FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

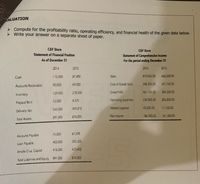

Compute for the profitability ratio, operating efficiency, and financial health of the given data below.

Transcribed Image Text:ALUATION

> Compute for the profitability ratio, operating efficiency, and financial health of the given data below.

> Write your answer on a separate sheet of paper.

C&F Store

C&F Store

Statement of Financial Position

Statement of Comprehensive income

For the period ending December 31

As of December 31

2014

2013

2014

2015

Cash

110,000

87,400

Sales

810,000.00

686,000.00

Accounts Receivable

90,000

69,920

Cost of Goods Sold

348,300.00

301,750.00

129,000

218,500

Gross Profit

461,700.00

384,250 00

Inventory

12,000

4,370

Operatung Expenses

234,900.00

205,800.00

Prepaid Rent

550,000

493,810

Interest Expense

40,500.00

17,150.00

Delivery Van

891,000

874,000

Net Income

186,300.00

161,300.00

Fotal Assets

75,000

61.298

Accounts Payabie

400,000

393.300

Loan Payable

416,000

413,402

Anistle Cruz, Capital

891,000

874,000

Total Liabilties and Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Classify the performance measures below into the most likely balanced scorecard perspective itrelates to. Label your answers using C (customer), P (internal process), I (innovation and growth), or F(financial). Customer satisfaction indexarrow_forwardexplain the impact on financial statement using FIFO, weighted avverage and LIFO. When would the three methods give similar profit figures? when would they give indentical profit figure?arrow_forwarddiscuss the advantages and disadvantages of economic value added for performance measurementarrow_forward

- Management uses Cost Volume Profit (CPV) analysis as a planning process to predict the future volume of activity, costs incurred, sales made and profit received. Required: i. List and explain FIVE assumptions in C-V-P analysis.arrow_forwardClassify the performance measures below into the most likely balanced scorecard perspective towhich it relates: customer (C), internal processes (P), innovation and growth (I), or financial (F). Residual incomearrow_forwardHow can you show how efficiency ratios can be used to determine the best way to conduct the operations of the company.arrow_forward

- Which of the following is a key performance indicator of the internal business perspective in a balanced scorecard? A. return on investment B. hours of employee training C. number of warranty claims received D. percentage of market sharearrow_forwardIdentify and calculate the common ratios used to assess profitability.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education