ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

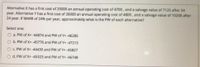

Transcribed Image Text:Alternative X has a first cost of 25000 an annual operating cost of 4700 , and a salvage value of 7125 after 24

year. Alternative Y has a first cost of 26000 an annual operating cost of 4800, and a salvage value of 10200 after

24 year. If MARR of 24% per year, approximately what is the PW of each alternative?

Select one:

O a. PW of X= -44874 and PW of Y= -46285

O b. PW of X= -45776 and PW of Y= -47215

O C. PW of X= -44430 and PW of Y= -45827

O d. PW of X= -45323 and PW of Y= -46748

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- ! Required information Lego Group in Bellund, Denmark, manufactures Lego toy construction blocks. The company is considering two methods for producing special-purpose Lego parts. Method 1 will have an initial cost of $370,000, an annual operating cost of $135,000, and a life of 3 years. Method 2 will have an initial cost of $770,000, an operating cost of $140,000 per year, and a 6-year life. Assume 12% salvage values for both methods. Lego uses an MARR of 14% per year. Which method should it select on the basis of a present worth analysis? The present worth of method 1 is $ -1,094,517 and that of method 2 is $ -782,345 Method 1 is selected.arrow_forwardCompare three alternatives on the basis of their capitalized costs at /= 11.00% per year and select the best alternative. (Include a minus sign if necessary.) Alternative First Cost AOC, per Year Salvage Value Life, Years E $75000 $-55000 $19000 2 The capitalized cost of alternative E is $ The best alternative is (Click to select) F $-315000 $16000 $69000 4 . alternative F is $ G $ 815000 $-4000 $400000 90 and alternative G is $arrow_forwardb) National Homebuilders, Inc., plans to purchase new cut-and-finish equipment. The details of the 2 alternative options are summarized in the table below. The interest rate is 10% per year. First Cost, S Annual Operating Cost, S Salvage Value, S Equipment Life (years) Consider only machine A now. Alternative A 15,000 3,500 1,000 4 Alternative B 18,000 3,100 2,000 8 a) Calculate the AW of Machine A for one life cycle. b) Calculate the AW of Machine A for LCM = 8 years (2 life cycles). c) Demonstrate the equivalence of AW over 2 life cycles and AW over one life cycle.arrow_forward

- National homebuilders Inc plans to purchase new rain gutter forming equipment. Two manufacturers offered the following estimates, First Cost, $ Annual Operating Cost, $/year Salvage Value, $ Life, years Vendor A 15,000 3500 1000 6 Vendor B 18,000 3100 2000 9 a. Determine which vendor should be selected on the basis of a PW comparison, if the MARR is 15% per year. b. National Homebuilders has a standard practice of evaluating all options over a 5-year period. If a study period of 5 years is used and the salvage values are not expected to change, which vendor should be selected?arrow_forwardCompare the alternatives C and D on the basis of a present worth analysis using an interest rate of 13% per year and a study period of 10 years. Alternative C $-46,000 $4,000 $-1,300 $6,000 10 First Cost AOC, per Year Annual Increase in Operating Cost, per Year Salvage Value Life. Years The present worth of alternative C is $1 (Click to select) offers the lower present worth. HELIME BIEN D $-20,000 $-7,500 $-100 $1,300 5 and that of alternative D is $ Aarrow_forwardQuestion 3 For the below ME alternatives, which machine should be selected based on the PW analysis. MARR=10% First cost, $ Annual cost, $/year Salvage value, $ Life, years Machine A Answer the below questions: A- PW for machine A= 23,979 8,679 4,000 Machine B 30000 6,000 5,000 Machine C 10000 4,000 1,000arrow_forward

- I need help only with the second part of inputting this data into excel calculating the Annual Worth for both options. Then using Goal Seek to find out the new salvage value that will equal AW equations, thank you.arrow_forwardCompare the alternatives C and D on the basis of a present worth analysis using an interest rate of 10% per year and a study period of 10 years. Alternative First Cost $-40,000 $-25,000 AOC, per Year Annual Increase in Operating Cost, per Year Salvage Value Life, Years $-9,000 $-10,000 $-200 $-600 $11,000 $200 10 5 The present worth of alternative C is $ -33518.05 and that of alternative D is $-102608.3 Alternative D voffers the lower present worth.arrow_forwardProblem 05.017 Alternative Comparison - Different Lives Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (i.e., low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 19% per year, which alternative has the lower present worth? Method First Cost M&O Cost, per Year Salvage Value Life DDM $-160,000 $-40,000 $10,000 2 years The present worth for the DDM method is $ The present worth for the LS method is $ The (Click to select) method is selected. LS $-500,000 $-10,000 $33,000 4 yearsarrow_forward

- Compare the alternatives C and D on the basis of a present worth analysis using an interest rate of 15.00% per year and a study period of 10 years. (Include a minus sign if necessary.) Alternative First Cost AOC, per Year Annual Increase in Operating Cost, per Year Salvage Value Life, Years The present worth of alternative C is $ с $-50000 $-8000 $-1500 $14000 10 $-21000 $-9000 $-200 $1500 5 and that of alternative D is $arrow_forward5arrow_forwardCompare the alternatives C and D on the basis of a present worth analysis using an interest rate of 14% per year and a study period of 10 years. Alternative First Cost AOC, per Year Annual Increase in Operating Cost, per Year Salvage Value Life, Years с $-48,000 $-9,000 $-1,400 $8,000 10 The present worth of alternative C is $ -117974.14 Alternative D offers the lower present worth. D $-34,000 $-9,000 $-1,500 $1,400 5 and that of alternative D is $ -73129.34 xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education