Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

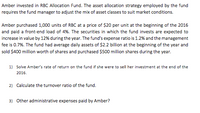

Transcribed Image Text:Amber invested in RBC Allocation Fund. The asset allocation strategy employed by the fund

requires the fund manager to adjust the mix of asset classes to suit market conditions.

Amber purchased 1,000 units of RBC at a price of $20 per unit at the beginning of the 2016

and paid a front-end load of 4%. The securities in which the fund invests are expected to

increase in value by 12% during the year. The fund's expense ratio is 1.2% and the management

fee is 0.7%. The fund had average daily assets of $2.2 billion at the beginning of the year and

sold $400 million worth of shares and purchased $500 million shares during the year.

1) Solve Amber's rate of return on the fund if she were to sell her investment at the end of the

2016.

2) Calculate the turnover ratio of the fund.

3) Other administrative expenses paid by Amber?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Fund had a value of $32,000 on 1 April 2011. A net cash ow of $7.000 was received on 1 April 2012, a further net cash ow of $8,000 was received on 1 April 2013, and a further net cash ow of $12,000 was received on 1 April 2014. Immediately before receipt of the _rst net cash ow, the fund had a value of $35,000, immediately before receipt of the second net cash flow, the fund had a value of $45,000, and immediately before receipt of the third net cash ow, the fund had a value of $55,000. The value of the fund on 1 April 2015 was $65,000. The money weighted rate of return per annum for the same period is Select one: a. 4.22% O b. 6.19% O c. 3.17% O d. 5.16% e. 8.41%arrow_forwardIn the prospectus for the Brazos Aggressive Growth fund, the fee table indicates that the fund has a 12b-1 fee of 0.35 percent and an expense ratio of 1.55 percent that is collected once a year on December 1. Joan and Don Norwood have shares valued at $116,250 on December 1. What is the amount of the 12b-1 fee this year? What is the amount they will pay for expenses this year? Note: For all requirements, round answers to 2 decimal places.arrow_forwardEdmonds Community College's (EDCC) scholarship fund received a gift of $325,000. The money is invested in stocks, bonds, and CDs. CDs pay 2.5% interest, bonds pay 2.9% interest, and stocks pay 7.8% simple interest. To spread the risk the College has a policy of having 4 times as much money in CDs as in stocks and bonds combined. If the annual income from the investments is $9,365 , how much was invested in each vehicle? solve by the method of your choice either using reduced row echelon form or the matrix equation EDCC invested $ in stocks ___________________ $ in bonds ___________________ $ in CDs ___________________arrow_forward

- A college scholarship fund received a gift of $ 156,469.08.The money is invested in CDs, bonds, and Stocks.CDs pay 4.25% interest, bonds pay 5.5% interest, and stocks pay 6.8% simple interest.ACM invests $ 51,181.71 more in bonds than in CDs. If the annual income from the investments is $9,331.00 , how much was invested in each vehicle?arrow_forwardQuantAlpha fund charges a 12b-1 fee of 1% and maintains an expense ratio of 0.75%. Assume the rate of return on fund portfolio (before any taxes) is 6% per year. How much will an investment of $1000 in the fund grow to after 10 years?arrow_forwardFund had a value of $32,000 on 1 April 2011. A net cash ow of $7.000 was received on 1 April 2012, a further net cash ow of $8,000 was received on 1 April 2013, and a further net cash ow of $12,000 was received on 1 April 2014. Immediately before receipt of the _rst net cash ow, the fund had a value of $35,000, immediately before receipt of the second net cash flow, the fund had a value of $45,000, and immediately before receipt of the third net cash ow, the fund had a value of $55,000. The value of the fund on 1 April 2015 was $65,.000. The money weighted rate of return per annum for the same period is Select one: a. 4.22% b. 6.19% c. 3.17% O d. 5.16% e. 8.41%arrow_forward

- On August 5th, 2013, Joseph invested $14,000 in a fund that was growing at 6% compounded semi-annually. a. Calculate the future value of the fund on March 15th, 2014. Round to the nearest cent b. On March 15th, 2014, the interest rate on the fund changed to 5% compounded monthly. Calculate the future value of the fund on March 26th, 2015. Round to the nearest centarrow_forwardA financial adviser is reviewing one of her client's accounts. The client has been investing $1,000 at the end of every quarter for the past II years in a fund that has averaged 7.3% compounded quarterly. Using a cash flow diagram, how much money does the client have in his account?arrow_forwardChris Lavigne invested a total of $10,200 in the AIC Diversified Canada Mutual Fund. The management fee for this particular fund is 2.55 percent of the total investment amount. Calculate the management fee Chris must pay this year. (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Management fee $arrow_forward

- On 1 January 2019, you invested £100 in a fund. A further £50 was invested on 1 January 2020. The values of the funds were: Date Fund Value (in £) 31 Dec 31 Dec 31 Dec 2018 2019 2020 0 105 242 Calculate the money-weighted rates of return over the period 1 January 2019 to 31 December 2020. Give your answer to 3 decimal places.arrow_forwardSteven Spear invested $14,000 today in a fund that earns 10% compounded annually. Click here to view factor tables. To what amount will the investment grow in 3 years? To what amount would the investment grow in 3 years if the fund earns 10% annual interest compounded semiannually? (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 458,581.) Investment at 10% annual interest Investment at 10% annual interest, compounded semiannually $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education