FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

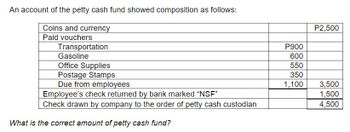

Transcribed Image Text:An account of the petty cash fund showed composition as follows:

Coins and currency

Paid vouchers

Transportation

Gasoline

Office Supplies

Postage Stamps

Due from employees

Employee's check returned by bank marked "NSF"

Check drawn by company to the order of petty cash custodian

What is the correct amount of petty cash fund?

P900

600

550

350

1,100

P2,500

3,500

1,500

4,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A $84 petty cash fund has cash of $17 and receipts of $72. The journal entry to replenish the account would include a Oa. credit to Cash Short and Over for $5 Ob. debit to Cash for $17 Oc. credit to Cash for $84 Od. credit to Petty Cash for $72arrow_forwardPetty Cash Fund Entries Journalize the entries to record the following: a. Check No. 12-375 is issued to establish a petty cash fund of $800. b. The amount of cash in the petty cash fund is now $288. Check No. 12-476 is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $4297; miscellaneous selling expense, $123; miscellaneous administrative expense, $77. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $500, record the discrepancy in the cash short and over account.) a. Journalize the entry to establish the petty cash fund. If an amount box does not require an entry, leave it blank. 88 b. Journalize the entry to replenish the petty cash fund. For a compound transaction, if an amount box does not require an entry, leave it blank.arrow_forwardCan you help me with this questionarrow_forward

- Journalize the entries to record the following (refer to the Chart of Accounts for exact wording of account titles): Instructions A. On March 1, Check is issued to establish a petty cash fund of $1,175. B. On April 1, the amount of cash in the petty cash fund is now $110. Check is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $665; miscellaneous selling expense, $211; miscellaneous administrative expense, $178. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $1,175, record the discrepancy in the cash short and over account.)arrow_forwardNonearrow_forwardWhich one of these principles is considered for cash disbursement control Select one: O a. Print check amount by machine O b. Same staff approve and make payment Oc. Reconcile bank statement annually O d. Rarely compare checks to invoicesarrow_forward

- Which of the following is true of a petty cash voucher? a.It must be issued once in a month by a bank. b.It must explain the purpose of the payment. c.It must only be used to account for payments of more than $5. d.It must be signed only by the person who authorized the payment.arrow_forwardD5.arrow_forwardA petty cash fund was established with a $500 balance. It currently has cash of $35 and petty cash tickets as shown below: Travel expense $105 Office supplies expense 315 Equipment rental expense 45 Which of the following would be the journal entry to replenish the Petty Cash account? A. debit Cash $35; credit various expenses $35 B. debit various expenses $465; credit Petty Cash $465 C. debit various expenses $465; credit Cash $465 D. credit Petty Cash $465; debit Cash $465arrow_forward

- A $126 petty cash fund contains $116 in petty cash receipts, and $7 in currency and coins. Which of the following would be part of the journal entry to replenish the account? Select the correct answer. credit to Cash Short and Over for $3 debit to Cash Short and Over for $3 credit to Cash for $116 credit to Petty Cash for $126arrow_forwardWhich of the following journal entries is recorded as a result of the bank reconciliation process to record a NSF check for $250? A. Cash 250 Accounts Receivable 250 B. Accounts Receivable 250 Petty Cash 250 C. Accounts Receivable 250 Cash 250 D. Cash 250 Accounts Payable 250arrow_forwardInstructions: Prepare a bank reconciliation for Kali Loli from the following checkbook records and bank statement CHECKBOOK Check number 801 802 803 804 805 Date Description fo transaction 44835 H&H Jewelers 44840 Deposit 44842 L.L. Bean 44844 Cashe 44847 Deposit 44847 Four Seasons Hotel 44849 American Express 44854 ATM Withdrawal 44858 Deposit 44861 Deposit 44862 Home-Depot - Debit Card BANK STATEMENT Statement Date: Checking Account Summary: Account Number: Checking Account Transactions Date Amount 44837 44840 44844 44847 44849 44851 44856 44858 44862 44864 BANK RECONCILIATION Check book balance. Amount of payment or withdrawal Amount of deposit or interest Balance Forward 879.36 November 3, 2021 October 1- 31, 2021 449-56-7792 Previous Balance Deposits Number Total Credits ✓ Check Number Total Debits Current Balance → 879.36 3 1954.59 7 1347.83 1486.12 Description 236.77 Check # 801 450.75 Deposit 324.7 Returned item 880.34 EFT payroll deposit 75.89 Check #803 507.82 Check #805…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education