ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

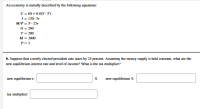

Transcribed Image Text:An economy is initially described by the following equations:

C = 60 + 0.8(Y–T)

I = 120–5r

MIP = Y-25r

G = 200

T= 200

M = 3000

P= 3

b. Suppose that a newly elected president cuts taxes by 25 percent. Assuming the money supply is held constant, what are the

new equilibrium interest rate and level of income? What is the tax multiplier?

new equilibrium r.

new equilibrium Y:

tax multiplier:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose the tax multiplier in an economy is -8. If the government wants to lower total spending (TS) by $8000 what should they do to Taxes (T)? Group of answer choices a. they should increase taxes by $64000 b. they should decrease taxes by $64000 c. they should increase taxes by $1000 d. they should decrease taxes by $1000arrow_forwardWhich is considered expansionary fiscal policy? a)a tax increase for wealthy individuals b)an increase in national defense spending c)regulations raising emission standards on trucks d)an increase in the money supplyarrow_forwardSuppose the economy begins at full employment. Label this starting point as point "1." Then, suppose that a long strike by coal miners reduces the coal supply and increases the price of coal. Show the effects on your graph and label the new equilibrium point "2." Lastly, suppose our government wants the economy to return to full-employment as quickly as possible. Should the government intervene? If so, show the impact of successful fiscal policy on your graph. Label this new equilibrium point "3."arrow_forward

- On the following graph, AD1 represents the initial aggregate demand curve in a hypothetical economy, and AS represents the initial aggregate supply curve. The economy's full-employment output is $12 trillion. On the following graph, use the grey point (star symbol) to mark the equilibrium. (Note: You will not be graded on any adjustments made to the graph.) PRICE LEVEL (CPI) AS 106 105 104 103 63 102 101 100 99 98 AD AD 吕 1 97 96 Full Employment 96 6 7 8 9 10 11 12 13 14 15 16 REAL GDP (Trillions of dollars) AD 2 Equilibrium The initial short-run equilibrium level of real GDP is $ trillion, and the initial short-run equilibrium price level is Suppose the government, seeking full employment, borrows money and increases its expenditures by the amount it believes necessary to close thearrow_forwardConsider the following economy: C = 300 + 0.8 (Y – T) I = $300 G = $200 and T = $250 What is the equilibrium level of national income? What is the change in national income, if only government spending increases by $10? What is the government spending multiplier? What is the change in national income, if only taxes increase by $10? What is the tax multiplier? Based on (b) and (c), does the balanced budget multiplier theorem hold? What is the change in national income, if both government spending and taxes increase by $10 each?arrow_forwardHow can a reduction in Corporation Tax lead to supply side improvements in an economy?arrow_forward

- 3.5arrow_forwardOn the following graph, AD1 represents the initial aggregate demand curve in a hypothetical economy, and AS represents the initial aggregate supply curve. The economy's full-employment output is $12 billion. On the following graph, use the grey point (star symbol) to mark the equilibrium. (Note: You will not be graded on any adjustments made to the graph.) PRICE LEVEL (CPI) 106 105 104 103 102 H AS 1ŏ1 101 ADA 100 AD 3 99 AD 2 98 AD1 97 Full Employment 96 6 7 8 9 10 11 12 13 14 15 16 REAL GDP (Billions of dollars) Equilibrium (?)arrow_forwardThe government lowers $0.9 trillion in taxes, restoring GDP from $10 trillion to its potential level of $11.2 trillion. What is the value of the tax multiplier? A -1.33 B -0.9 C -0.75 D -1 E -1.2arrow_forward

- 3.6arrow_forwardGiven that the maginal propensity to consume (MPC) is 0.50, what is the change in equilibrium output (or aggregate demand), if there is a tax is reduced by 50? Hint: Use the tax multiplier formula. -50 -25 50 25arrow_forwardAssume the tax multiplier is estimated to be 1.3 and the aggregate supply curve has its usual upward slope. Suppose the government lowers taxes by $75 million. Aggregate demand will by $ million. (Enter your response rounded to one decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education