FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Traditional and Contribution Format Income Statements

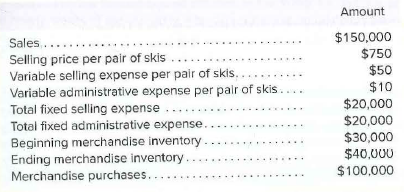

The Alpine House, Inc., is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31:

Required:

1. Prepare a traditional income statement for the quarter ended March 31.

2. Prepare a contribution format income statement for the quarter ended March 31.

3. What was the contribution margin per unit?

Transcribed Image Text:Amount

$150,000

$750

Sales....

Selling price per pair of skis

Variable selling expense per pair of skis,

Variable administrative expense per palr of skis.

Total fixed selling expense ..

Total fixed administrative expense.

Beginning merchandise inventory-

Ending merchandise inventory.

Merchandise purchases..

$50

$10

$20,000

$20,000

$30,000

.3B

$40,000

$100,000

.... ..

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Income statements under absorption costing and variable costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (204,000 units) during the first month, creating an ending inventory of 25,000 units. During February, the company produced 179,000 units during the month but sold 204,000 units at $530 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Manufacturing costs in February 1 beginning inventory: Variable Fixed Total Manufacturing costs in February: Variable Fixed Total Selling and administrative expenses in February: Variable Fixed Total Number of Units Unit Cost 25,000 $265.00 $6,625,000 25,000 850,000 $299.00 $7,475,000 204,000 204,000 34.00 179,000 $265.00 $47,435,000 179,000 7,016,800 $304.20 $54,451,800 39.20 26.10 Total Cost 1.00 27.10 $5,324,400 204,000 $5,528,400 This information has been collected in the Microsoft Excel…arrow_forward(2) Allocate the common cost between the previous five products during November 2018 using the physical measurement method. 1-1 (degree) (3) Prepare an income statement for the five products, calculating the percentage of gross profit for each product during the month of November 2018 1-1 (degree) (4) Allocating the common cost among the previous five products during the month of November 2018 using the weights method It is likely that a detailed table will be prepared, indicating how to allocate the joint cost of (55,000 dinars). - (1 degree - 1) You have the following information: Gulf Wooden Industries Company uses oak tree wood to produce its various products, which are five products and are as follows: tables - chairs - libraries - wooden window frames - reception rooms). Note that the cost of the raw material, which is the oak wood that was used, and the costs necessary to manufacture it, amounted to (55,000 dinars) per month. November 2018. The following table shows a summary of…arrow_forwardThe Alpine House, Incorporated, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Required 2 Required 3 Prepare a traditional income statement for the quarter ended March 31. The Alpine House, Incorporated Traditional Income Statement Required 1 Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses Amount $ 1,428,000…arrow_forward

- Please give me correct answerarrow_forwardLucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below. Sales Variable expenses Contribution margin Fixed expenses Net operating income Claimjumper $ 112,000 34,600 $77,400 Makeover $ 56,000 7,400 $ 48,600 Total $ 168,000 42,000 126,000 86,400 $ 39,600 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 11 Required 21 Required 3 Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. (Do not round intermediate calculations, Round your…arrow_forwardHello, I need help solving this accounting problem.arrow_forward

- Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a traditional income statement for the quarter ended March 31. The Alpine House, Incorporated Traditional Income Statement 138 25 Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses 1 Required 3 Net operating income $ 1,470,000 $ 420 49 $16 $ 135,000 $ 110,000 HON 1.470 000 $ 65,000 $ 115,000 $ 320,000 0arrow_forwardProvide correct solutionarrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Jopl Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (4,600 units) Cost of goods sold: Cost of goods manufactured (5,200 units) Inventory, April 30 (700 units) Total cost of goods sold Gross profit Selling and administrative expenses Operating income Joplin Company Variable Costing Income Statement For the Month Ended April 30 Variable cost of goods sold: If the fixed manufacturing costs were $29,484 and the fixed selling and administrative expenses were $12,590, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. 1:110 $109,200 (14,700) Fixed costs: $138,000 (94,500) $43,500 (25,700) $17,800arrow_forward

- Continued from previous questionarrow_forward1arrow_forwardOn ff Company Company Materials inventory, December 1 $81,110 $109,500 Materials inventory, December 31 (a) 123,730 Materials purchased 206,020 (a) Cost of direct materials used in production 217,370 (b) Direct labor 305,780 246,380 Factory overhead 94,900 122,640 Total manufacturing costs incurred in December (b) 708,470 Total manufacturing costs 773,780 773,780 Work in process inventory, December 1 155,730 263,900 Work in process inventory, December 31 131,400 (c) Cost of goods manufactured (c) 701,900 Finished goods inventory, December 1 137,080 122,640 Finished goods inventory, December 31 143,560 (d) Sales 1,195,560 1,095,000 Cost of goods sold (d) 708,470 Gross profit (e) (e) Operating expenses 155,730 (f) Net income (f) 243,090arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education