of answer choices 4.80% 4.97% 6.01% 6.64%arrow_forwardA broker wants to sell a customer an investment costing $100 with an expected payoff in one year of $108.6. The customer indicates that a 8.6 percent return is not very attractive. The broker responds by suggesting the customer borrow $80 for one year at 6.6 percent interest to help pay for the investment. a. What is the customer's expected return if she borrows the money? (Round your answer to 1 decimal place.) Customer's expected return %arrow_forwardThe current spot rate for USD/GBP is 1.058 1.086. If you were to buy £4,799,207 worth of dollars and then sell them five minutes later, how much would the dealer make on your transactions? Iarrow_forward

- 4. You are given the following information: A 183-day T-bill, face value $100, currently trading at a discount rate of 5% a) What is the price of the T-bill b) You sell the T-bill 10 days later. The T-bill discount rate is 4.5% c) What is the semi-annual compounded APR. Please answer with excel showing formulas.arrow_forwardSuppose you enter into a short 6-month forward position at a forward price of $100. What is the payoff in 6 month for the underlying prices of $150 QUESTION 4 Suppose you enter into a long 6-month forward position at a forward price of $50. What is the payoff in 6 month for the underlying prices of $50arrow_forwardYou would like to purchase a T-bill that has a $20,000 face value and is 309 days from maturity. The current price of the T-bill is $19,300. Calculate the discount yield on this T-bill. (Do not round intermediate calculations. Round your answer to 3 decimal places. (e.g., 32.162))arrow_forward

- 1arrow_forwardSuppose a investor purchases 95 day commercial paper with a par value of $ 1 000 000 for a price of $ 990,023. What is the EAR of this commercial paper?arrow_forwardSuppose you are offered $7,100 today but must make the following payments: 1 2 Cash Flows ($) O $7,100 1-3,800 2-2,500 3 -1,600 4 -1,400 Year 4 6. 7 9. 10 11 What is the IRR of this offer? (Do not round intermediate calculations. Enter your ans 12 a. 13 14 15 16 17 b. If the appropriate discount rate is 10 percent, should you accept this offer? 18 19 multiple choice 1 20 21 Reject Ассept 22 23 24 25 C. If the appropriate discount rate is 19 percent, should you accept this offer? 26 27 multiple choice 2 28 29 Аcсept Reject 30 31 32 33 What is the NPV of the offer if the appropriate discount rate is 10 percent? (A negative ar What is the NPV of the offer if the appropriate discount rate is 19 percent? (A negative ar 34 d-1. 35 d-2. 36arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT