FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

An analysis of the accounts shows the following.

| 1. | The equipment |

|

| 2. | One-third of the unearned rent revenue was earned during the quarter. | |

| 3. | Interest of $500 is accrued on the notes payable. | |

| 4. | Supplies on hand total $590. | |

| 5. | Insurance expires at the rate of $400 per month. |

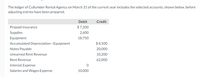

Transcribed Image Text:The ledger of Cullumber Rental Agency on March 31 of the current year includes the selected accounts, shown below, before

adjusting entries have been prepared.

Debit

Credit

Prepaid Insurance

$7,200

Supplies

2,600

Equipment

18,750

Accumulated Depreciation-Equipment

$ 8,500

Notes Payable

20,000

Unearned Rent Revenue

10,200

Rent Revenue

62,000

Interest Expense

Salaries and Wages Expense

10,000

Transcribed Image Text:Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are

Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expense. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually.)

No.

Date

Account Titles and Explanation

Debit

Credit

1.

Mar. 31

2.

Mar. 31

3.

Mar. 31

Mar. 31

5.

Mar. 31

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, the Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $40,000 and $1,500 respectively. During the year, the company reported $80,000 of credit sales. There were $500 of receivables written off as uncollected during the year. Cash collections of receivables amounted to $78,200. The company estimates that it will be unable to collect 4% of the year-end accounts receivable balance. The net realizable value of receivables appearing on the balance sheet will amount toarrow_forwardDuring its first year of operations, Fertig Company had credit sales of $3,000,000, of which $400,000 remained uncollected at year- end. The credit manager estimates that $18,000 of these receivables will become uncollectible. The accounts receivable turnover is 10 times and average collection period is 36.5 days. Assume that average net accounts receivable were $300.000. Explain what these measures tell us. BI V T, TI E LE E H I 99 H E à ला 11 A A OWord(s)arrow_forwardAt the end of the year, Dahl Enterprises estimates the uncollectible accounts expense to be 0.8 percent of net sales of $7,575,000. The current credit balance of Allowance for Uncollectible Accounts is $12,900. Prepare the entry to record the uncollectible accounts expense. What is the balance of Allowance for Uncollectible Accounts after this adjustment? You must show your computations.arrow_forward

- During the year, credit sales amounted to $800,000. Cash collected on credit sales amounted to $760,000, and $18,000 has been written off. At the end of the year, the company adjusted for bad debts expense using the percent-of-sales method and applied a rate, based on past history, of 2.5%. The ending balance of Accounts Receivable would be:arrow_forwardA year-end review of Accounts Receivable and estimated uncollectible percentages revealed the following: 1-30 days $120,000 1% 31-60 days $80,000 3% 61-90 days $20,000 8% Over 90 days $8,000 40% The Allowance for Uncollectible Accounts had a credit balance before adjustment of $2,000. Under the aging-of-receivables method, the uncollectible-account expense for the year is:arrow_forwardPlease help mearrow_forward

- At 30 September 20X2 a company's allowance for receivables amounted to $38,000, which was equivalent to five per cent of the receivables at that date. At 30 September 20X3 receivables totalled $868,500. It was decided to write off $28,500 of debts as irrecoverable. The allowance for receivables required was to be the equivalent of five per cent of receivables. What should be the charge in the statement of profit or loss for the year ended 30 September 20X3 for receivables expense?arrow_forwardOn April 1, ABC has an Accounts Receivable balance of $190,000. During the month, credit sales total $210,000. As a result of collections efforts, the aging of Accounts Receivable is as follows for April 30: Current $100,000 (1% is estimated to be uncollectible) 0-30 Days Past Due $50,000 (5% is estimated to be uncollectible) 31-60 Days Past Due $ 20,000 (10% is estimated to be uncollectible) 31-90 Days Past Due $10,000 (20% is estimated to be uncollectible) > 90 Days Past Due $20,000 (50% is estimated to be uncollectible) Balance in Allowance for Doubtful Accounts (prior to any April 30 entry) $5,000 Credit If ABC is using the % of sales method of estimating its bad debts, what is the journal entry made at the end of the month if the estimated % of sales that are uncollectible is 4% ?arrow_forwardIn the first year of operations, Ralph's Repair Service recognized $482,000 of service revenue earned on account. The ending accounts receivable balance was $88,900. Ralph estimates that 2% of sales on account will not be collected. During the year, Ralph wrote off a $200 receivable that was determined to be uncollectible. Assume there were no other transactions affecting accounts receivable. Required: a. What amount of cash was collected in Year 1? b. What amount of uncollectible accounts expense was recognized In Year 1? c. What will be Ralph's net realizable value of receivables on the December 31, Year 1 balance sheet? a. Cash collected b. Uncollectible accounts expense c. Net realizable value of receivablesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education