ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

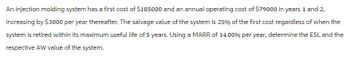

Transcribed Image Text:An injection molding system has a first cost of $185000 and an annual operating cost of $79000 in years 1 and 2,

increasing by $3000 per year thereafter. The salvage value of the system is 25% of the first cost regardless of when the

system is retired within its maximum useful life of 5 years. Using a MARR of 14.00% per year, determine the ESL and the

respective AW value of the system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Required information For equipment that has a first cost of $10,500, the estimated operating costs and year-end salvage values are as shown. Year Operating Cost, $ Salvage Value, $ 1 -1,000 7,000 2 -1,200 5,000 3 -1,300 4,500 4 -2,000 3,000 5 -3,000 2,000 Determine the economic service life ESL, at i= 10% per year using factors. The economic service life ESL, is 4 O years with the AW $- 5982.12 =arrow_forwardA piece of equipment has a first cost of $150,000, a maximum useful life of 7 years, and a market (salvage) value described by the relation S = 120,000 – 17,000k, where k is the number of years since it was purchased. The salvage value cannot go below zero. The AOC series is estimated using AOC = 60,000 + 7,000k. The interest rate is 14% per year. Determine the economic service life and the respective AW. The economic service life is ...... year(s) and the AW value is ........arrow_forwardApricot Computers is considering replacing its material handling system and either purchasing or leasing a new system. The old system has an annual operating and maintenance cost of $31,000, a remaining life of 8 years, and an estimated salvage value of $5,300 at that time. A new system can be purchased for $259,000; it will be worth $24,000 in 8 years; and it will have annual operating and maintenance costs of $16,000/year. If the new system is purchased, the old system can be traded in for $19,000. Leasing a new system will cost $25,000/year, payable at the beginning of the year, plus operating costs of $7,100/year, payable at the end of the year. If the new system is leased, the old system will be sold for $9,000. MARR is 15%. Compare the annual worths of keeping the old system, buying a new system, and leasing a new system based upon a planning horizon of 8 years. Click here to access the TVM Factor Table Calculator For calculation purposes, use 5 decimal places as displayed in the…arrow_forward

- A granary has two options for a conveyor used in the manufacture of grain for transporting, filling, or emptying. One conveyor can be purchased and installed for $45,000 with $3,500 salvage value after 16 years. The other can be purchased and installed for $95,000 with $3,000 salvage value after 16 years. Operation and maintenance for each is expected to be $21,500 and $14,000 per year, respectively. The granary uses MACRS-GDS depreciation, has a marginal tax rate of 40%, and has a MARR of 9% after taxes. Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. Determine which alternative is less costly, based upon comparison of after-tax annual worth. Show the AW values used to make your decision: Conveyor 1: $ Conveyor 2: $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±10. What must the cost of the second (more expensive) conveyor be for there to be no economic…arrow_forwardA machine purchased 3 years ago for $140,000 is now too slow to satisfy the demand of the customers. It can be upgraded now for $88,000 or sold to a smaller company internationally for $50,000. The upgraded machine will have an annual operating cost of $88,000 per year and a $24,000 salvage value in 3 years. If upgraded, the presently owned machine will be retained for only 3 more years, then replaced with a machine to be used in the manufacture of several other product lines. The replacement machine, which will serve the company now and for a maximum of 8 years, costs $223,000. Its salvage value will be $56,000 for years 1 through 5: $20,000 after 6 years; and $10,000 thereafter. It will have an estimated operating cost of $45,000 per year. Perform an economic analysis at 11% per year using a specified 3-year planning horizon. a) Determine if the current machine should be replaced now or 3 years from now. b) Once decided, determine the equivalent AW for the next three years. a) The…arrow_forwardA new production system for a factory is to be purchased and installed for $151.910. This system will save approximately 300.000 kwh of electric power each year for a 6-year period. Assume the cost of electricity is $0.10 per kwh, and factory MARR is 15% per year, and the salvage value of the system will be $9.222 at year 6. Using the PW method to analyzes if this investment is economically justified A-calculate the PW of the above investment and insert the result below.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education