Question

thumb_up100%

Pls help ASAP on this question (90)

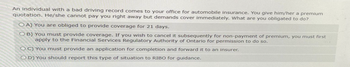

Transcribed Image Text:An individual with a bad driving record comes to your office for automobile insurance. You give him/her a premium

quotation. He/she cannot pay you right away but demands cover immediately. What are you obligated to do?

OA) You are obliged to provide coverage for 21 days.

OB) You must provide coverage. If you wish to cancel it subsequently for non-payment of premium, you must first

apply to the Financial Services Regulatory Authority of Ontario for permission to do so.

OC) You must provide an application for completion and forward it to an insurer.

OD) You should report this type of situation to RIBO for guidance.

Expert Solution

arrow_forward

Step 1: Define automobile insurance

Automobile insurance, often known as car insurance, is a type of insurance that provides financial protection in the case of certain hazards associated with owning and operating a motor vehicle. It is a contract between an individual or corporation (the insured) and an insurance company (the insurer) in which the insurer agrees to compensate the insured for specific losses or obligations related to the insured vehicle.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Question 34 The term "soft constraints" is associated with which of the following? Goal Programming Expected Monetary Value Network Models Integer Programmingarrow_forwardPlease answer question 2arrow_forwardQuestion 40 Philips manufacturers multicookers in Woodlands, Pasir Ris, and Toa Payoh. Multicookers must then be transported to meet demand in Novena, Orchard, and Bukit Timah. The table below shows the transportation costs per unit, supply, and demand information. Source \ Destination Novena Orchard Bukit Timah SUPPLY Woodlands $10 $20 $30 1000 Pasir Ris $15 $25 $20 1500 Toa Payoh $20 $20 $10 2000 DEMAND 1000 1800 1200 How many units should be shipped from Pasir Ris to Novena in order to minimize transportation costs? O 500 O 1,500 O 800 O 1,200 O 1,000arrow_forward

- Question 26 Amazon has 350 regional warehouse and maintains and average inventory of $150,000,000. The company is considering consolidating to 175 regional warehouses to reduce costs. What would be the combined average inventory in this new arrangement?arrow_forwardQuestion 28 For the following linear programming problem, what is the maximum profit? Some students want to start a business that cleans and polishes cars. It takes 1.5 hours of labor and costs $2.25 in supplies to clean a car. It takes 2 hours of labor and costs $1.50 in supplies to polish a car. The students can work a total of 120 hours in one week. They also decide that they want to spend no more than $135 per week on supplies. The students expect to make a profit of $7.75 for each car that they clean and a profit of $8.50 for each car that they polish. What is the maximum profits the students can make? $620 $330 $565arrow_forwardQuestion 3 Maya Itd. wants to use the Centre of Gravity location technique to determine where to setup its distribution centre. I. What is the main objective of using this technique? II. What information will be needed in order to use this technique? III. Setup a numerical example that can be used to demonstrate to the owner of the company how the technique can be used.arrow_forward

- Question 1. Busch Gardens Sweets is preparing for the Halloween rush. They prepare two sizes of Peanut/Raisin Ghoulish Delight and need to calculate how many bags of deluxe and standard mixes they can produce. • The deluxe mix takes 0.9 of a pound of raisins and 0.4 of a pound of peanuts.• The standard mix takes 0.7 of a pound of raisins and 0.6 of a pound of peanuts.The shop has 100 pounds of raisins and 70 pounds of peanuts. The profit on the deluxe mix is $1.80 and the standard mix profit is $1.60. The owner wants no more than 110 bags of each type prepared. Do not forget the non-negativity constraint and remember that you cannot sell partial bags (whole numbers only). Use Excel Solver Question 2. Take a screenshot (snip tool) of you excel spreadsheet and save it.arrow_forwardQUESTION 13 (Please use at least four significant figures in your calculations.) $60 S-curve Turntables $160 Hullabaloo Records $40 $260 S-Curve Turntables manufactures turntables, and sells them through Hullabaloo Records, a chain of specialty record stores. For a model year, they will manufacture their newest model of turntable, called "Orbitz", which will be sold through the record stores. It costs $60 for S- Curve to manufacture the turntables, which it then sells to Hullabaloo for $160. Hullabaloo Records then sells the turntables at retail for $260. Whatever doesn't sell gets put on clearance for $40. Demand for the turntable is expected to be normally distributed with a mean of 1833 and a standard deviation of 1092. What is the optimal order amount that will maximize the SUPPLY CHAIN'S expected profit?arrow_forwardQuestion 9 ADM Security Consultants is a small security service company, whose specialty is providing security on a short term basis for single events such as concerts. The company has an offsite technical team of operators that back up the security personnel that are onsite The following table shows the staffing requirements of the technical team on each day of the week. These operators work long hours and management.wishes to create a staffing schedule that ensures each operator gets two consecutive days off. Schedule each operator, guaranteeing two consecutive days off MO TUE WED THUR FRI SAT SUN Requirement 2. 4. 2arrow_forward

- Question 5 Silicon Valley Transport Commission (SVTC) has a fleet of maintenance vehicles that includes cars, vans, and trucks. SVTC is currently evaluating four different approaches to help them maintain their fleet of cars and vans efficiently at the lowest possible cost. Their options are: (1) No preventive maintenance at all and repair vehicle components when they fail; (2) Take oil samples at regular intervals and perform whatever preventive maintenance is indicated by the oil analysis; (3) Perform an oil change on a regular basis on each vehicle and perform repairs when needed; (4) perform oil changes at regular intervals, take oil samples regularly, and perform maintenance repairs as indicated by the sample analysis. Option #1 costs nothing to implement and results in two possible outcomes: There is a .10 probability that a defective component will occur, requiring emergency maintenance at a cost of $1,200, or there is a chance that no defects will occur and no maintenance…arrow_forwardQuestion 35 of 50 You are working for an online retailer and you get an email from an upset customer. Their delivery was expected yesterday and still has not arrived. Which phrase is best to use in your response to the customer? "I can see why you're frustrated." "Estimated delivery dates provide us with only a guess as to when your item will arrive. Do you have a tracking number?" "Sometimes deliveries can get held up depending on when you placed the order." "I know you expected the item yesterday, but exactly when the shipping companies will deliver your item is out of our control." "Did you need to receive the item yesterday for an important occasion? Previous Nextarrow_forwardQuestion 2CWD Manufacturing makes three components for sale to refrigeration companies. Thecomponents are processed on two machines: a shaper and a grinder. The times (in minutes)required on each machine are as follows: Machine Component Shaper Grinder 1 6 4 2 4 5 3 4 2 The shaper is available for 120 hours, and the grinder is available for 110 hours. No more than200 units of component 3 can be sold, but up to 1000 units of each of the other components canbe sold. In fact, the company already has orders for 600 units of component 1 that must besatisfied. The profit contributions for components 1, 2, and 3 are $8, $6, and $9, respectively. (see image) If there are two possible answers one will suffice. Where necessary a range analysis must be shown.(convert to minutes)a) What is the optimal solution (in words)? b) An additional 4 hours of shaper time became available. Evaluate the effect? Explainc) Two hours of Grinder time was lost. Evaluate the effect? d) An additional…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios