ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

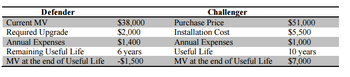

An existing robot can be kept if $2,000 is spent now to upgrade it for future service requirements. Alternatively, the company can purchase a new robot to replace the old robot. The following estimates have been developed for both the defender and challenger.

The company?s before-tax MARR is 20% per year. Based on this information, should the existing robot be replaced right now? Assume the robot will be needed for an indefinite period of time. (Hint: Use the AW method)

Transcribed Image Text:Defender

Current MV

Required Upgrade

Annual Expenses

Remaining Useful Life

MV at the end of Useful Life

$38,000

$2,000

$1,400

6 years

-$1,500

Challenger

Purchase Price

Installation Cost

Annual Expenses

Useful Life

MV at the end of Useful Life

$51,000

$5,500

$1,000

10 years

$7,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A pallette conveyor system used to transport pallettes of product at the Browning Harvey plant in St. John's costs $250,000 plus $35,000 to install. It is estimated to depreciate at a declining balance rate of 25% per year over its 15-year useful life. Annual maintenance costs are estimated to be $9,000 for the first year, increasing by 20% every year thereafter. In addition, every third year, the rollers must be replaced at a cost of $6,000. Interest is at 9%. Construct a spreadsheet that has the following headings: Year, Salvage Value, Maintenance Costs, and the EAC of each of Capital Costs, Maintenance Costs and a Total Equivalent Annual Costs (as used in the lectures and is shown below). The economic life of the conveyor system is determined by the year that has the lowest Total Equivalent Annual Cost. Complete the row of the table below, inputting data for the row that has the lowest Total Equivalent Annual Cost from your spreadsheet for this project: NOTE: (Use 5 significant…arrow_forwardEstimate the approximate after-tax rate of return for a project that has a before-tax ROR of 18.6%. Assume the company's effective tax rate is 26% and it uses MACRS depreciation for an asset that has a $40,000 salvage value. The approximate after-tax rate of return is %.arrow_forwardHenredon purchases a high-precision programmable router for shaping furniture components for $190,000. It is expected to last 12 years and have a salvage value of $5,000. It will produce $45,000 in net revenue each year during its life. Corporate income taxes are 40 percent, and the after-tax MARR is 10 percent. Determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR, if the router is kept for 12 years. After-tax PW: $enter a dollar amount rounded to the nearest dollar After-tax AW: $enter a dollar amount rounded to the nearest dollar After-tax IRR: enter percentages rounded to 1 decimal place % After-tax ERR: enter percentages rounded to 1 decimal placearrow_forward

- The Industrial Engineering at Shocker Communications has devised one alternative method involving new tooling for a job being machined in the shop. Data on the present and proposed method are shown in the table below. What production quantity would be required for the alternative method to be more economical? Assume the base pay rate is $10.0 per hour. The estimated production quantity is 15040 per year. The fixtures are capitalized and depreciated in 4 years. Round your answer to the closest integer. Method Standard Time (min) Fixture Cost Tool Cost Average Tool Life Present 10,000 0.856 0 $6 Method pieces 32845 Alternative 0.791 $930 $20 piecesarrow_forwardA 5 year-old tooling kit that was purchased new for $9000 has a current market value of $4000 and expected 0&M costs of $3000, increasing by $1200 per year. Future market values are expected to decline by 25% annually (going forward). The kit can be used for another 3 years at most. The optimal replacement kit costs $8000 and has 0&M costs starting at $2500 per year, increasing by $2000 per year. Salvage value for the new kit at the end of the first year is $4000 and falls by $1000 per year thereafter (until zero). The new model kit will be needed indefinitely. Assume a unique minimum AEC~(15%) for both kits (both the current and replacement kit). The MARR is 15%. 1) What is the AECC• ? a) Less than 6925.70 b) 6925.70-6945.70 c) 6945.70-6965.70 ) d) 6965.70-6985.70 e) More than 6985.70arrow_forwardThe Smith and Jones Research and Development firm has bought a new laboratory equipment (MACRS-GDS 3-year property class) to be used in a research project that will last 3 years. The cost of equipment is $750,000 but require bringing a technician to install the equipment and train the personal with an additional cost of $75,000. The equipment’s supplier will buy back the equipment at the end of the project for $50,000. The O&M costs per year incurred by the equipment are $70,000. The firm signed a contract with the DOD that states that they will receive a one lump-sum of $Y at the end of the life of the research project that will generate a rate of return of 8%. The firm will finance the equipment with a loan at 6% interest rate per year, and considering that the firm will not generate any revenue until the end of year 3, the bank has agreed that principal and accrued interests will be paid at the end of year three. Perform an ATCF analysis to determine the value of Y$ that will…arrow_forward

- Required information Nuclear safety devices installed several years ago have been depreciated from a first cost of $200,000 to zero using the Modified Accelerated Cost Recovery System (MACRS). The devices can be sold on the used equipment market for an estimated $15,000, or they can be retained in service for 5 more years with a $9000 upgrade now and an operating expenses (OE) of $6000 per year. The upgrade investment will be depreciated over 3 years with no salvage value. The challenger is a replacement with newer technology at a first cost of $40,000, n=5 years, and S=0. The new units will have operating expenses of $7000 per year. Use a 5-year study period, an effective tax rate of 41%, an after-tax minimum acceptable rate of return (MARR) of 12% per year, and an assumption of classical straight line depreciation (no half-year convention) to perform an after-tax AW-based replacement study. The annual worth of the defender is determined to be $[ The annual worth of the challenger is…arrow_forwardThe cost of a embroidery machine is P1.2M and the cost of installation isP50,000. If the salvage value is 10% of the cost of the machine at the end of 10 years,determine the book value at the end of the 3rd year. Use Straight-Line Method. Show complete and logical solutionarrow_forwardYou are considering the purchase of a new high-efficiency machine to replace older machines now. The new machine can replace four of the older machines, each with a current market value of $600. The new machine will cost $5000 and will save the equivalent of 10,000 kWh of electricity per year. After a period of 10 years, neither option (new or old) will have any market value. If you use a before-tax MARR of 25% and pay $0.075 per kilowatt-hour, would you replace the old machines today with the new one?A professor of engineering economics owns an older car. In the past 12 months, he has paid $2000 to replace the transmission, bought two new tires for $160, and installed a music system for $110. He wants to keep the car for 2 more years because he invested money 3 years ago in a 5-year certificate of deposit, which is earmarked to pay for his dream machine, a red European sports car. Today the old car’s engine failed.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education