College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Can you explain the correct approach to solve this general accounting question?

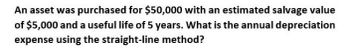

Transcribed Image Text:An asset was purchased for $50,000 with an estimated salvage value

of $5,000 and a useful life of 5 years. What is the annual depreciation

expense using the straight-line method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years. Prepare depreciation schedules reporting the depreciation expense, accumulated depreciation, and book value of the machine for each year under the double-declining-balance and sum-of-the-years-digits methods. For the double-declining-balance method, round the depreciation rate to two decimal places.arrow_forwardCalculate the depreciation expense for an asset with the following details: Initial Cost: $50,000 Salvage Value: $5,000 Useful Life: 5 yearsarrow_forwardAcme Corporation purchases machinery for $78,000 with a salvage value of $8,000 and an expected useful life of 7 years. What is the annual depreciation expense using the straight-line method? Helparrow_forward

- What is the amount of depreciation?arrow_forwardBullock Enterprises buys equipment for $63,000 with a salvage value of $6,000 and an expected useful life of 7 years. What is the annual depreciation expense using the straight-line method?arrow_forwardA piece of equipment is purchased for $40,000 and has an estimated salvage value of $1,000 at the end of the recovery period. Prepare a depreciation schedule for the piece of equipment using the straight-line method, the sum-of-the-years method, and the 200% declining-balance method with a recovery period of five years. Compare these depreciation methods in a graph.arrow_forward

- Need Help to get Answerarrow_forwardWhat is the depreciation for year 2 ?arrow_forwardAn owner may calculate depreciation using the 'units of production' methods of depreciation. Consider a depreciable asset costing $100,000 that is expected to have a useful life of 120,000 Units of production. Salvage value is estimated to be negligible. Estimated annual production for the next 7 years is 30,000, 30,000, 20,000, and 10,000 per year over the remaining 4 years. Use the 'units of production' depreciation method and determine the depreciation each year.arrow_forward

- IF A COMPANY PURCHASES EQUIPMENT FOR $12,000, WITH A SALVAGE VALUE OF $2,000 AND A USEFUL LIFE OF 5 YEARS, WHAT IS THE ANNUAL STRAIGHT- LINE DEPRECIATION EXPENSE? A) $1,000 B) $2,000 C) $2,500 D) $3,000arrow_forwardMarissa's company recently purchased a depreciable asset for $190,000. The estimated salvage value is $18,000, and the estimated useful life is 8 years. The straight-line method will be used for depreciation. Given this information, the depreciable base of the asset will be O $115,000. O $208,000. O $172,000. O $23,750. Submit Answer Save for Laterarrow_forwardGive me answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,