Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

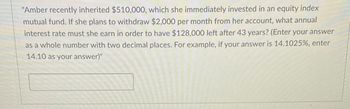

Transcribed Image Text:"Amber recently inherited $510,000, which she immediately invested in an equity index

mutual fund. If she plans to withdraw $2,000 per month from her account, what annual

interest rate must she earn in order to have $128,000 left after 43 years? (Enter your answer

as a whole number with two decimal places. For example, if your answer is 14.1025%, enter

14.10 as your answer)"

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Your grandma invested some money 64 years ago into an account earning 4.91% per year, compounded quarterly. She now has $11804 in her account Round to the pekny. How much money did your grandam invest 64 years ago? $ a. b. How much interest did she earn on the investment? $arrow_forwardBella is 23 years old and wants to invest money for her retirement. She wants to have $2,000,000 saved up when she retires at age 65. A) If she can earn 10% per year in an equity mutual fund, calculate the amount of money she would have to invest in equal annual amounts to achieve her retirement goal. B) Alteratively, how much would she have to invest in equal monthly amounts starting at the end of the current year or monthly respectively.arrow_forwardIsabella purchased $20,000 worth of 26-week T-Bills for $19,700. What will be the rate of return on her investment? (Round your answer to two decimal places.)arrow_forward

- Mike and Emily each have invested $100, 000 in an investment account. No other contributions will be made to their investment account. Both have the sarne goal; they each want their account to reach $3,000,000 at which time each will retire. Mike has his money invested in risk free securities with an expected return of 12% compounded monthly. Emily has her money invested in a stock fund with an expected return of 15% compounded quarterly. How many years after Emily retires will Mike retire?arrow_forwardA four-year investment requires annual deposits of $300 at the beginning of each year. The deposits earn 9% per year. What is the investment's future value? Remember, the deposits are made at the beginning of each year (annuity due). A four-year investment requires annual deposits of $300 at the beginning of each year. The deposits earn 9% per year. What is the investment's future value? Remember, the deposits are made at the beginning of each year (annuity due). $1,495.41 $1,459.98 $1,425.22 $1,391.12 $ 1,357.69arrow_forwardWendy has $23,000.00 invested in a bank that pays 14.25% annually. How long will it take for her funds to triple?Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. Group of answer choicesarrow_forward

- Your sister turned 35 today, and she is planning to save $60,000 per year for retirement, with the first deposit to be made one year from today. She will invest in a mutual fund that's expected to provide a return of 7.5% per year. She plans to retire 30 years from today, when she turns 65, and she expects to live for 25 years after retirement, to age 90. Under these assumptions, how much can she spend each year after she retires? Her first withdrawal will be made at the end of her first retirement year. a. $266,770.46 b. $556,561.79 c. $598,303.93 d. $517,731.90 e. $248,158.57arrow_forwardTwo people plan to invest $50,000. Matt is going to invest it in one lump sum and leave it in the account for 25 years to use for retirement. Sarah is going to invest $2000 per year for 25 years and will also use the money in the account for retirement. Is it reasonable to expect that Matt will have more money in his account than Sarah does in 25 years if both accounts earn the same interest?arrow_forwardMonica has recently inherited $9600, which she wants to deposit into an IRA account. She has determined that her two best bets are an account that compounds monthly at an annual rate of 3.7%(Account 1) and an account that compounds quarterly at an annual rate of 4.7%(Account 2).Step 2 of 2 : How much would Monica's balance be from Account 2 over 2.7years? Round to two decimal places.arrow_forward

- 9 years ago Mary purchased shares in a certain mutual fund at Net Asset Value (NAV) of $96. She reinvested her dividends into the fund, and today she has 7.7% more shares than when she started. If the fund's NAV has increased by 39.5% since her purchase, compute the rate of return on her investment if she sells her shares today. Round your answer to the nearest tenth of a percent.arrow_forwardStanley Roper has $2,300 that he is looking to invest. His brother approached him with an investment opportunity that could give Patrick $4,900 in 4 years. What interest rate would the investment have to yield in order for Stanley’s brother to deliver on his promise? (Answer needs to be stated as a decimal. For example: .1192) Round to four decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education