FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

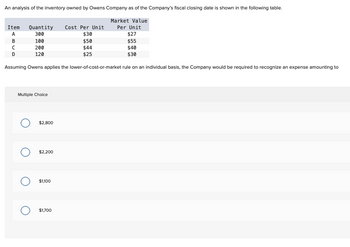

Transcribed Image Text:An analysis of the inventory owned by Owens Company as of the Company's fiscal closing date is shown in the following table.

Market Value

Per Unit

$27

$55

$40

$30

Assuming Owens applies the lower-of-cost-or-market rule on an individual basis, the Company would be required to recognize an expense amounting to

Item

A

B

с

D

Quantity Cost Per Unit

300

$30

100

200

120

Multiple Choice

O

$2,800

$2,200

$1,100

$1,700

$50

$44

$25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Preparation of Operating Activities Section—Indirect Method, Periodic Inventory) The income statement of Dunne Company is shown below.Dunne Company Income Statement For the Year Ended December 31, 2020Sales revenue $ 8,900,000 Cost of goods sold 5,700,000 Gross profit 3,200,000 Operating expenses Selling expenses 550,000 Administrative expenses 725,000 1,275,000 Net income 1,925,000 1. Accounts receivable increased 340,000 during the year2. Inventory decreased $200,000 during the year3. Prepaid expenses increased $150,000 during the year4. Accounts payable to suppliers decreased $310,000 during the year5. Accrued expenses payable increased $70,000 during the year6. Administrative expenses include depreciation expense of $60,000 Prepare the operating activities section of the statement of cash flows for the year ended Dec 31, 2020 for Dunne company, using the indirect methodarrow_forwardColonial Corporation uses the retail method to value its inventory. The following information is available for the year: Beginning inventory Purchases Freight-in Net markups Net markdowns Net sales Beginning inventory Purchases Freight-in Net markups Required: Determine ending inventory and cost of goods sold by applying the conventional retail method using the information provided. Note: Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign. Net markdowns Goods available for sale Cost-to-retail percentage Net sales Cost $ 190,000 600,000 8,000 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold Retail $ 280,000 840,000 $ 20,000 4,000 800,000 Cost 190,000 $ 600,000 8,000 798,000 $ Retail 280,000 840,000 20,000 1,140,000 (4,000) 1,136,000 79,520 1,056,480 Cost-to-Retail Ratio 70.00 %arrow_forwardRJ Corporation has provided the following information about one of its inventory items: Number of Date Transaction Cost per Unit Units 1/1 460 $3,000 Inventory 6/6 Purchase 815 $3,675 9/10 Purchase 1,215 $4,225 11/15 Purchase 875 $4,500 During the year, RJ sold 2,970 units. What was ending inventory using the LIFO cost flow assumption under a periodic inventory system? Beginningarrow_forward

- Valuing Inventory at Lower-of-Cost-or-Market Management of Tarry Company takes the position that under the lower-of-cost-or-market rule, the two items below are reported in ending inventory at $119,520 (total). Inventory cost is reported using LIFO. • Edgers: 2,160 in inventory; cost is $22 each; replacement cost is $16 each; estimated sale price is $30 each; estimated distribution cost is $3 each; and normal profit is 10% of sale price. • Hedge clippers: 1,440 in inventory; cost is $50 each; replacement cost is $36 each; estimated sale price is $90 each; estimated distribution cost is $28 each; and normal profit is 20% of sale price. a. Compute your inventory valuation by item and in total for the Tarry Company inventory reported above. Inventory valuation for edgers $ Inventory valuation for hedge clippers Total inventory valuation b. Prepare the entry, if any, to report inventory at the lower-of-cost-or-market. Assume that all adjustments directly impact cost of goods sold and…arrow_forwardQq.12. Subject :- Accountarrow_forwardCurrent Attempt in Progress Marigold Inc. uses a perpetual inventory system. At January 1, 2025, inventory was $368,080 at both cost and net realizable value. At December 31, 2025, the inventory was $491,920 at cost and $455,800 at net realizable value. Prepare the entry under (a) the cost-of-goods-sold method and (b) the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation (a) (b) e Textbook and Media List of Accounts Save for Later Debit Credit Attempts: 1 of 3 used Submit Answerarrow_forward

- Sanchez Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31, current year. Ending inventory information about the four major items stocked for regular sale follows: Item ABUD A ENDING INVENTORY, CURRENT YEAR Quantity Unit Cost When on Hand Acquired (FIF0) Required: 1. Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. 2. What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 31, current year? Complete this question by entering your answers in the tabs below. Total Net tem Quantity Total Cost Realizable Value D Required 1 Required 2 Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. C D 31 31 66 46 21 $16 45 56 33 66 DE $…arrow_forwardTatum Company has four products in its inventory. Information about the December 31, 2021, inventory is as follows: Total Net Product Total Cst Realizable Value 101 102 $148,000 104,000 74,000 $114,000 124,000 64,000 64,000 103 104 44,000 Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. 2. Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. Inventory Value Product Cost NRV 101 2$ 148,000 114,000 $114,000 102 104,000 124,000 104,000 103 74,000 64,000 66,000 X 104 44,000 64,000 44,000 370,000 $ 328,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education