Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

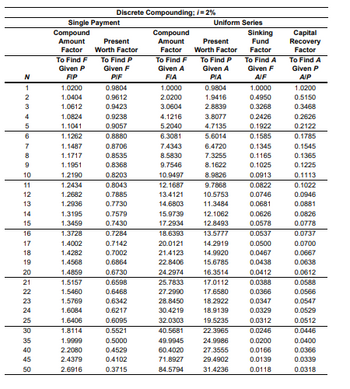

An award is being established, and it will pay $11,000 every four years, with the first installment being paid in four

years. The award will be given for an indefinitely long period of time. If the interest rate is 2%

per annum, what lump-sum amount of money (invested now) will be required to endow this award forever?

Transcribed Image Text:Present

Worth Factor

Discrete Compounding;/=2%

Single Payment

Compound

Amount

Factor

Compound

Amount

Uniform Series

Sinking

Capital

Factor

Present

Worth Factor

Fund

Factor

To Find F

To Find P

To Find F

To Find P

Given P

Given F

Given A

Given A

Given F

To Find A

Recovery

Factor

To Find A

Given P

N

FIP

PIF

FIA

PIA

AIF

AIP

1

1.0200

0.9804

1.0000

0.9804

1.0000

1.0200

2

1.0404

0.9612

2.0200

1.9416

0.4950

0.5150

3

1.0612

0.9423

3.0604

2.8839

0.3268

0.3468

4

1.0824

0.9238

4.1216

3.8077

0.2426

0.2626

5

1.1041

0.9057

5.2040

4.7135

0.1922

0.2122

6

1.1262

0.8880

6.3081

5.6014

0.1585

0.1785

7

1.1487

0.8706

7.4343

6.4720

0.1345

0.1545

8

1.1717

0.8535

8.5830

7.3255

0.1165

0.1365

9

1.1951

0.8368

9.7546

8.1622

0.1025

0.1225

10

1.2190

0.8203

10.9497

8.9826

0.0913

0.1113

11

1.2434

0.8043

12.1687

9.7868

0.0822

0.1022

12

1.2682

0.7885

13.4121

10.5753

0.0746

0.0946

13

1.2936

0.7730

14.6803

11.3484

0.0681

0.0881

14

1.3195

0.7579

15.9739

12.1062

0.0626

0.0826

15

1.3459

0.7430

17.2934

12.8493

0.0578

0.0778

16

1.3728

0.7284

18.6393

13.5777

0.0537

0.0737

17

1.4002

0.7142

20.0121

14.2919

0.0500

0.0700

18

1.4282

0.7002

21.4123

14.9920

0.0467

0.0667

19

1.4568

0.6864

22.8406

15.6785

0.0438

0.0638

20

1.4859

0.6730

24.2974

16.3514

0.0412

0.0612

21

1.5157

0.6598

25.7833

17.0112

0.0388

0.0588

2222229

1.5460

0.6468

27.2990

17.6580

0.0366

0.0566

23

1.5769

0.6342

28.8450

18.2922

0.0347

0.0547

24

1.6084

0.6217

30.4219

18.9139

0.0329

0.0529

25

1.6406

0.6095

32.0303

19.5235

0.0312

0.0512

30

1.8114

0.5521

40.5681

22.3965

0.0246

0.0446

35

1.9999

0.5000

49.9945

24.9986

0.0200

0.0400

40

2.2080

0.4529

60.4020

27.3555

0.0166

0.0366

45

2.4379

0.4102

71.8927

29.4902

0.0139

0.0339

50

2.6916

0.3715

84.5794

31.4236

0.0118

0.0318

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Present value of a growing perpetuity) As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The first payment will occur in a year and will be for $30,000. You will continue receiving monetary awards annually with each award increasing by 7 percent over the previous award, and these monetary awards will continue forever. If the appropriate interest rate is 12 percent, what is the present value of this award? The present value of the award is $ nearest cent.) (Round to thearrow_forwardA four-year investment requires annual deposits of $300 at the beginning of each year. The deposits earn 9% per year. What is the investment's future value? Remember, the deposits are made at the beginning of each year (annuity due). A four-year investment requires annual deposits of $300 at the beginning of each year. The deposits earn 9% per year. What is the investment's future value? Remember, the deposits are made at the beginning of each year (annuity due). $1,495.41 $1,459.98 $1,425.22 $1,391.12 $ 1,357.69arrow_forwardTanya is considering an investment that will require an initial payment of 400,000 and additional payments of 100,000 and 50,000 at the end of years one and two, respectively. It is expected that revenue from this investment will be 150,000 per year for five years, beginning one year from the initial investment.Assuming an annual effective rate of 10%, calculate the net present value of this investment.arrow_forward

- A 10-year annuity of $5,000 annual payments begins in 6 years. The discount rate is 10%, compounded annually. What is its value today? What is its value in 7 years?arrow_forwardWe are funding an organization for ten years. The first payment will be made one year from today (end of year one) and will be $8,350. Each year after that, the organization will receive payment from us annually. The payment will increase at a rate of 2% per year after the second payment. If the annual interest rate is 15%, what is the present value of this endowment?arrow_forwardYou plan to invest $10,000 in an engineering project. You want to recover your irrvestment in 5 years. What should be the semiannual revenue at an interest rate of 5% per quarter.arrow_forward

- A 10-year annuity of twenty $10,000 semiannual payments will begin 12 years from now, with the first payment coming 12.5 years from now. a.If the discount rate is 8 percent compounded monthly, what is the value of this annuity 8 years from now? b.What is the current value of the annuity?arrow_forwardFind the future value of AED 10,000 per month (at the beginning of the month) for six years at 10 percent. At the end of 6 years you take the proceeds and invest them for 9 years at 12 percent. How much will you have after 15 years?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education