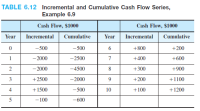

An American-Australian joint venture has been contracted to provide the train cars for a 25-mile subway system using new tunnel-boring and track-design technologies. Austin, Texas was selected as the proof-of-concept site based on its variety in landscape features (hilly terrain, lake and green space areas, and relatively low precipitation) and its public environmental mindedness. Selection of either a Swiss or Japanese contractor to provide the gears and power components for the electric transfer motor assemblies resulted in two cost alternatives. as shown gives the incremental cash flow estimates (in $1000) over the expected 10-year life of the motors. Determine the number of i* values and estimate them graphically.

Step by stepSolved in 3 steps with 4 images

- BBK Industries plans to sell 2 million shares of its common stock for $80 per share, with an annual dividend of $1.90 per share. Determine the lower cost of equity capital under the following conditions: (a) The company expects a dividend growth rate of 3% per year, and (b) a 5% discount is offered to attract stock purchases and a much lower dividend growth rate of 1% per year is anticipated.arrow_forwardIn conducting a sensitivity analysis of a proposed project, the present worth values of $–10,000, $40,000, and $50,000 were believed to have chances of 25%, 40%, and 35%, respectively. The expected PW is closest to: (a) $19,000 (b) $26,000 (c) $28,500 (d) $31,000arrow_forwardThe sheriff of Los Lunas county along the Arizona- Mexico border asked the county to build a new minimum security detention facility for personscaught while attempting to enter the United States illegally. The construction cost will be $22 million, with annual operating costs of $2.1 million. The new facility will create jobs that produce benefits for many local businesses including realtors, restaurants, etc. The benefits are estimated to be $5 million in years 1 and 2, $2.8 million in year 3, and $1.12 million per year beginning in year 4 and continuing through the 30-year life of the facility. At a discount rate of 8% per year, does the conventional B/C ratio indicate that the project is economically justified?arrow_forward

- The landfill for Wellsburg has an area of 30 acres available for receiving waste from the city of 40,000 people who generate 36,000 tons of municipal solid waste (MSW) per year. If the fixed cost of the landfill is $425,000 per year and the operating cost is $14 per ton, how much must the landfill charge per ton of MSW to break even? The landfill charge per ton of MSW to break even is determined to be $arrow_forwardThe capital investment cost for a switchgrass-fueled ethanol plant with a capacity of 250.000 gallons per year is $6.6 million. The costcapacity factor for this particular plant technology is 0.62 for capacities ranging from 200.000 gallons per year to 600.000 gallons per year. What is the estimated capital investment for a similar ethanol plant with a capac of 550.000 gallons per year? The estimated capital investment for a similar ethanol plant with a capacity of 550,000 gallons per year is $ (Round to the nearest ten thousands)arrow_forwardRincon, LLC is considering a project that will require an initial investment of $750,000 with estimated net income of $135,000 per year for 10 years. (a) Determine the IROR, PI, and PW values at MARR = 12% per year. (b) For which of these measures is the project economically justified? (c) Reflect on the answers above and the breakeven i*. Is there any MARR value that will cause any of the three measures to result in different conclusions about the economic viability of the project? Explain your answer.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education