Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

vv.2

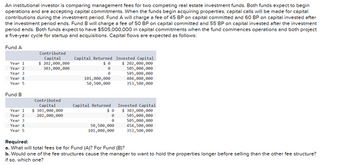

Transcribed Image Text:An institutional investor is comparing management fees for two competing real estate investment funds. Both funds expect to begin

operations and are accepting capital commitments. When the funds begin acquiring properties, capital calls will be made for capital

contributions during the investment period. Fund A will charge a fee of 45 BP on capital committed and 60 BP on capital invested after

the investment period ends. Fund B will charge a fee of 50 BP on capital committed and 55 BP on capital invested after the investment

period ends. Both funds expect to have $505,000,000 in capital commitments when the fund commences operations and both project

a five-year cycle for startup and acquisitions. Capital flows are expected as follows:

Fund A

Year 1

Year 2

Year 3

Year 4

Year 5

Fund B

Year 1

Year 2

Year 3

Year 4

Year 5

Contributed

Capital

$ 202,000,000

303,000,000

Contributed

Capital

$ 303,000,000

202,000,000

Capital Returned

$0

0

0

101,000,000

50,500,000

Capital Returned

0

0

50,500,000

101,000,000

Invested Capital

$ 202,000,000

505,000,000

505,000,000

404,000,000

353,500,000

Invested Capital

$ 303,000,000

505,000,000

505,000,000

454,500,000

353,500,000

Required:

a. What will total fees be for Fund (A)? For Fund (B)?

b. Would one of the fee structures cause the manager to want to hold the properties longer before selling than the other fee structure?

if so, which one?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- excelarrow_forward7. Explain the importance of financial management. 8. What if financial statement? 9. What is financial statement analysis? 10. Discuss various types of financial statement analysis. 11. Explain various methods of financial statement analysis. 12. What are the differences between fund flow and cash flow? 13. What is ratio analysis? Explain its typesarrow_forwardne NPV of go ərket..(Do nc IDarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education