FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

An analysis of WTI's insurance policies shows that $3,468 of coverage has expired.

An inventory count shows that teaching supplies costing $3,006 are available at year-end.

Annual depreciation on the equipment is $13,871.

Annual depreciation on the professional library is $6,936

On September 1, WTI agreed to do five training courses for a client for $2,600 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $13,000 cash in advance for all five training courses on September 1, and WTI credited Unearned Revenue

On October 15, WTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at the end of the class. At December 31, $10,548 of the tuition revenue has been earned by WTI

WTI's two employees are paid weekly. As of the end of the year, two days salaries have accrued at the rate of $100 per day for each employee.

The balance in the Prepaid Rent account represents rent for December

Transcribed Image Text:Cash

Accounts receivable

Teaching supplies

Prepaid insurance

Prepaid rent

Professional library.

Accumulated depreciation-Professional library

Equipment

Accumulated depreciation-Equipment

Accounts payable

Salaries payable

Unearned revenue

Common stock

Retained earnings

Dividends

Tuition revenue

Training revenue

Depreciation expense-Professional library

Depreciation expense-Equipment

Salaries expense

Insurance expense

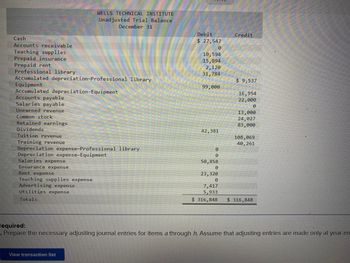

WELLS TECHNICAL INSTITUTE

Unadjusted Trial Balance

December 31

Rent expense

Teaching supplies expense

Advertising expense

Utilities expense

Totals

View transaction list

Debit

$ 27,547

0

10,594

15,894

2,120

31,784

99,000

42,381

0

0

50,858

0

Credit

$ 9,537

16,954

22,000

0

13,000

24,027

83,000

108,069

40, 261

23,320

0

7,417

5,933

$ 316,848 $ 316,848

Required:

. Prepare the necessary adjusting journal entries for items a through h. Assume that adjusting entries are made only at year-en

![Required information

[The following information applies to the questions displayed below.]

Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training

to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts.

Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting

entries on December 31.

Additional Information Items

a. An analysis of WTI's insurance policies shows that $3,468 of coverage has expired.

b. An inventory count shows that teaching supplies costing $3,006 are available at year-end.

c. Annual depreciation on the equipment is $13,871.

d. Annual depreciation on the professional library is $6,936.

e. On September 1, WTI agreed to do five training courses for a client for $2,600 each. Two courses will start immediately

and finish before the end of the year. Three courses will not begin until next year. The client paid $13,000 cash in

advance for all five training courses on September 1, and WTI credited Unearned Revenue.

f. On October 15, WTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at

the end of the class. At December 31, $10,548 of the tuition revenue has been earned by WTI.

g. WTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per

day for each employee.

h. The balance in the Prepaid Rent account represents rent for December.

Cash

Accounts receivable

WELLS TECHNICAL INSTITUTE

Unadjusted Trial Balance

December 31

Debit

$27,547

0

S

Credit](https://content.bartleby.com/qna-images/question/3872d851-27db-40d9-8fe5-69d396345726/1d67b260-e083-41df-bb6c-90629edcfc1b/kbnlg2i_thumbnail.jpeg)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training

to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts.

Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting

entries on December 31.

Additional Information Items

a. An analysis of WTI's insurance policies shows that $3,468 of coverage has expired.

b. An inventory count shows that teaching supplies costing $3,006 are available at year-end.

c. Annual depreciation on the equipment is $13,871.

d. Annual depreciation on the professional library is $6,936.

e. On September 1, WTI agreed to do five training courses for a client for $2,600 each. Two courses will start immediately

and finish before the end of the year. Three courses will not begin until next year. The client paid $13,000 cash in

advance for all five training courses on September 1, and WTI credited Unearned Revenue.

f. On October 15, WTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at

the end of the class. At December 31, $10,548 of the tuition revenue has been earned by WTI.

g. WTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per

day for each employee.

h. The balance in the Prepaid Rent account represents rent for December.

Cash

Accounts receivable

WELLS TECHNICAL INSTITUTE

Unadjusted Trial Balance

December 31

Debit

$27,547

0

S

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dhapaarrow_forwardPrepare the following journal entry: Baily Corporation purchased a new Bus for $215,000 and paid 15% as a down payment and signed a promissory note for the reminder of the amount owed.arrow_forwardThere was an explosion at the plant on December 23, 2021 with damages estimated at $1,385,000. The company has insurance to cover such incidents totaling $5,000,000 if the incident was an accident and $1,000,000 if it was due to company error. The incident was investigated and the explosion found to be due to a faulty gas tank that was last serviced on July 15, 2021. The company policy was to service every 6 months however industry standards was generally 3 months. Management was advised by legal counsel that there was a high probability the company would be held responsible for the damages. Employees were not injured during the incident however the employees’ union has indicated that there are discussions underway relating to filing a $3,000,000 claim for unsafe working conditions. Prepare the journal entries necessary to record the transactions above using appropriate dates. ii.Prepare the adjusting entries necessary at December 31, 2021 in order to properly report interest expense…arrow_forward

- Help me please?arrow_forwardCrest Corporation established its Poblacion branch in 2019. Merchandise costing P120,000 is shipped to this branch. During the initial year, the home office acquires an equipment for P80,000 to be carried in the branch books, and the branch maintains physical possession and use. The equipment has a useful life of 4 years. The branch sells 60 percent of the inventory for P100,800 on account and subsequently collected half of the amount. The branch remits 80 percent in cash to the Home Office. What is the correct Home Office account balance on the records of the branch?arrow_forwardA construction company entered into a fixed-price contract to build an office building for $18 million. Construction costs incurred during the first year were $6 million, and estimated costs to complete at the end of the year were $9 million. The company recognizes revenue over time according to percentage of completion. During the first year the company billed its customer $6 million, of which $3 million was collected before year-end. What would appear in the year-end balance sheet related to this contract? Note: Enter your answers in whole dollars and not in millions (i.e., $4 million should be entered as $4,000,000). Balance Sheet (Partial) Assets:arrow_forward

- It's a week before Frogbox's October 31, 2023, year-end. You are the personnel director and are reviewing some financial information regarding the March 1, 2021, purchase of office furniture for the Western Region offices totalling $700,000 ($300,000 was paid in cash and the balance was financed over four years at 4% annual interest with annual principal payments of $100,000). The useful life of the furniture was estimated to be five years with a projected resale value at that time of $20,000. Insurance was purchased on the furniture at a cost of $8,000 annually, payable each March 1. You leave the office for the day wondering what needs to be considered regarding these items in preparation for year-end. Required 1. Identify the relevant facts. 2. Describe what principles need to be considered. 3. Outline the goal of financial reporting. 4. Recommend an appropriate accounting policy and describe the impact to the year-end financial statements. 4 MODE 6 PLAN Please donot provide…arrow_forwardBonita Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $3,960,000 on March 1, $2,640,000 on June 1, and $6,600,000 on December 31. Bonita Company borrowed $2,200,000 on March 1 on a 5-year, 10% note to help finance construction of the building. In addition, the company had outstanding all year a 12%, 5-year, $4,400,000 note payable and an 11%, 4-year, $7,700,000 note payable. Compute avoidable interest for Bonita Company. Use the weighted-average interest rate for interest capitalization purposes. (Round "Weighted-average interest rate" to 4 decimal places, e.g. 0.2152 and final answer to O decimal places, eg. 5,275.) Avoidable interest %24arrow_forwardUniversity Car Wash built a deluxe car wash across the street from campus. The new machines cost $228,000 including installation. The company estimates that the equipment will have a residual value of $24,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours, actual use per year as follows: 1 year 3,000 hours; 2 years 1,700 hours; 3 years, 1,800 hours, 4 years 2,200 hours 5 years 2,000 hours 6 years 1,300 hours. Prepare depreciation schedule for 6 years using the activity based methodarrow_forward

- Munabhaiarrow_forwardVeras Bus Transportation provides on-campus bus services for universities. On January 1, it enters into a one-year contract with Moose University to operate five bus lines traveling throughout the campus. Under the contract, Veras will be paid $110,000 on the last day of each month. In addition, Veras will receive an additional $130,000 at the end of each six-month period, provided it remains free of accidents. On January 1, based on historical experience, Veras estimated that there is a 70% chance that it will remain free of accidents for the entire year. On March 20, three of the most senior drivers at Veras abruptly left. As a result, Veras had to hire inexperienced drivers to fill the vacant positions. Consequently, Veras revised its estimate to a 30% chance that it would be entitled to receive the semiannual bonus and decided to continue this 30% probability estimate until its six-month review at the end of June. On June 30, Moose confirmed that there was no accident between…arrow_forwardCrestfield leases office space. On January 3, the company incurs $26,000 to improve the leased office space. These improvements are expected to yield benefits for 10 years. Crestfield has 5 years remaining on its lease. What journal entry would be needed to record the expense for the first year related to the improvements?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education