Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

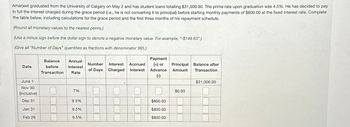

Transcribed Image Text:Amarjeet graduated from the University of Calgary on May 2 and has student loans totalling $31,000.00. The prime rate upon graduation was 4.5%. He has decided to pay

in full the interest charged during the grace period (i.e., he is not converting it to principal) before starting monthly payments of $800.00 at the fixed interest rate. Complete

the table below, including calculations for the grace period and the first three months of his repayment schedule.

(Round all monetary values to the nearest penny.)

(Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63")

(Give all "Number of Days" quantities as fractions with denominator 365.)

Payment

Date

Balance Annual

before Interest

Transaction Rate

Number

Interest Accrued

of Days Charged Interest Advance

(-)

(+) or

Principal Balance after

Amount Transaction

June 1

Nov 30

$31,000.00

7%

(inclusive)

Π

$0.00

Dec 31

9.5%

Jan 31

9.5%

$800.00

$800.00

Feb 29

9.5%

$800.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Am. 111.arrow_forwardJefferson qualifies for an income-adjusted monthly payment of $475. If Jefferson has a subsidized student loan of $48,000 at an annual interest rate of 4% (compounded monthly), how many months are required to repay the loan? (Round your answer up to the nearest month.)arrow_forwardJeffery Wei received a 7-year non-subsidized student loan of $31,000 at an annual interest rate of 5.9%. What are Jeffery's monthly loan payments for this loan after he graduates in 4 years? (Round your answer to the nearest cent.)arrow_forward

- Lacy has a $49,500.00 student loan when she graduates on May 4, and the prime rate is set at 4.5%. She has decided at the end of the grace period to convert the interest to principal, and she sets her fixed monthly payment at $950.00. She opts for the variable rate on her student loan. Create the first four repayments of her repayment schedule. Calculate the total interest charged for both the grace period and the four payments combined. Assume February does not involve a leap year. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63".) (Give all "Number of Days" quantities as fractions with denominator 365.) Date Balance Annual before Interest Transaction Rate Number Interest Accrued of Days Charged Interest Payment (+) or Advance (-) Principal Amount Balance after Transaction June 1 $49,500.00 Nov 30 7% (inclusive) ☐ ☐ Dec 31 7% Jan 31 7% Feb 28 7% Mar 31 7% Total combined interest…arrow_forwardOn May 6, Jim Ryan borrowed $14,000 from Lane Bank at 7 1/2% interest. Jim plans to repay the loan on March 11. Assume the loan is on ordinary interest. How much will Jim repay on March 11? (Use Days in a year table.) (Round your answer to the nearest cent.) Jim Repayarrow_forwardJoseph and three other friends bought a $270,000 house close to the university at the end of August last year. At that time, they put down a deposit of $10,000 and took out a mortgage for the balance. Their mortgage payments are due at the end of each month (September 30, last year, was the date of the first payment) and are based on the assumption that Joseph and his friends will take 20 years to pay off the debt. Annual nominal interest is 6 percent, compounded monthly. It is now February. Joseph and his friends have made all their fall-term payments and have just made the January 31 payment for this year. How much do they still owe? Click the icon to view the table of compound interest factors for discrete compounding periods when i = 0.5%. They will owe $ (Round to the nearest dollar as needed.)arrow_forward

- Jason received a 10-year non-subsidized loan of $40,000 at an annual interest rate of6%. What are Jason’s monthly loan payments for this loan after he graduates in 4years?arrow_forwardNikularrow_forwardPeyton received a 10-year subsidized student loan of $21,000 at an annual interest rate of 4.1%. Assuming Peyton graduates in 4 years, determine Peyton's monthly payment on the loan. (Round your answer to the nearest cent.)arrow_forward

- Nonearrow_forwardAmarjeet graduated from the University of Calgary on May 2 and has student loans totalling $36,000.00. The prime rate upon graduation was 4.25%. He has decided to pay in full the interest charged during the grace period (i.e., he is not converting it to principal) before starting monthly payments of $800.00 at the fixed interest rate. Complete the table below, including calculations for the grace period and the first three months of his repayment schedule. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63".) (Give all "Number of Days" quantities as fractions with denominator 365.) Date Balance Annual before Interest Transaction Rate Number Interest Accrued of Days Charged Interest Payment (+) or Advance Principal Balance after Amount Transaction (-) June 1 Nov 30 6.75% ப $0.00 (inclusive) Dec 31 9.25% $800.00 Jan 31 9.25% $800.00 Feb 29 9.25% $800.00 $36,000.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education