FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

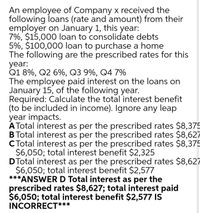

Transcribed Image Text:An employee of Company x received the

following loans (rate and amount) from their

employer on January 1, this year:

7%, $15,000 loan to consolidate debts

5%, $100,000 loan to purchase a home

The following are the prescribed rates for this

year:

Q1 8%, Q2 6%, Q3 9%, Q4 7%

The employee paid interest on the loans on

January 15, of the following year.

Required: Calculate the total interest benefit

(to be included in income). Ignore any leap

year impacts.

ATotal interest as per the prescribed rates $8,375

B Total interest as per the prescribed rates $8,627

CTotal interest as per the prescribed rates $8,375

$6,050; total interest benefit $2,325

DTotal interest as per the prescribed rates $8,627

$6,050; total interest benefit $2,577

***ANSWERD Total interest as per the

prescribed rates $8,627; total interest paid

$6,050; total interest benefit $2,577 IS

INCORRECT***

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Annette Corp. issued a $330,000, three-year, zero-interest-bearing note payable to Agnes Corp. for equipment on April 30, Year 5. Annette would normally pay interest at 6%. Annette has a December 31 year-end and will repay the note with three equal yearly payments of $110,000. Annette Corporation follows IFRS. Instructions Prepare the following journal entries for Annette Corporation: (show all your work) 1. Record the note 2. December 31, Year 5 interest accrual 3. April 30, Year 6 payment 4. December 31, Year 6 interest accrual 5. April 30, Year 7 paymentarrow_forwardThomas Martin receives an hourly wage rate of $25, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $308; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? a.$1,300 b.$1,800 c.$2,400 d.$1,200arrow_forwardRosewood Company made a loan of $7,000 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice O O $420 in Year 1 and $0 in Year 2 $0 in Year 1 and $420 in Year 2 $105 in Year 1 and $315 in Year 2 $315 in Year 1 and $105 in Year 2arrow_forward

- A company’s first weekly pay period of the year ends on January 8. Sales employees earned $30,000 and office employees earned $20,000 in salaries. The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insurance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Part 1. Compute FICA Social Security taxes payable and FICA Medicare taxes payable. Prepare the journal entry to record the company’s January 8 (employee) payroll expenses and liabilities. Part 2. Prepare the journal entry to record the company’s (employer) payroll taxes resulting from the January 8 payroll. Its state unemployment tax rate is 5.4% on the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%.arrow_forwardThomas Martin receives an hourly wage rate of $16, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 47; federal income tax withheld, $354; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? a.$1,504 b.$808 c.$1,128 d.$752arrow_forwardOn March 8, Manuel borrowed $720.00 from his uncle at 4.3% per annum calculated on the daily balance. He gave his uncle six cheques for $110.00 dated the 8th of each of the next six months starting April 8 and a cheque dated October 8 for the remaining balance to cover payment of interest and repayment of principal. Construct a complete repayment schedule for the loan including totals for Amount Paid, Interest Paid, and Principal Repaid. Complete the repayment schedule below. (Round to the nearest cent as needed.) Balance Before Payment Amount Paid Balance After Payment Payment Number O Mar. 8 Interest Paid Principal Repaid $720.00 1 Apr. 8 $720.00 $110.00 2 May 8 $110.00 3 June 8 $110.00 4 July 8 $110.00 5 Aug. 8 $110.00 6 Sept. 8 $110.00 7 Oct. 8 $0.00 Totals:arrow_forward

- On October 31st, David signed a 4-month, $5,000 simple interest loan earning 7. Find the maturity date, interest, and maturity value.arrow_forwardSelect all that apply Jenco Company's gross pay for employees at the end of the pay period is $100,000. Jenco withholds the following amounts: Federal withholding tax $20,000 FICA Withholding -- employee portion $5,000 Health insurance premiums $2,000 Which of the following are included in the journal entry required for employee payroll? Credit health insurance payable $2,000 Credit FICA payable $5,000 Credit wages payable $73,000 Credit wages payable $100,000 Debit payroll expense $73,000 Debit payroll expense $100,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education