Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

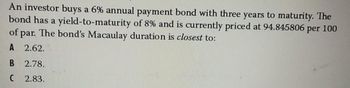

Transcribed Image Text:An investor buys a 6% annual payment bond with three years to maturity. The

bond has a yield-to-maturity of 8% and is currently priced at 94.845806 per 100

of par. The bond's Macaulay duration is closest to:

2.62.

2.78.

2.83.

B

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A bond has a par value of $1.000 a cument yield of 693 percent, and semiannual coupon payments. The bond is quoted at 101.56 What is the amount of each coupon payment? O O O O O $360 42038 SJAASarrow_forwardA 9% semiannual coupon bond matures in 6 years. The bond has a face value of $1,000 and a current yield of 8.9427%. What are the bond's price and YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answer for the bond's price to the nearest cent and for YTM to two decimal places. Bond's price: $ YTM: %arrow_forwardThe Sisyphean Company has a bond outstanding with a face value of $1,000 that reaches maturity in 15 years. The bond certificate indicates that the stated coupon rate for this bond is 9.5% and that the coupon payments are to be made semannually.Assuming the appropriate YTM on the Sisyphean bond is 7.4%, then this bond will trede at A a premium. B. par c. a discount. D. none of the abovearrow_forward

- A Treasury bond has a face value of $100, a maturity of 20 years, a coupon of 4%, and pays the coupon every six months, at the end of each six month period. The price of the bond is $105. What is the yield of this bond? a. 3.65% b. 1.8% C. 1.7% d. 3.8%arrow_forwardThe Sisyphean Company has a bond outstanding with a face value of $1,000 that reaches maturity in 8 years. The bond certificate indicates that the stated coupon rate for this bond is 9.8% and that the coupon payments are to be made semiannually. Assuming the appropriate YTM on the Sisyphean bond is 7.2%, then the price that this bond trades for will be closest to: A. $1,387 B. $1,618 O C. $1,156 D. $925arrow_forwardThe face Value of the 8.5% bond is $1,000 with a maturity period of 5 years. The bond is selling currently at $943:15: The yield-to maturity on the similar bond-is 10%. Calculate Bond Duration and Volatility of the Bondarrow_forward

- A bond currently has a price of $1,050. The yield on the bond is 6%. If the yield increases 27 basis points, the price of the bond will go down to $1,028. The duration of this bond is __________ years. (Select the closest answer.) Multiple Choice 7.32 8.27 8.42 7.78arrow_forwardA 9% semiannual coupon bond matures in 5 years. The bond has a face value of $1,000 and a current yield of 8.8514%. What are the bond's price and YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answer for the bond's price to the nearest cent and for YTM to two decimal places. Bond’s price: $ YTM: %arrow_forwardA bond with a 9-year duration is worth $1,086, and its yield to maturity is 8.6%. If the yield to maturity falls to 8.38%, you would predict that the new value of the bond will be approximately $1,083.61 $1,086.00 $1,105.77 $1,088.39arrow_forward

- A fixed-income analyst, Sean, observes a 7-year, 8% semiannual-pay bond. the face amount is ¥1,000. He believes that the yield-to-maturity (YTM) on a semiannual bond basis should be 12.29%. Based on this yield estimate, the price of this bond would be A. ¥942.73. B. ¥900.89. C. ¥828.39. D. ¥802.40.arrow_forwardThere is a bond that has a quoted price of 105.039 and a par value of $2,000. The coupon rate is 6.87 percent and the bond matures in 25 years. If the bond makes semiannual coupon payments, what is the YTM of the bond? 4.85 % 3.14% 3.23% 5.81 % 6.46%arrow_forwardPlease show working Please answer ALL OF QUESTIONS 1 AND 2 1. A 7% semiannual coupon bond matures in 6 years. The bond has a face value of $1,000 and a current yield of 7.5219%.a. What is the bond's price? Do not round intermediate calculations. Round your answer to the nearest cent.b. What is the bond's YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answers to two decimal places. 2. Nesmith Corporation's outstanding bonds have a $1,000 par value, a 7% semiannual coupon, 18 years to maturity, and a 9% YTM. What is the bond's price? Round your answer to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education